- United States

- /

- IT

- /

- NYSE:SNOW

Snowflake (SNOW) Announces New CFO As Brian Robins Joins Leadership Team

Reviewed by Simply Wall St

Snowflake (SNOW) recently announced a key executive change with the appointment of Brian Robins as the new CFO, set to take effect later this month, replacing Mike Scarpelli. This shift aligns with the company's growth strategy and could positively shape investor sentiment. Last week, Snowflake's collaboration with Siemens aims to integrate technological data for enhanced manufacturing processes, indicating a forward-thinking partnership. Simultaneously, Snowflake expanded its AI Data Cloud services to South Africa, highlighting its market penetration efforts. These announcements align well with tech market dynamics, reflected in a notable 14% share price rise amidst an overall steady market.

Snowflake has 2 warning signs we think you should know about.

Find companies with promising cash flow potential yet trading below their fair value.

The appointment of Brian Robins as Snowflake's new CFO coincides with the company's strategic push to strengthen its market position through technological advancements and key partnerships. This executive change, along with the partnership with Siemens and expansion into South Africa, could reinforce the ongoing efforts to bolster Snowflake's product adoption and revenue growth in the competitive cloud-based data platform industry. Over the longer term, Snowflake's total return, including its share price movement and dividends, was 107% over the past year. This reflects a significant increase when compared to the previous year and highlights its strong performance relative to the US market, which posted an 18.1% return.

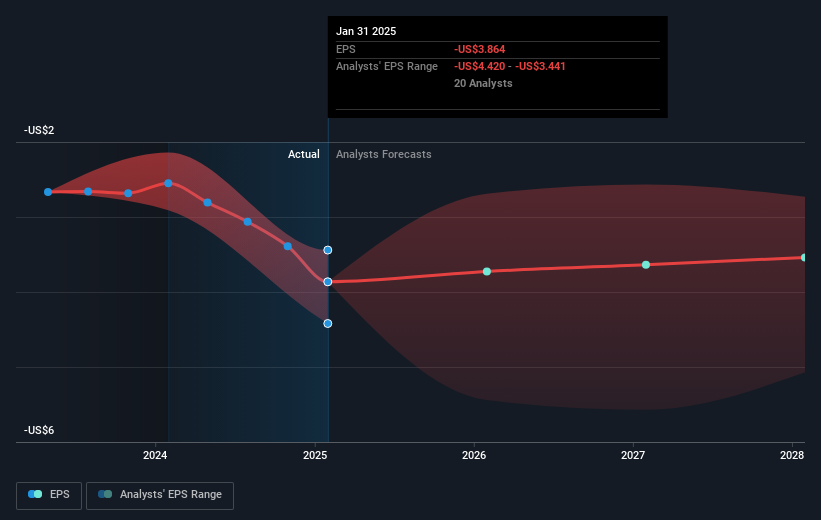

In terms of revenue and earnings forecasts, these recent developments could potentially enhance Snowflake's competitive edge and operational efficiency, leading to improved product adoption and higher margins. Analysts project annual revenue growth of 18.5%, driven by AI-driven initiatives and partnerships with major tech players like Microsoft. Despite a 14% share price rise, the current share price of $229.33 still shows a 0.14% discount compared to the consensus price target of $260.62. This indicates investor optimism but also cautious anticipation of future performance relative to the expectations set by analysts. Whereas Snowflake's revenue growth is expected to outpace the general US market, the firm is yet to turn profitable, highlighting a key area for continued evaluation. Overall, these factors combined provide a robust context for understanding Snowflake's current standing and future trajectory.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SNOW

Snowflake

Provides a cloud-based data platform for various organizations in the United States and internationally.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)