- United States

- /

- IT

- /

- NYSE:SNOW

Snowflake (NYSE:SNOW) Gains Department Of Defense Authorization

Reviewed by Simply Wall St

Snowflake (NYSE:SNOW) has been actively enhancing its offerings through several recent partnerships and product advancements. Moveworks' integration of Cortex AI with Snowflake highlights the company's growing footprint in data insights, while MedeAnalytics' Health Fabric aims to boost healthcare outcomes using Snowflake's cloud. Additionally, the company's collaboration with Wiland for MarketSignals showcases its relevance in marketing optimization. Alongside achieving Department of Defense authorization, these developments underscore Snowflake's progress. This comes amid a 10% price move over the past week, paralleling general market trends as the S&P 500 sees a notable upswing amidst broader investor optimism.

We've spotted 1 warning sign for Snowflake you should be aware of.

Recent partnerships and product advancements by Snowflake, including collaborations with Moveworks and Wiland, are likely to support the company's narrative of expanding its market position through AI-driven innovations. These initiatives could enhance both revenue and earnings forecasts, as they underscore the company's commitment to integrating sophisticated technology solutions. Furthermore, Snowflake's Department of Defense authorization may instill confidence in its security capabilities, potentially aiding future contract acquisitions and boosting revenue growth.

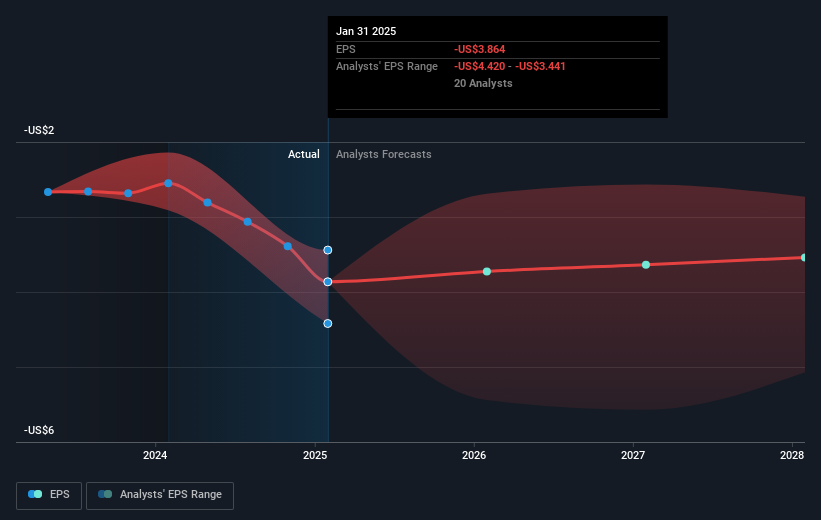

Snowflake's share performance over the last year has lagged behind both the US IT industry, which returned 11.8%, and the broader market which posted a 7.9% return. Specifically, Snowflake's total shareholder return, including dividends, was 4.04% over this period. This performance might reflect investor caution due to the company's ongoing unprofitability and the challenges of executing its ambitious growth strategy in a competitive market.

In terms of valuation, Snowflake's current trading price of US$140.23 represents a discount of approximately 28.8% to the consensus analyst price target of US$196.84. This gap implies that the market may be skeptical about the company's ability to reach future earnings projections, despite optimistic revenue growth forecasts driven by its AI and cloud innovations. Achieving the analyst price target would require significant improvements in profit margins and revenue growth over the next few years.

Take a closer look at Snowflake's potential here in our financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SNOW

Snowflake

Provides a cloud-based data platform for various organizations in the United States and internationally.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives