- United States

- /

- Biotech

- /

- NasdaqGS:IRWD

High Growth Tech Stocks In The United States To Watch

Reviewed by Simply Wall St

The United States market has remained flat over the last week, yet it is up 31% over the past year with earnings forecasted to grow by 15% annually. In this environment, identifying high growth tech stocks involves looking for companies that demonstrate strong potential for innovation and scalability while aligning with these positive market trends.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 23.83% | 24.32% | ★★★★★★ |

| Ardelyx | 25.47% | 69.63% | ★★★★★★ |

| Sarepta Therapeutics | 24.00% | 42.51% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.35% | 70.33% | ★★★★★★ |

| Clene | 79.31% | 60.16% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Alkami Technology | 21.94% | 98.60% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 243 stocks from our US High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

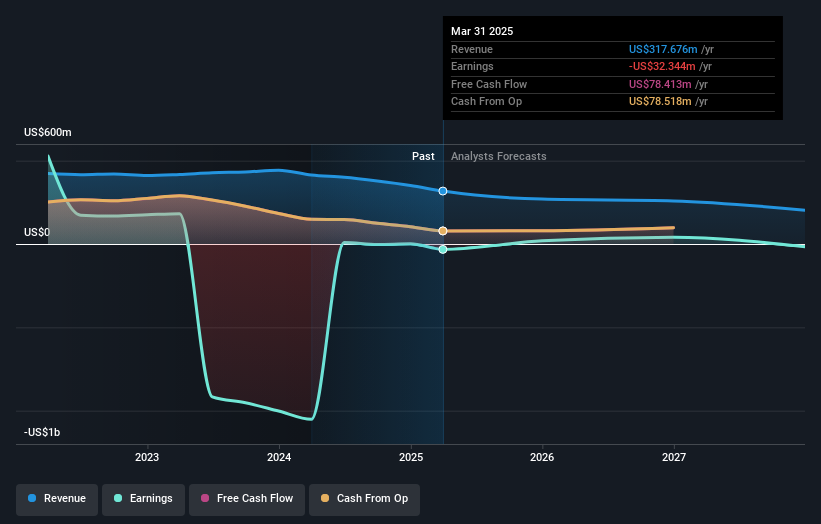

Ironwood Pharmaceuticals (NasdaqGS:IRWD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ironwood Pharmaceuticals, Inc. is a healthcare company that specializes in developing and commercializing gastrointestinal products, with a market cap of $548.90 million.

Operations: Ironwood Pharmaceuticals focuses on the development and commercialization of gastrointestinal products, generating revenue primarily from its Human Therapeutics segment, which reported $378.42 million.

Amidst a backdrop of executive reshuffles, Ironwood Pharmaceuticals has maintained its focus on growth and innovation, particularly in R&D. The company's commitment to research is evident from its significant R&D expenditure, which is crucial for advancing its pipeline of pharmaceutical solutions. Despite recent challenges, including a notable 10% revenue growth forecast that lags behind the industry's 20%, Ironwood has demonstrated resilience with earnings expected to surge by approximately 54.9% annually. This growth trajectory is supported by strategic moves such as the expansion of their credit facilities and active participation in major healthcare conferences, positioning them well within the competitive landscape of biotech innovations.

Lumentum Holdings (NasdaqGS:LITE)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Lumentum Holdings Inc. is a company that manufactures and sells optical and photonic products across the Americas, Asia-Pacific, Europe, the Middle East, and Africa with a market capitalization of $6.17 billion.

Operations: Lumentum generates revenue primarily from two segments: Industrial Tech, contributing $241 million, and Cloud & Networking, which accounts for $1.14 billion. The company's business model focuses on delivering advanced optical and photonic products across various global markets.

Lumentum Holdings, amidst a challenging market, is steering towards profitability with an expected earnings growth of 117.5% per year. This optimistic forecast aligns with their strategic presentations at key technology conferences, signaling robust engagement with industry trends and potential growth avenues. Notably, their R&D commitment is underscored by a substantial investment rate compared to revenue, positioning them well for innovative breakthroughs in optical communications. Despite a recent net loss reported in Q1 2025, the company's forward-looking revenue guidance between $380 million to $400 million suggests a recovery trajectory supported by ongoing product development and market expansion strategies.

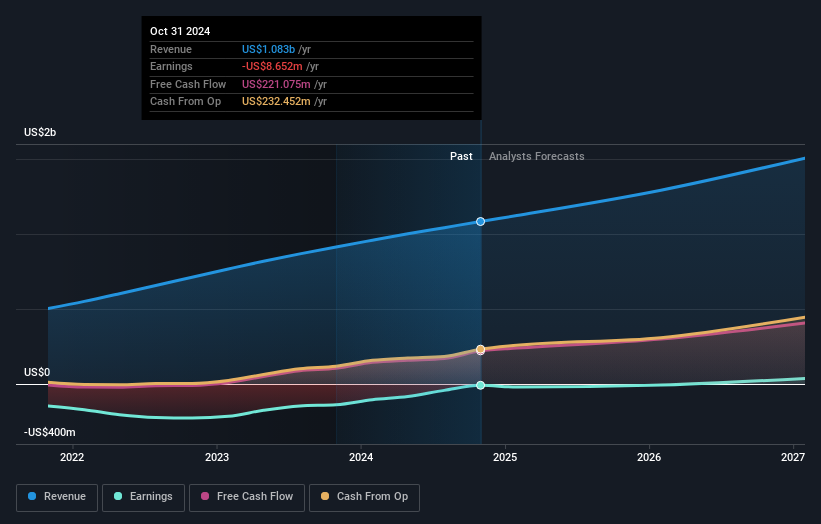

Smartsheet (NYSE:SMAR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Smartsheet Inc. offers an enterprise platform designed to help teams and organizations plan, capture, manage, automate, and report on work, with a market capitalization of approximately $7.85 billion.

Operations: The company generates revenue primarily from its Internet Software & Services segment, amounting to $1.08 billion. The platform supports various business functions by enabling efficient work management and automation for teams and organizations.

Smartsheet's recent financial performance and strategic initiatives underscore its position in the high-growth tech sector, despite some operational challenges. In Q3 2024, the company reported a significant revenue increase to $286.87 million from $245.92 million year-over-year, transitioning from a net loss to a modest net income of $1.32 million. This turnaround is pivotal as Smartsheet invests heavily in R&D, committing 14% of its revenue to foster innovation—higher than many peers—aiming for robust future growth with projected earnings increases of 62.8% annually. Moreover, the recent approval by shareholders for an $8.4 billion merger underscores confidence in Smartsheet’s trajectory and potential under new ownership, despite some investor concerns about the valuation being too low which reflects underlying tensions about future growth expectations and market positioning.

- Click here to discover the nuances of Smartsheet with our detailed analytical health report.

Assess Smartsheet's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Embark on your investment journey to our 243 US High Growth Tech and AI Stocks selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Ironwood Pharmaceuticals, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IRWD

Ironwood Pharmaceuticals

A biotechnology company, focuses on the development and commercialization of therapies for gastrointestinal (GI) and rare diseases in the United States and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives