Shopify Inc’s ( NYSE:SHOP ) stock price rocketed to a new all time high on Friday. The rally was seemingly triggered by positive comments about the company during Affirm’s ( Nasdaq: AFRM ) earnings call, as well as derivative activity. Shopify is benefitting from significant tailwinds and operational performance continues to impress. But investors should exercise caution at the current valuation.

Shopify currently trades on a price-to-earnings ratio (or "P/E's") of 61.5x based on trailing 12 month earnings. While this is well ahead of the broader market, it doesn’t appear excessive for a growth stock with Shopify’s track record.

View our latest analysis for Shopify

EPS expected to fall

Although the P/E ratio based on trailing 12-month earnings appears reasonable, the forward P/E is beginning to look excessive. Net income in recent quarters has been boosted by unusual items, mostly related to Shopify’s investments in Affirm and Global-E ( Nasdaq:GLBE ). So, while the net profit margin over the past 12 months is 81%, the operating margin is only 11%.

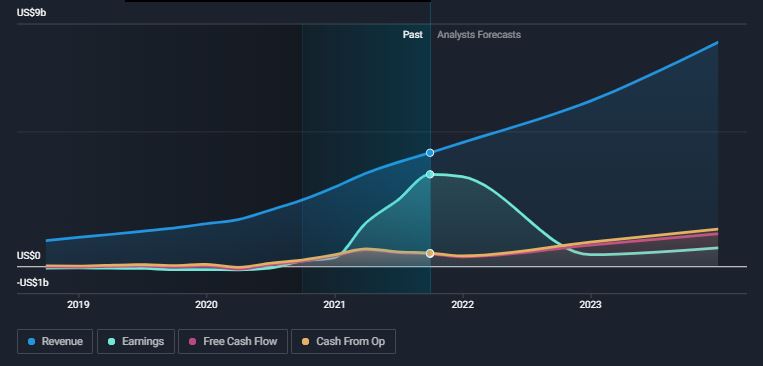

The following chart illustrates the gap between cash flows and earnings, and how analysts expect Shopify’s earnings to fall over the next year.

The range between the highest and lowest estimates for FY22 is also very wide (-$2.49 to $18.34). This indicates that there is a lot of uncertainty over the forecasts, and earnings will also be affected by the value of the investments in Affirm and Global-E. However, even the most optimistic forecast is lower than current earnings.

If we exclude the negative EPS forecasts, the forward P/E to December next year is anywhere between 90x and 505x with an average of 240x. If Shopify can deliver on the most optimistic forecast, the valuation may be manageable, but if earnings are closer to the middle of the range Shopify will look very pricey.

Key Takeaways

Shopify’s business fundamentals look rock solid, but there is a limit to the price investors can pay to earn a decent return.

Shopify’s earnings growth includes unusual items related to investments that the company has made. Operating income has grown at a much slower rate than net income, and has also been quite lumpy. On balance, analysts are looking for EPS to decline 28% next year, which will result in the P/E rising. If sentiment turns and the P/E looks unsustainable, the share price will be at risk.

Net income will also be affected by the value of Shopify’s investments. Of course this can work both ways, and could also result in better than expected results. Shopify currently owns 7.3% of Affirm which accounts for 25% of the company’s equity.

This post has only touched on one aspect of Shopify. Have a look at our free report on Shopify if you’d like to know more about the company as well as several other risks we have identified.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a P/E below 20x.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.

About NasdaqGS:SHOP

Shopify

A commerce technology company, provides tools to start, scale, market, and run a business of various sizes in Canada, the United States, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives