- United States

- /

- IT

- /

- NasdaqGS:SHOP

Shopify's Inc. (NYSE:SHOP) Growth is Backed by its Ability to Scale Well

After Shopify Inc. (NYSE:SHOP) released its second-quarter results, we want to see how the long term future looks for the company. In this article, we will put past performance in sync with analysts estimates and see if Shopify is delivering for investors.

Shopify's second quarter yielded an overall positive result, with revenues beating expectations by 6.6% to hit US$1.1b. Shopify also reported a statutory profit of US$6.90, which was above what the analysts had forecasted.

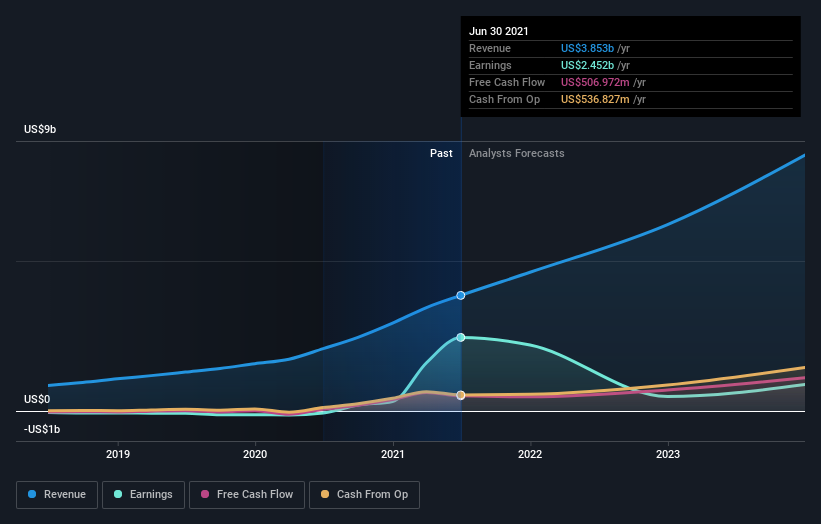

Trailing twelve months (ttm) measuring sums up the numbers from the past 4 quarters and gives investors a normalized result, accounting for differences in seasonality. That is why, in the chart blow you can see clearly how a company performs every quarter and find key breakpoints in the business.

See our latest analysis for Shopify

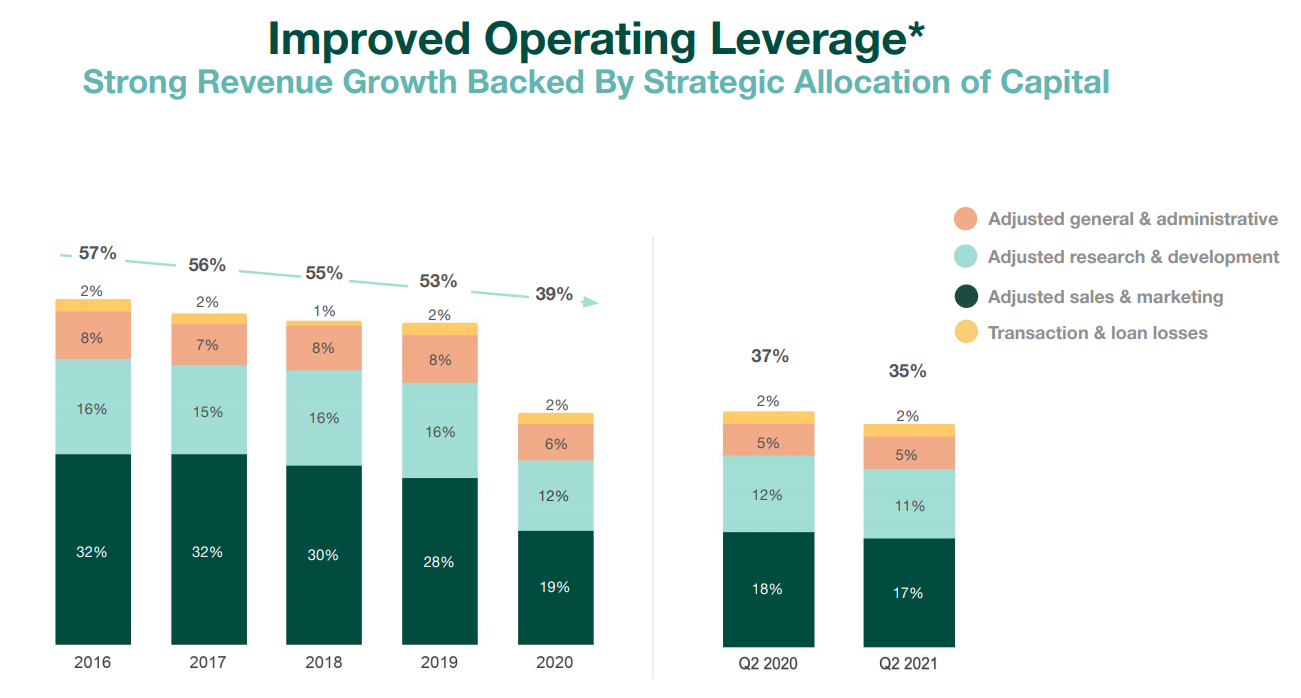

The company seems to be firing on all cylinders and keeps delivering profit baked growth. The company also seems to scale up pretty good and allow for high margins. In their Q2 report (page 24), we can see a meaningful decline in expenses as a percentage of revenue, the effect is especially notable in the sales and marketing category.

Following the latest results, Shopify's 38 analysts are now forecasting revenues of US$4.62b in 2021. This would be a major 20% improvement in sales compared to the last 12 months. Statutory earnings per share are expected to drop 13% to US$17.36 in the same period. Yet prior to the latest earnings, the analysts had been anticipated revenues of US$4.46b and earnings per share (EPS) of US$10.11 in 2021. There's been a pretty noticeable increase in sentiment, with the analysts upgrading revenues and making a very substantial lift in earnings per share in particular.

With these upgrades, analysts have lifted their price target 7.0% to US$1,720per share.

That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. There are some variant perceptions on Shopify, with the most bullish analyst pricing it at US$3,300 and the most bearish at US$862 per share. We would probably assign less value to the analyst forecasts in this situation, because such a wide range of estimates could imply that the future of this business is difficult to value accurately. With this in mind, we wouldn't rely too heavily on the consensus price target, as it is just an average and analysts clearly have some deeply divergent views on the business.

Of course, another way to look at these forecasts is to place them into context against the industry itself. We can infer from the latest estimates that forecasts expect a continuation of Shopify's historical trends, as the 44% annualized revenue growth to the end of 2021 is roughly in line with the 45% annual revenue growth over the past five years. Compare this with the broader industry, which analyst estimates (in aggregate) suggest will see revenues grow 15% annually. So although Shopify is expected to maintain its revenue growth rate, it's definitely expected to grow faster than the wider industry.

The Bottom Line

Shopify's continuous growth is in line with expectations and is great from a business point of view. From an investors' perspective, it may not be enough to sustain such high stock price levels for the company.

Analyst's price targets vary widely, and investors need to be aware that the stock might be quite volatile in the future.

The company delivered solid growth, and it seems to scaling very well, as costs have not increased as much as the revenue growth rate. This paves the way for wider margins and efficient operations on all fronts.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At Simply Wall St, we have a full range of analyst estimates for Shopify going out to 2023, and you can see them free on our platform here..

That said, it's still necessary to consider the ever-present specter of investment risk. We've identified 5 warning signs with Shopify (at least 2 which are a bit concerning) , and understanding them should be part of your investment process.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:SHOP

Shopify

A commerce technology company, provides tools to start, scale, market, and run a business of various sizes in Canada, the United States, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives