- United States

- /

- Software

- /

- NYSE:SEMR

Does Semrush Present an Opportunity After a 47% Drop in 2024?

Reviewed by Bailey Pemberton

If you’re staring at Semrush Holdings and wondering if now is the moment to buy, sell, or simply watch, you’re not alone. The digital marketing software provider has captured more than its share of attention, and right now, the stock’s story is as much about market perception as it is about fundamentals. Over the past year, the share price has dropped nearly 47%, with a steady slide continuing year-to-date, down almost 39% in 2024 so far. Even the past month hasn’t offered respite, with a 3.1% decline building on recent weakness.

Much of this downturn reflects shifting risk appetites in tech and SaaS stocks more broadly, as investors reevaluate growth expectations in a volatile economic environment. However, the extent of Semrush’s decline hints that the market might be overlooking some of the company’s strengths or pricing in more risk than the business actually warrants. That is where valuation comes in, and here things get interesting. By evaluating Semrush on six major measures of value, the company comes out with a perfect score of 6 out of 6 for being undervalued. That is rare for any software name, especially one with a global footprint and a sticky customer base.

Of course, not all valuation methods tell the same story. In the next section, we will break down how these different approaches stack up and reveal why some go far beyond surface-level numbers. And for those seeking a truly robust way to measure value, be sure to read all the way through. We will save our best insight for last.

Why Semrush Holdings is lagging behind its peers

Approach 1: Semrush Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a core valuation method that estimates the intrinsic value of a company by forecasting its future cash flows and then discounting them back to today's dollars. For Semrush Holdings, the DCF model extrapolates the company's expected free cash flows for the next decade using current analyst estimates and longer-term projections.

Right now, Semrush is generating $31.0 Million in trailing twelve month free cash flow. This figure is anticipated to rise substantially over time, with projections reaching roughly $75.1 Million by the end of 2026. Projections continue rising through to 2035, with smaller annual growth increments in the later years. It is worth noting that while analysts estimate cash flows out five years, the figures beyond that are extrapolated using industry-standard growth rates by Simply Wall St.

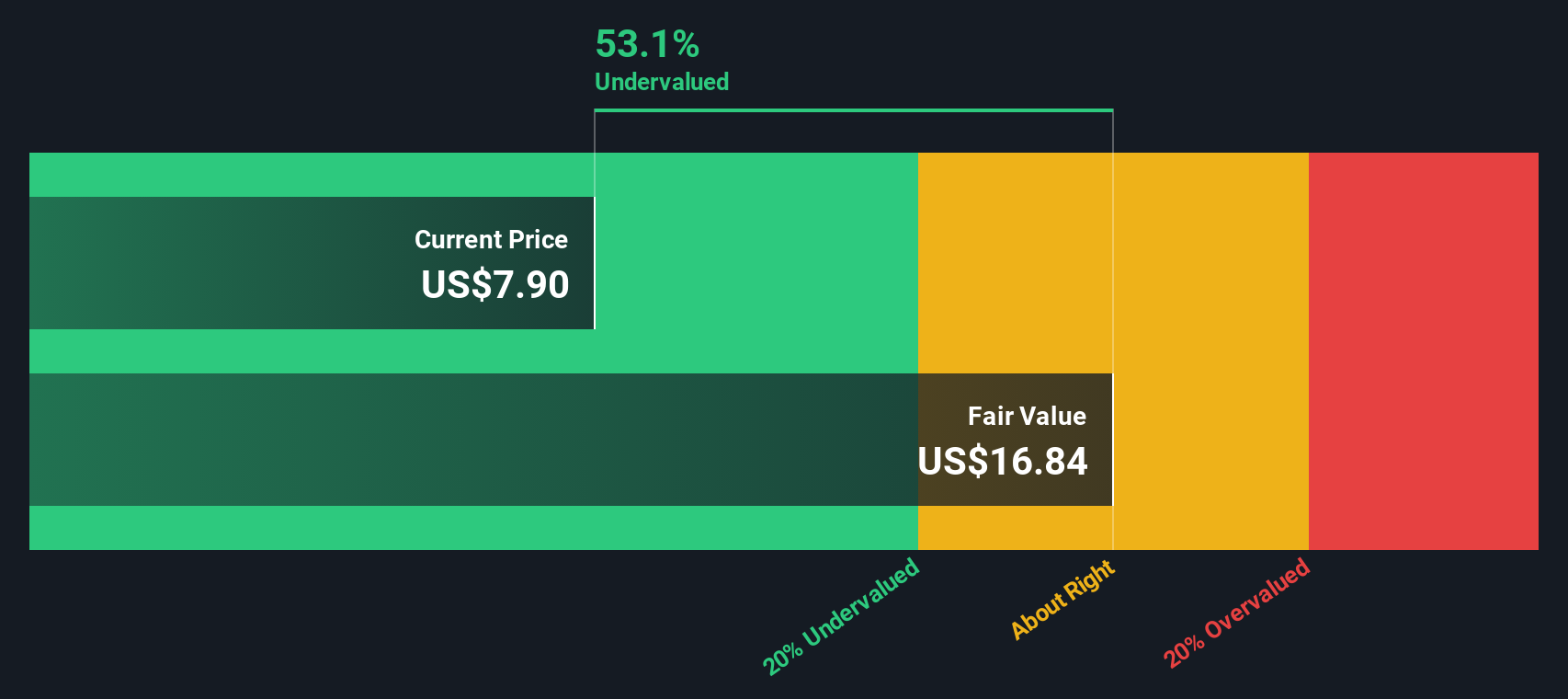

Applying this set of projections, the DCF model arrives at an intrinsic value for Semrush Holdings of $16.73 per share. Compared to the current stock price, this represents a substantial implied discount of 57.1%, suggesting the stock is significantly undervalued according to this method.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Semrush Holdings is undervalued by 57.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Semrush Holdings Price vs Sales

The Price-to-Sales (P/S) ratio is often a strong valuation yardstick for software companies like Semrush Holdings that are investing heavily for future growth rather than near-term profits. For businesses where earnings may be suppressed due to reinvestment or expansion, the P/S ratio cuts through short-term noise to focus on the company’s top-line performance, making it a relevant metric.

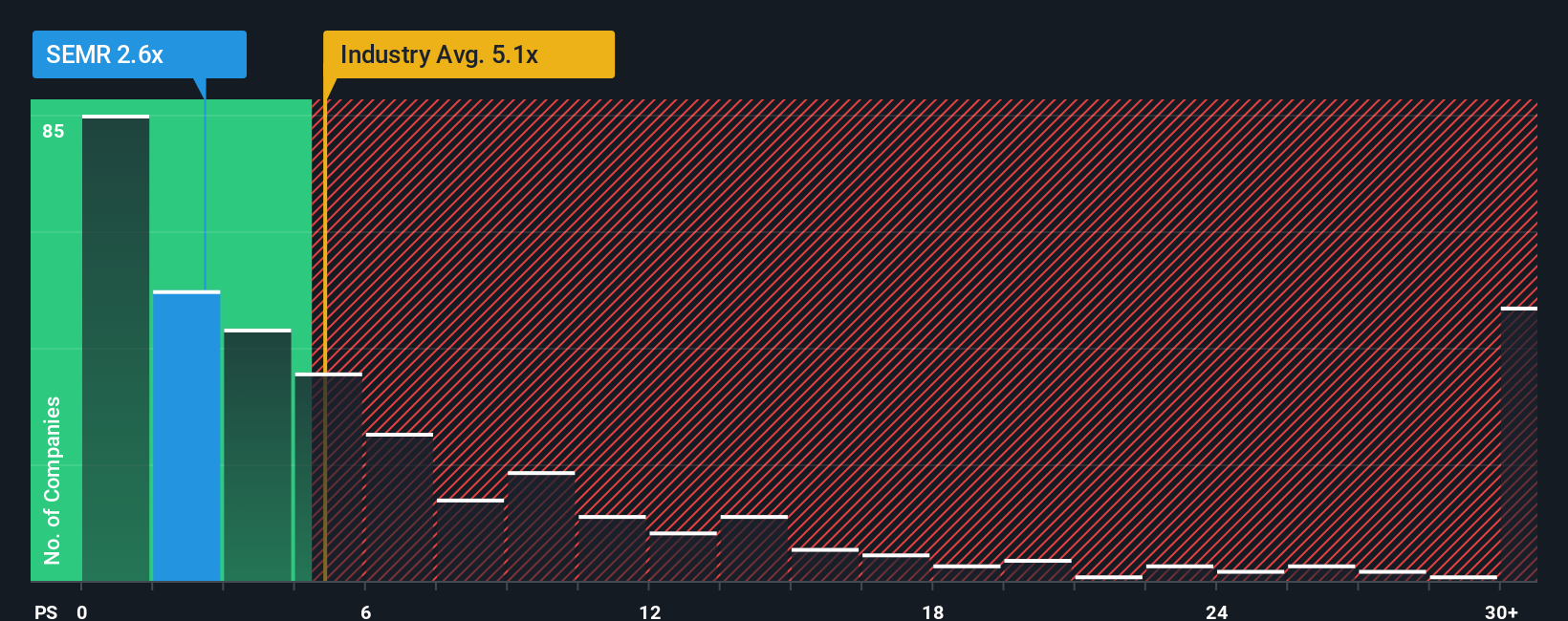

It is important to recognize that growth expectations and risk directly impact what constitutes a “normal” or “fair” P/S. Companies with higher expected revenue growth, better margins, or more robust business models can justify higher multiples. Riskier or slower-growing names typically trade at lower ratios. For Semrush, the current P/S multiple stands at 2.58x. This is below both the software industry average of 5.19x and the peer group average of 2.88x, already signaling a discount relative to the broader landscape.

However, rather than relying solely on sector or peer comparisons, Simply Wall St employs a “Fair Ratio.” This proprietary metric blends company-specific factors such as earnings growth, profit margins, risk levels, and market cap to set a personalized benchmark for valuation. It aims to answer what multiple a business should trade at, given everything unique to its situation. For Semrush, the Fair Ratio is 4.93x, meaning the shares are trading well below what would typically be warranted for a company with its growth prospects and strengths.

With Semrush’s current P/S ratio meaningfully lower than its Fair Ratio, this analysis supports the case for the stock being undervalued on a relative basis.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Semrush Holdings Narrative

Earlier we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative combines your story about a company, including your expectations for its revenue, profits, risks, and growth drivers, with the numbers. This connects business trends to a financial forecast and a fair value estimate.

On Simply Wall St’s Community page, Narratives are a simple, interactive tool used by millions that turn analysis into an accessible conversation. You can share your perspective on what will drive Semrush Holdings’ future and instantly see how those assumptions change the fair value versus the current price, helping you decide whether to buy, sell or hold.

Because Narratives update automatically whenever new data, earnings, or news come out, your fair value stays reflective of reality and is not based on out-of-date projections. Since every investor brings their own assumptions, one Narrative might emphasize Semrush’s expanding AI-powered enterprise business and project a bullish price target of $13.00. Another might focus on competitive threats and market commoditization, resulting in a lower, more cautious value of $9.00. This demonstrates how different stories can yield different investing decisions.

Do you think there's more to the story for Semrush Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SEMR

Semrush Holdings

Develops an online visibility management software-as-a-service platform in the United States, the United Kingdom, and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives