- United States

- /

- Software

- /

- NYSE:S

SentinelOne (S) Reports Revenue Growth but Posts Increased Net Loss for Q2 2025

Reviewed by Simply Wall St

SentinelOne (S) recently reported its second-quarter earnings, showing increased sales but a larger net loss compared to the previous year. Despite these mixed financial results, the company's stock price saw a 5.83% rise last week. This performance occurred despite tech stocks generally facing pressure, with major indexes like the Nasdaq down by 1.1%. The market's 2.3% rise over the same period suggests that while SentinelOne benefited from its sales growth and future revenue expectations, it also contended with broader tech sector challenges. The combination of these elements contributed to its price movement against a volatile market backdrop.

Every company has risks, and we've spotted 2 weaknesses for SentinelOne you should know about.

The recent earnings report from SentinelOne highlights increased sales coupled with a larger net loss, a dynamic that could influence its broader narrative. The firm's shift to an AI-native cybersecurity platform, outlined in its strategic plan, aims to drive revenue growth and margin improvements, but the immediate net loss raises questions about the timeline to profitability. This development might impact earnings forecasts, adding pressure on SentinelOne to strengthen its partnerships and manage product phase-outs effectively.

Looking at SentinelOne's longer-term performance, the stock experienced a 27.41% decline over the past year. This contrasts sharply with its recent short-term share price rise and reflects ongoing challenges in achieving consistent growth. Relative to the broader US market, which saw a 17.2% increase in the past year, and the US Software industry with a remarkable 27.7% gain, SentinelOne's performance underscores significant hurdles that must be addressed to meet industry benchmarks.

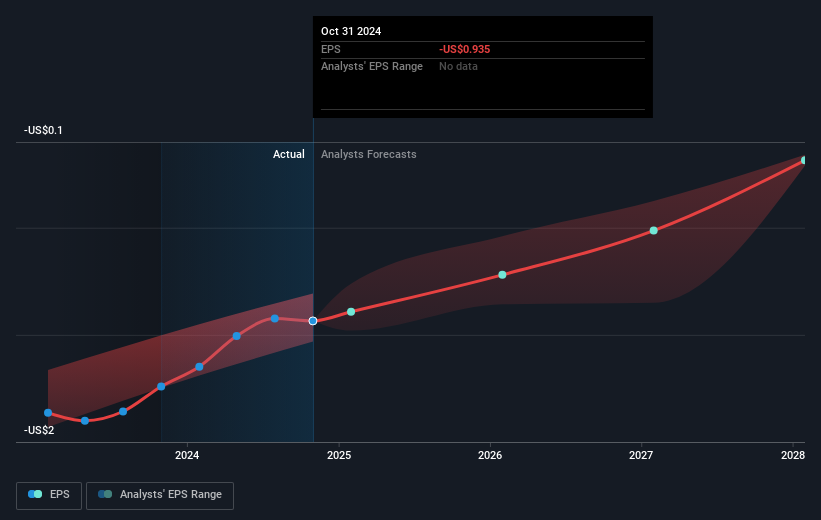

As for revenue and earnings forecasts, the recent 5.83% share price rise signals market optimism regarding SentinelOne’s potential for future sales growth, possibly fueled by AI-driven initiatives. However, it is essential to note that analysts project the company will remain unprofitable over the next three years. This projection is vital as the current share price of US$17.61 still trails behind the analyst consensus price target of US$22.71, suggesting potential upside if financial improvements align with market expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:S

SentinelOne

Operates as a cybersecurity provider in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives