- United States

- /

- Software

- /

- NYSE:S

SentinelOne (S): Assessing Valuation After Upbeat Q2 Results and Raised Revenue Outlook

Reviewed by Simply Wall St

If you’re looking at SentinelOne (S) and weighing your next move, you’re not alone. The company just reported second-quarter results that came in above what analysts were expecting, especially when it comes to profitability and recurring revenue. Management reinforced that momentum by raising their full-year revenue outlook, signaling growing confidence in the strength of their business. This move has made a real impact on investor sentiment.

Following this upbeat results announcement, shares of SentinelOne jumped 4.5% and have strung together several days of gains, indicating fresh optimism among investors. The past month has seen some renewed upward momentum, with the stock gaining 5%, though it’s still off around 16% on the year. Over the longer term, returns remain challenged, but new customer growth and product expansion have given the story a new spark.

With the stock’s latest rally and a higher revenue target in play, some may wonder whether the current price presents an opportunity to participate in future AI-powered growth, or if the market has already accounted for what lies ahead.

Most Popular Narrative: 17% Undervalued

The most widely followed narrative suggests SentinelOne is undervalued by 17 percent, given strong growth prospects and improving fundamentals.

“SentinelOne has transformed its business model from an endpoint-focused approach to a comprehensive AI-native cybersecurity platform. This shift is expected to drive future revenue growth as enterprises increasingly require integrated solutions. The company is investing heavily in AI-powered innovations and prioritizing this technology to redefine security applications, which could lead to improved net margins by reducing operational costs and increasing efficiencies.”

Curious how SentinelOne could outperform the market’s muted outlook? This narrative hints at ambitious growth targets and aggressive profit margin assumptions. If you want to discover the numbers behind this bold price target, you won’t want to miss the full story.

Result: Fair Value of $22.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, potential missteps such as unpredictable financial guidance or difficulties arising from the retirement of legacy products could complicate SentinelOne's growth trajectory and risk analyst optimism.

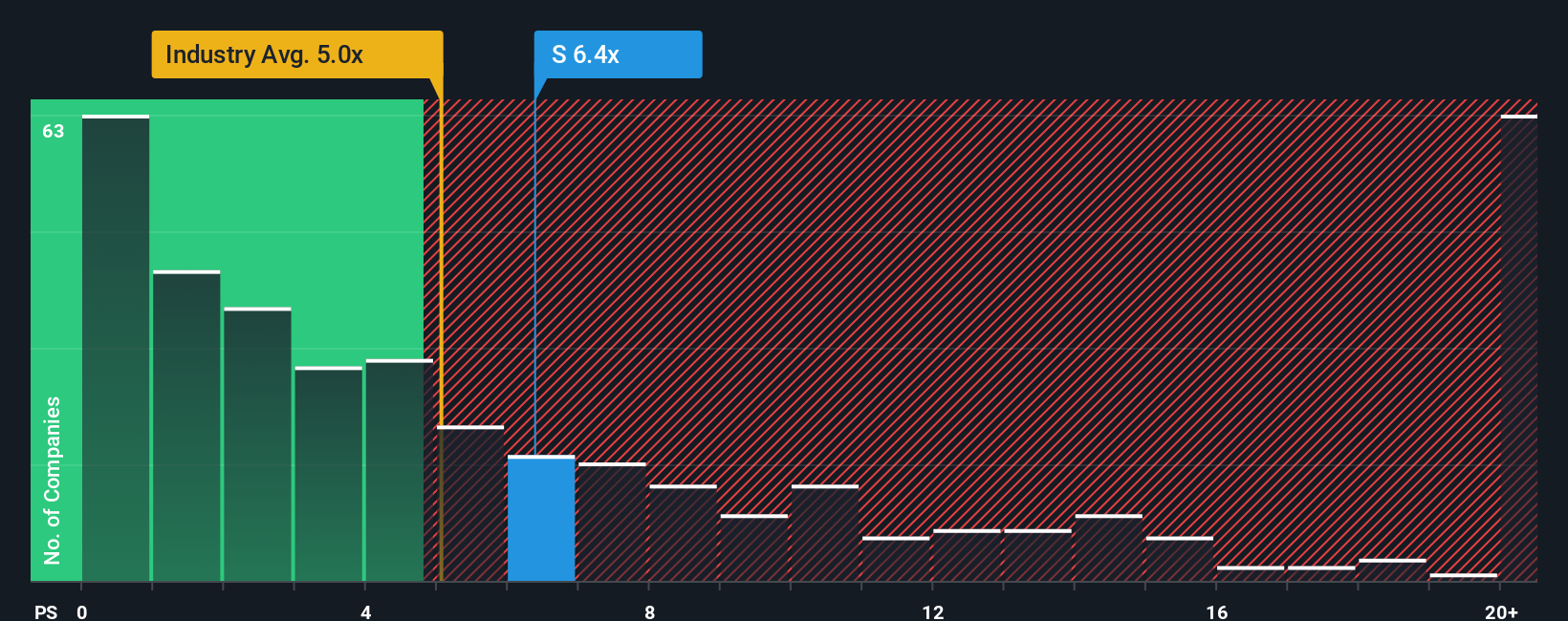

Find out about the key risks to this SentinelOne narrative.Another View: Valuation by Sales Ratio

Looking from a different angle, SentinelOne is valued based on its sales compared to the industry. This approach suggests the stock may be less of a bargain than the earlier narrative implies. Which view would you lean on?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding SentinelOne to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own SentinelOne Narrative

If you’d rather dive in and shape your own perspective, you can explore the details and craft your own analysis in just minutes. Do it your way.

A great starting point for your SentinelOne research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why settle for only one opportunity? Now is the perfect moment to act and uncover stocks aligned with your goals. Don’t let these exciting opportunities pass you by.

- Tap into potential by tracking companies with consistent payouts using our list of dividend stocks with yields > 3%.

- Ride the wave of groundbreaking progress and find innovators at the intersection of healthcare and AI with our handpicked healthcare AI stocks.

- Unlock hidden gems trading below their value with our specially curated undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:S

SentinelOne

Operates as a cybersecurity provider in the United States and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)