- United States

- /

- Software

- /

- NYSE:S

SentinelOne (NYSE:S) Unveils Future-Ready Program Amid 7% Share Price Dip

Reviewed by Simply Wall St

Last week, SentinelOne (NYSE:S) launched its Global PartnerOne Program, aimed at enhancing partner strategies and growth. Despite this initiative, aimed at reinforcing partner collaborations, SentinelOne's stock experienced a 7% decline. This decline coincided with broader market turmoil, where major indexes fell due to escalating trade tensions and tariffs. The Dow Jones dropped 4%, pushing the Nasdaq into bear market territory, reflecting investor concern over economic stability. As tech stocks broadly declined, SentinelOne's price move aligned with these trends, demonstrating the impact of macroeconomic factors on individual stock performance despite positive company announcements.

We've identified 2 risks for SentinelOne that you should be aware of.

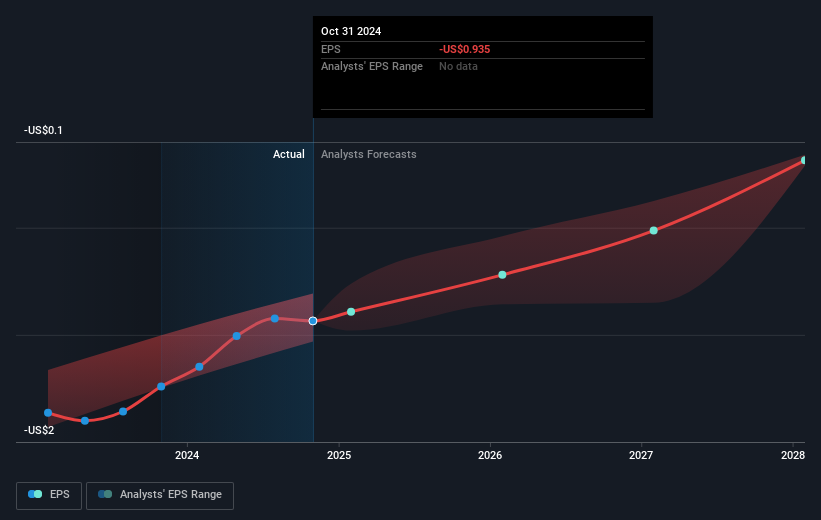

Over the last year, SentinelOne experienced a total return of 18.07% decline, contrasting the modest 3.3% return of the broader US market and further underperforming the US Software industry, which saw a 3.1% drop. The company's financial results, reported in March 2025, indicated significant growth with full-year sales rising from US$621.15 million to US$821.46 million. However, the substantial net loss of US$70.79 million highlights ongoing profitability challenges. The integration of AI-driven security solutions with partners like Obsidian and High Wire Networks also marked progress, but did not immediately bolster investor sentiment. Nevertheless, these technological advancements might lay the groundwork for future performance improvements.

The appointment of Barbara Larson as Chief Financial Officer in September 2024 and the continued partnership advancements, specifically with Lenovo and Google Cloud, further position SentinelOne in the AI cybersecurity arena. Despite these initiatives, economic uncertainties and reliance on non-GAAP measures present continued risks, impacting investor confidence and highlighting challenges in achieving consistent earnings growth.

Upon reviewing our latest valuation report, SentinelOne's share price might be too pessimistic.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:S

SentinelOne

Operates as a cybersecurity provider in the United States and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives