- United States

- /

- Software

- /

- NYSE:RNG

Should RingCentral's (RNG) Expanded Credit Facility and Lower Rates Prompt a Strategic Reassessment?

Reviewed by Simply Wall St

- Earlier this week, RingCentral announced the expansion and extension of its existing credit agreement, increasing the total facility to US$1.24 billion, of which US$930 million remains undrawn, led by Bank of America and JPMorgan, with enhanced terms including lower interest rates and extended maturities to 2030.

- This move provides substantial capital flexibility, allowing RingCentral to address its US$609 million in convertible notes due 2026 and optimize its borrowing structure amidst evolving financial needs.

- We'll examine how this expanded credit access and lower borrowing costs could influence RingCentral's investment narrative and future financial position.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

RingCentral Investment Narrative Recap

To be a shareholder in RingCentral, you need to believe in the company's ability to lead in cloud-based communications through ongoing product innovation and effective adaptation to a fiercely competitive landscape. The newly expanded US$1.24 billion credit facility offers financial flexibility to address upcoming debt maturities, but does not materially shift the biggest near-term catalyst: accelerating adoption of AI-powered solutions like RingCX and RingSense. The main risk remains competitive pressures from bundled productivity suites, which could erode RingCentral's standalone value proposition in the months to come.

Among recent developments, the multiyear renewal of the NiCE partnership aligns with RingCentral's push to deepen distribution and drive adoption for its Contact Center offerings. This could support customer retention and incremental growth, helping offset some competitive pressures by strengthening its foothold with larger enterprise clients.

By contrast, investors should be aware that while refinancing efforts lower short-term financial risk, the longer-term challenge of customer migration to bundled suites remains unresolved...

Read the full narrative on RingCentral (it's free!)

RingCentral's outlook anticipates $2.8 billion in revenue and $219.0 million in earnings by 2028. This implies a 5.0% annual revenue growth rate and a $231.2 million increase in earnings from the current level of -$12.2 million.

Uncover how RingCentral's forecasts yield a $33.24 fair value, a 9% upside to its current price.

Exploring Other Perspectives

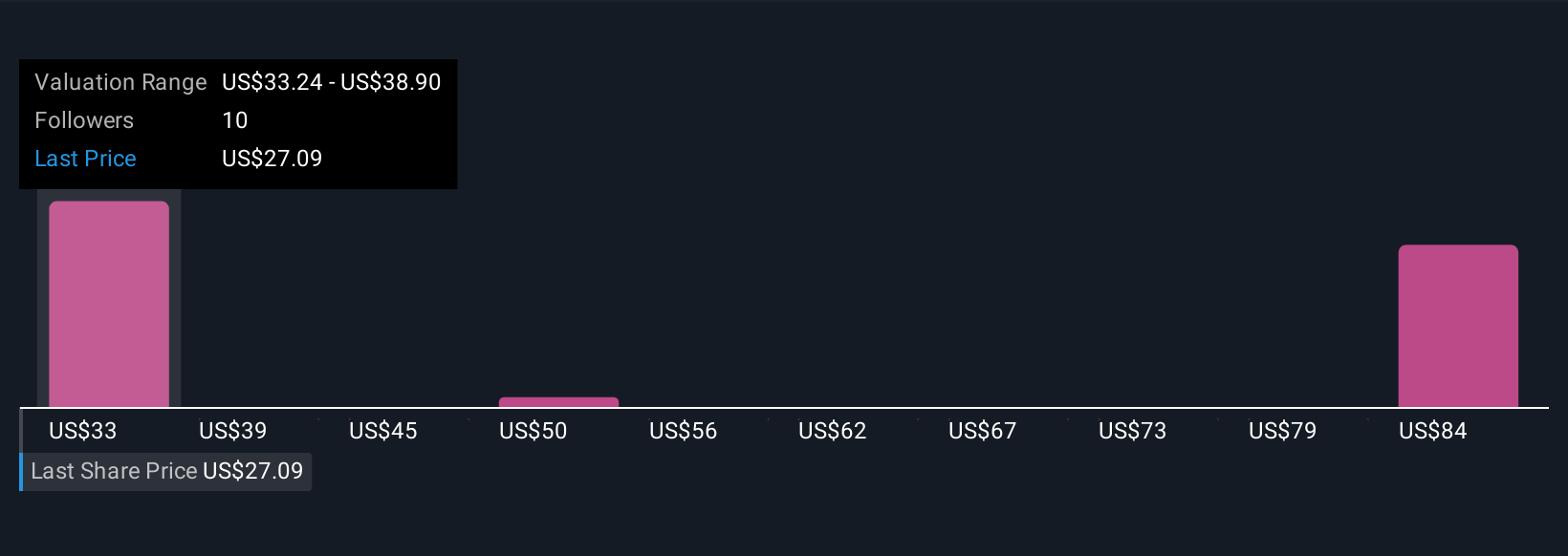

Four different Simply Wall St Community members estimate RingCentral’s fair value between US$33.24 and US$90.93 per share. With ongoing competition from bundled suites still a major concern, consider how these diverse outlooks could reflect uncertainty in RingCentral’s future growth and resilience.

Explore 4 other fair value estimates on RingCentral - why the stock might be worth over 2x more than the current price!

Build Your Own RingCentral Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your RingCentral research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free RingCentral research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate RingCentral's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RNG

RingCentral

Provides cloud business communications, contact center, video, and hybrid event solutions in North America and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives