- United States

- /

- Software

- /

- NYSE:RBRK

A fresh look at Rubrik (RBRK) valuation after new Amazon Bedrock integration and AWS resilience recognition

Reviewed by Simply Wall St

Rubrik (RBRK) just rolled out Rubrik Agent Cloud for Amazon Bedrock AgentCore, pairing it with a fresh AWS resilience credential, and that combo is quietly reshaping how investors think about its AI security moat.

See our latest analysis for Rubrik.

The Amazon Bedrock AgentCore launch and fresh AWS resilience credential land at a time when Rubrik’s $69.4 share price has a modest year to date share price return of 4.6 percent but a far stronger 1 year total shareholder return of 36.27 percent, suggesting that recent weakness may reflect a resetting of expectations rather than a broken growth story.

If this kind of AI security momentum has your attention, it could be worth scanning other high growth tech names via high growth tech and AI stocks for your watchlist.

With Rubrik posting solid double digit growth yet still trading at a steep discount to analyst targets, investors are left wondering if AI security upside remains underappreciated or if markets are already pricing in years of expansion.

Most Popular Narrative Narrative: 39.8% Undervalued

Rubrik’s most followed narrative pegs fair value near $115, well above the $69.4 last close, framing a sizable upside if its plan holds.

Operational efficiencies and improved expense management have led to significant enhancements in subscription ARR contribution margin, which can lead to improved profitability and expectations of higher free cash flow, supporting future earnings growth.

Want to see what powers that jump in fair value? This narrative leans on rapid revenue expansion, margin rebuild, and an aggressive future earnings multiple. Curious which assumptions really move the needle?

Result: Fair Value of $115.2 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside hinges on execution, with fierce cyber resilience competition and uncertain AI adoption timelines both capable of knocking those growth assumptions off course.

Find out about the key risks to this Rubrik narrative.

Another View: Market Ratios Flash Caution

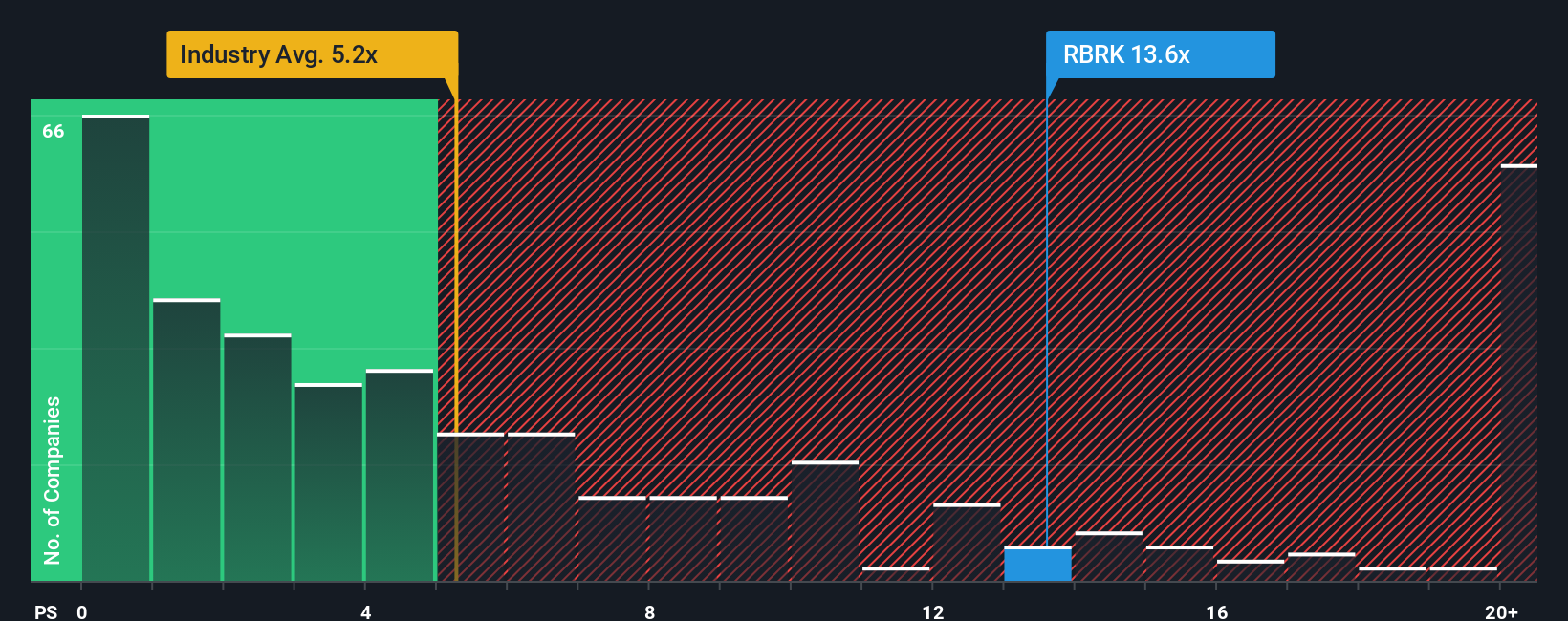

While the narrative and our model point to upside, the market ratio picture is harsher. Rubrik trades at a 12.7x price to sales, far above the 4.7x software average and a 9.7x fair ratio, suggesting investors are already paying up for execution risk.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rubrik Narrative

If this storyline does not quite fit your view, dive into the numbers yourself, shape a custom thesis in minutes, and Do it your way.

A great starting point for your Rubrik research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider your next steps with fresh opportunities from the Simply Wall St Screener so you do not miss tomorrow’s standouts.

- Explore potential opportunities by scanning these 3567 penny stocks with strong financials that combine low share prices with stronger balance sheets and improving business momentum.

- Focus on these 25 AI penny stocks that apply machine learning and automation within their business models.

- Review these 935 undervalued stocks based on cash flows that appear inexpensive on certain cash flow metrics while still having identified long term growth plans.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RBRK

Rubrik

Provides data security solutions to individuals and businesses worldwide.

Slightly overvalued with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026