- United States

- /

- Software

- /

- NYSE:RAMP

A Look at LiveRamp (RAMP) Valuation Following New AI Launch and Publicis Middle East Partnership

Reviewed by Kshitija Bhandaru

LiveRamp Holdings (NYSE:RAMP) has recently announced a partnership with Publicis Groupe Middle East to expand commerce media capabilities. The company is also rolling out advanced AI tools designed to boost marketing automation and data collaboration for its clients.

See our latest analysis for LiveRamp Holdings.

The recent 2% share price bump following LiveRamp’s new AI tools and Middle East partnership stands out after a stretch of muted performance. However, its one-year total shareholder return of 16% hints that momentum could be building as profitability improves and product innovation draws investor attention.

Curious what else is attracting interest beyond LiveRamp’s sector? Now is a great moment to broaden your search and discover fast growing stocks with high insider ownership

With shares recently rallying and fresh innovation hitting the platform, is LiveRamp stock currently trading at an attractive discount, or are markets already reflecting all of its potential for future growth?

Most Popular Narrative: 30.8% Undervalued

With LiveRamp last closing at $27.41, the most widely followed narrative places its fair value significantly higher, anchored at $39.63. This gap spotlights a bullish outlook rooted in product innovation, privacy leadership, and an evolving media landscape.

As digital advertising shifts rapidly towards AI-powered personalization and omni-channel engagement, the proliferation of AI agents and the growing complexity of customer journeys are increasing the need for secure, interoperable data connectivity and identity infrastructure that can maximize the value of first-party, cross-partner, and contextual data. LiveRamp's positioning as a neutral enabler for AI-driven marketing across fragmented data sources is likely to drive sustained multi-year revenue growth.

What’s fueling this bold fair value? It is not just optimism. Dive into projections that assume a complete transformation in earnings and margins over the next several years. The secret is a financial roadmap that few companies can match right now. Want to see the full story behind these ambitious expectations? Find out what could power LiveRamp’s breakout move.

Result: Fair Value of $39.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition and revenue concentration among large clients remain key risks. These factors could dampen LiveRamp’s growth outlook if not carefully managed.

Find out about the key risks to this LiveRamp Holdings narrative.

Another View: What Do Market Ratios Reveal?

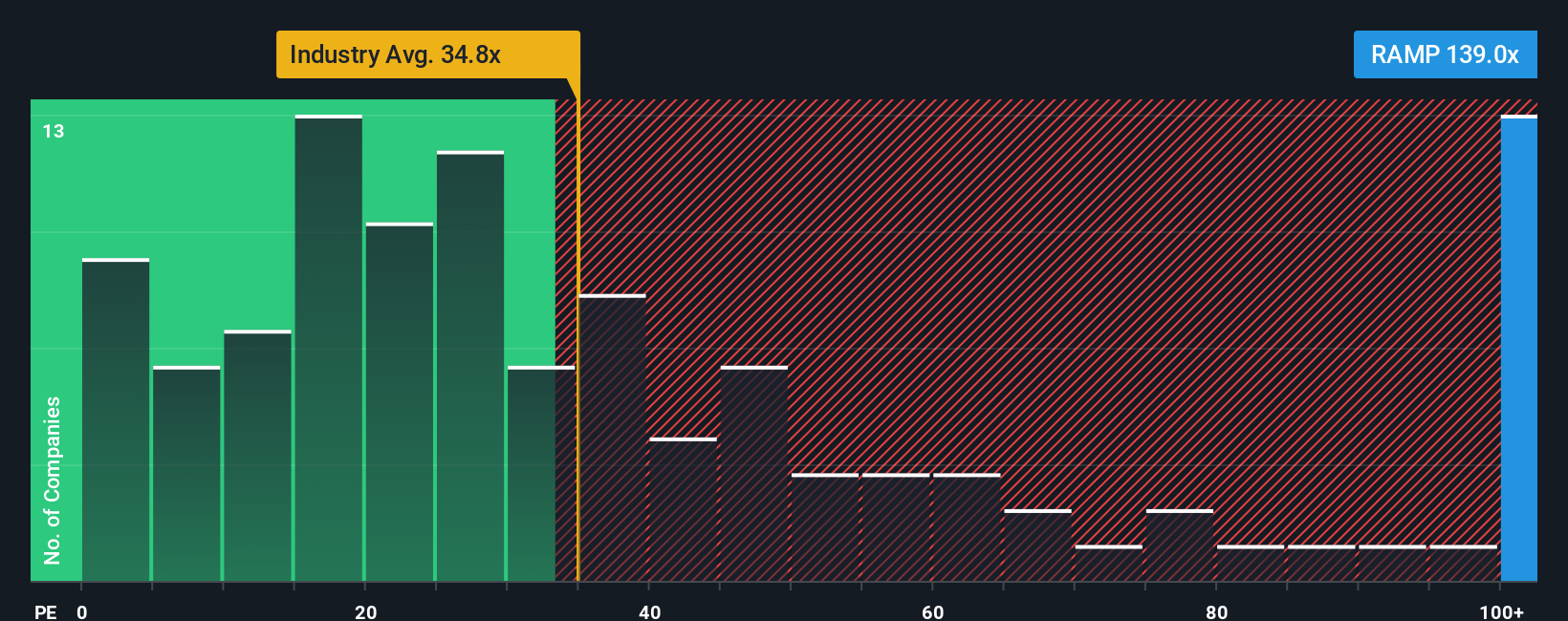

Taking a look through the lens of market ratios, LiveRamp trades at a price-to-earnings ratio of 141.2 times, which is much higher than the US Software industry average of 35.7 and the peer average of 75.1. Even the fair ratio for LiveRamp is estimated at just 61.8. This sizable gap suggests investors are pricing in major growth, which leaves less room for error. Are expectations running too high, or is a big payoff on the horizon?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own LiveRamp Holdings Narrative

If you have a different perspective or like to dig into the numbers yourself, you can craft your own LiveRamp narrative in just a few minutes. Do it your way

A great starting point for your LiveRamp Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Standout Investment Ideas?

Don’t let opportunity pass you by. There is a world of high-potential companies just waiting to be found. Use these handpicked screens to energize your strategy and catch the next big wave in the market:

- Tap into future breakthroughs by following these 26 quantum computing stocks, set to lead in advanced computing, security, and innovation-driven growth.

- Maximize your portfolio’s income and stability by selecting these 19 dividend stocks with yields > 3%, offering sustainable dividends and proven financial strength.

- Ride the momentum of technological change by targeting these 24 AI penny stocks, shaping the new era of automation, analytics, and intelligent solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RAMP

LiveRamp Holdings

A technology company, operates a data collaboration platform in the United States, Europe, the Asia-Pacific, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives