- United States

- /

- Software

- /

- NYSE:QTWO

Q2 Holdings (QTWO) Valuation After Solid Results but Slower Growth, Higher Churn and Margin Pressures

Reviewed by Simply Wall St

Q2 Holdings (QTWO) is back in the spotlight after solid quarterly results and a higher full year outlook, which have collided with some nagging issues, including elevated churn and softer annual recurring revenue growth.

See our latest analysis for Q2 Holdings.

The stock has bounced recently, with a 1 month share price return of nearly 17 percent off its lows. However, that follows a steep year to date share price decline and a weak 1 year total shareholder return, suggesting momentum is only cautiously rebuilding as investors reassess growth and margin risks.

If Q2s latest move has you rethinking your watchlist, this could be a good moment to explore high growth tech and AI stocks that are shaping the next wave of digital finance and beyond.

With shares still trading below analyst targets but growth concerns mounting, is Q2 Holdings quietly offering mispriced upside, or is the market already discounting a slower, more competitive future for this digital banking platform specialist?

Most Popular Narrative Narrative: 18.4% Undervalued

With Q2 Holdings last closing at $73.22 against a narrative fair value near $89.71, the story leans toward upside driven by earnings and margin expansion.

The increasing focus by financial institutions on digital transformation, evidenced by strong engagement and expanded investments in mission-critical digital banking, fraud prevention, and AI solutions, is likely to drive robust subscription revenue growth and improve retention for Q2 over the longer term.

Heightened demand for integrated, omni-channel, and mobile-first banking experiences is accelerating adoption of Q2's unified platform across both new and existing customers, expanding the addressable market and supporting higher average revenue per user (ARPU) and overall revenue growth.

Curious how steady double digit growth, expanding margins, and a punchy future profit multiple all fit together into that fair value target? The full narrative unpacks the exact revenue ramp, earnings curve, and valuation bridge that aim to justify this premium outlook without leaving anything to guesswork.

Result: Fair Value of $89.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated churn, tied to bank consolidation and intensifying point solution competition, could still derail subscription growth and compress margins faster than bulls expect.

Find out about the key risks to this Q2 Holdings narrative.

Another Lens on Valuation

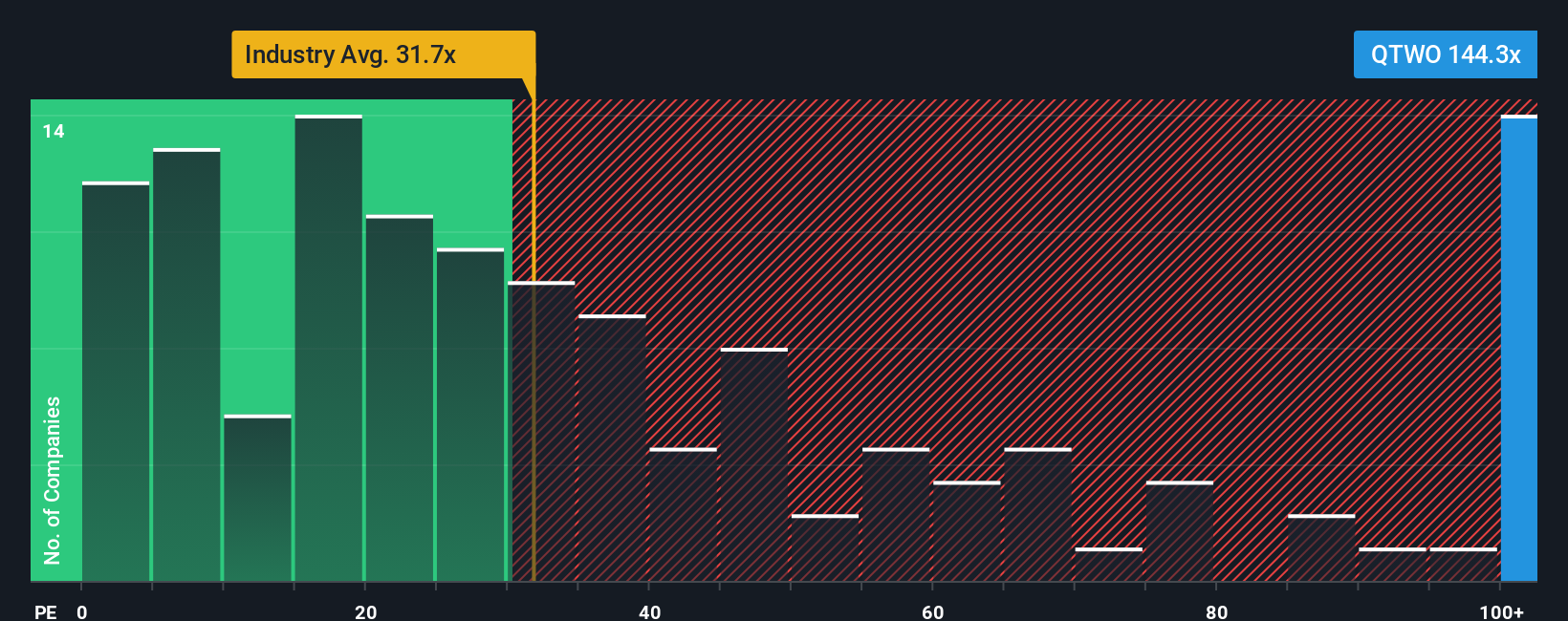

Price-based models tell a tougher story. Q2 trades on a 144.3 times earnings multiple, far richer than both the US software sector at 32 times and its peer group at 28.7 times, and well above a fair ratio of 54.4 times. This raises questions about how much upside is really left.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Q2 Holdings Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Q2 Holdings.

Ready for more investment ideas?

Before you move on, consider your next opportunity by scanning curated stock ideas built from data, not hype, using our powerful screeners.

- Look for potential upside in smaller, less-followed names by scanning these 3573 penny stocks with strong financials with balance sheets and fundamentals that appear stronger than their low share prices suggest.

- Explore the cutting edge of innovation by targeting these 25 AI penny stocks that are using artificial intelligence to reshape industries.

- Seek more value for every dollar invested by focusing on these 921 undervalued stocks based on cash flows where cash flow strength and price still appear out of sync.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Q2 Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QTWO

Q2 Holdings

Provides digital solutions to financial institutions, financial technology companies, FinTechs, and alternative finance companies (Alt-FIs) in the United States.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026