- United States

- /

- Software

- /

- NYSE:QTWO

Q2 Holdings (QTWO): Examining Valuation After Helix’s Strategic Win With Bangor Savings Bank

Reviewed by Simply Wall St

Bangor Savings Bank, a major regional lender with over $7 billion in assets, has tapped Helix by Q2 Holdings (QTWO) as a strategic partner for its Banking as a Service (BaaS) platform expansion. This partnership leverages Q2’s expertise in powering fintech growth and embedded finance solutions.

See our latest analysis for Q2 Holdings.

Q2 Holdings has captured plenty of attention with its Helix win, but that hasn’t yet translated into a consistent resurgence in its share price. While the 1-month share price return stands out at 13.7%, long-term momentum is still subdued. This is reflected in a year-to-date share price decline of nearly 29%, as well as a 1-year total shareholder return of -34%. However, the three-year total shareholder return remains highly positive at nearly 180%, suggesting the company is capable of significant runs when conditions turn in its favor.

If this kind of fintech momentum has you curious, now's a great time to broaden your search and discover fast growing stocks with high insider ownership

Given recent momentum and a share price well below year-ago levels, is Q2 Holdings a compelling value play right now? Or has the market already priced in the company’s growth prospects after its major Helix partnership?

Most Popular Narrative: 21.7% Undervalued

Q2 Holdings’ most followed fair value estimate stands at $90.36, which is meaningfully higher than its last close of $70.78. This narrative suggests that a combination of growth catalysts may drive shares much higher from here and builds on bold assumptions behind the target.

The increasing focus by financial institutions on digital transformation, evidenced by strong engagement and expanded investments in mission-critical digital banking, fraud prevention, and AI solutions, is likely to drive robust subscription revenue growth and improve retention for Q2 over the longer term. Heightened demand for integrated, omni-channel, and mobile-first banking experiences is accelerating adoption of Q2's unified platform across both new and existing customers, expanding the addressable market and supporting higher average revenue per user (ARPU) and overall revenue growth.

Want to uncover what powers such a bullish price target? The narrative leans on aggressive future earnings, significant margin improvements, and growth that challenges industry benchmarks. Discover which ambitious forecasts stand behind this valuation leap. Are you ready to see the numbers that could impact your outlook?

Result: Fair Value of $90.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued banking sector consolidation or an increase in customer churn could pressure Q2 Holdings’ growth and challenge the current bullish outlook.

Find out about the key risks to this Q2 Holdings narrative.

Another View: Multiples Raise Red Flags

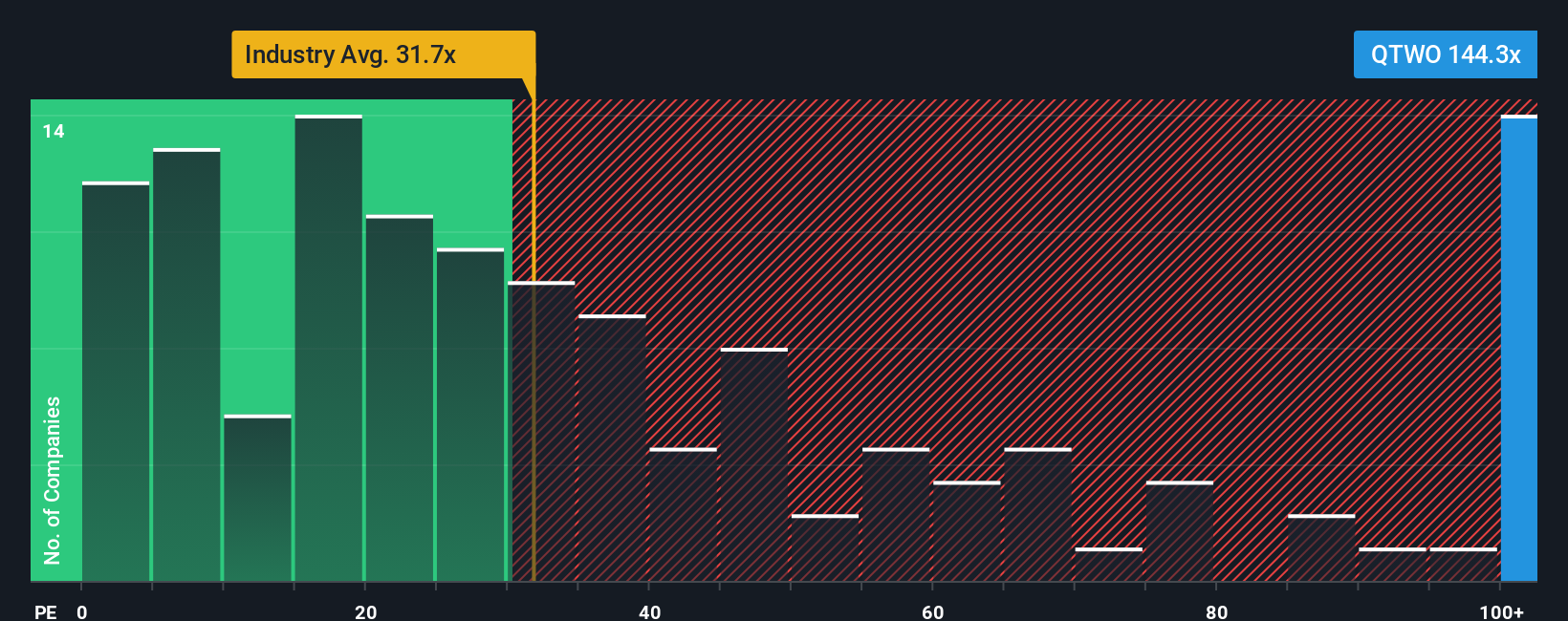

Looking at valuation through the lens of the price-to-earnings ratio changes the perspective. Q2 Holdings trades at 139.5 times earnings, which is far above the industry average of 28.8 and its fair ratio of 59.6. This premium suggests investors are paying up for future growth, but it raises concerns about potential downside if results disappoint.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Q2 Holdings Narrative

If you see things differently or want to dig deeper into Q2 Holdings' story, you can review the data and share your unique analysis in just a few minutes, then Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Q2 Holdings.

Looking for More Compelling Investment Ideas?

Why stop at just one opportunity? Explore unique ways to strengthen your portfolio by checking out these handpicked investment angles before the next wave of growth arrives.

- Seize the chance to benefit from high-potential upstarts by reviewing these 3588 penny stocks with strong financials with strong financials and growth tracks.

- Tap into the power of future tech by finding these 26 quantum computing stocks innovating in quantum computing and changing how tech shapes our world.

- Grow your passive income with these 15 dividend stocks with yields > 3% offering strong yields and reliable payout track records.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Q2 Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QTWO

Q2 Holdings

Provides digital solutions to financial institutions, financial technology companies, FinTechs, and alternative finance companies (Alt-FIs) in the United States.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026