- United States

- /

- Software

- /

- NasdaqGS:PLTR

Unboxing Palantir Technologies (NYSE:PLTR) - the Business, the Risks, and The Value

Looking at Palantir Technologies Inc. (NYSE:PLTR), some investors might ask themselves if there is an opportunity to get the stock while it is down some 50% from the last three months. In this article, we attempt to better understand the business and estimate the fundamental worth of the company. This can allow us to evaluate if Palantir is more appropriate for trading or long term investing.

The State Of The Business

Palantir is sitting on the crossroads between developing for government and commercial clients. The company has about 203 clients (p. 27) in total, and has potentially realized that it may not be able to sustain high client growth in the government sector.

Currently, they seem to be pushing sales into the commercial sector in order to offset the mentioned declining growth. It seems that finding a niche in the commercial sector will be somewhat more difficult for Palantir, as this sector competes with every other data analytic platform, while on the government side, Palantir may be privy and able to develop restricted technologies. While Palantir offers a valuable analytics platform that integrates with services such as SAP, CRM etc., this field is rapidly evolving, and the said companies are creating their in-house solutions in order to drive off competitors like Palantir and improve their own profitability.

In order for Palantir to have an edge into this landscape, they must develop high performing proprietary technology that will shield it from competition, while at the moment, their services also rely on public domain statistical technology such as multiple logistic regressions, significance tests, classification models paired with vision AI, etc.

While it may seem that I am critical of the company, it is not quite true, a heavy use of analytics will drive talent to the company and there is good reason to suspect that they will actually develop the proprietary tech that stands out from the competition. I think that the company is a prime candidate to achieve this, however I don't feel that they are there yet.

The Services

Palantir is a bit of a black box for people that have never worked with data analytics, and the company seems to have designed itself to be vague about what it does. One can suspect, that if they explained it in plain words, that they would put their market cap at risk. That is also why we see some heavy visual effects on their promotional videos, and they seem to be targeted at government officials or retail investors that may not be able to distinguish between functionalities of the service and video cosmetics.

In their latest filing (p. 22), we see that the split between services from government and commercial revenue is 59% to 41%, respectively for the last 9 months ending in Q3 2021.

As far as services go, Palantir has currently 3 main platforms:

- Foundry - The main analytics service offered commercially

- Gotham - The main analytics service offered to governments

- Apollo - Allows software developers to continuously deploy and update their software that needs to need government security checks such as Europe's GDPR

The main approach that Palantir has in developing these analytics platforms is a bold one, especially in the world of "Big Data". While most platforms prioritize full automatization of machine learning solutions and delivering them via APIs, Palantir seems to prioritize the hybrid approach, where an analyst monitors data and makes sure to act on relevant events. This is more costly than automated analytics, but seems to magnify quality value for clients that overshadows the costs and risk of human error.

As you can see, I feel that Palantir has a lot to improve and develop, however it already has a foothold in the technology, and is one of the companies that has a good chance to stay ahead in the race.

I would add, that the main risk I see for the company, are rapid and public technological shifts that will decrease margins and be utilized by competitors.

In essence, Palantir is a young company (still), that has the potential to deliver high cash flows for investors in the future, but the future seems to be a bit further than one may expect.

With that, let's move on to the fundamentals, and see what this means for the stock.

See our latest analysis for Palantir Technologies

Fundamental Overview

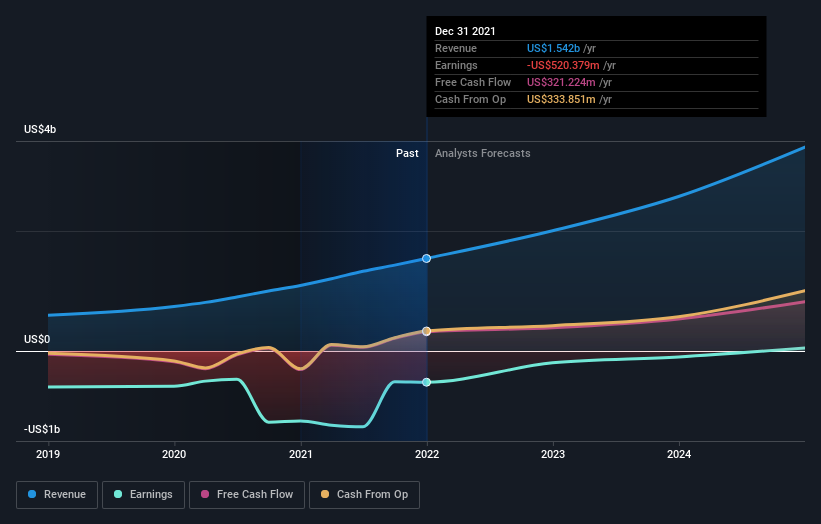

Shareholders of unprofitable companies usually expect strong revenue growth. Palantir Technologies grew its revenue by 41% over the last year, which is a great performance for a young growth company, but may be too early to be valued via sales multiples.

The company also has a gross margin of 78%, and positive free cash flows of US$321m. The high gross margin means that the software solutions are cheap (not easy) to distribute, while the company can use the rest to push for more sales and development. The free cash flows are also a validation of the business model and give honest signals that profit should converge up to cash flows and the company has lower risk of bankruptcy. This also allows the company to borrow money while not being profitable yet, and invest the funds into the business.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Ultimately, all these figures need to be tied together in a way that helps investors make decisions.

One way to do that, is to construct a valuation model. The Simply Wall St discounted cash flow model attempts to value the future cash flows in a rough way - the estimates are hard to get right with young companies, so take it with a grain of salt. The intrinsic value comes up to about US$30.7b today, or $15.3 per share - undervalued some 31.6% from the current $10.48 per share.

Click HERE to see the details of the model.

Having a potentially undervalued stock, does not automatically mean that the price will jump to value anytime soon. Markets have a mind of their own, and it may take a long time (if ever) before the 2 values converge.

We should always consider market factors that may impact price swings, such as:

- Depressed market mood, partly resulting from an expected economy contraction

- Prioritizing other investments that are more resistant to expected inflation

- Reduction of liquidity in equity markets

- A price jump resulting from the demand for security services due to a developing geopolitical situation in Eastern Europe and South Asia

What I hoped to illustrate, is that volatility is still expected to be high, and the stock is still high risk due to it being in its early growth stage. This can be great for short term traders or investors that are willing to hold through volatility for a longer period.

Being part of the software side of the defense industry can also offer investors some diversification benefits, as companies like this are rare.

Key Takeaways

Palantir's business seems to be a black box by design, which staves off competitors and can intrigue retail investors. The necessary growth avenue for the company is the commercial sector, which is also the largest portion that is at risk of competition.

The stock seems to be undervalued, however the pace of change in technology and current market sentiment do not necessarily make it a good investment. Alternatively, seasoned traders can exploit price movements by attempting to predict catalyst events in the near future.

The company has real potential to develop into a differentiated analytics platform for enterprise level companies that have ties to, or must meet, heavy government regulations.

The stock also offers some diversification qualities as it focuses on the software and analytics side of defense systems.

Alternatively, you can view this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:PLTR

Palantir Technologies

Palantir Technologies Inc. builds and deploys software platforms for the intelligence community to assist in counterterrorism investigations and operations in the United States, the United Kingdom, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives