- United States

- /

- Software

- /

- NasdaqGS:PLTR

It looks like Institutional investors are warming to Palantir Technologies Inc. (NYSE:PLTR)

Palantir Technologies’ (NYSE:PLTR) share price has fallen as much as 25% in the last 3 weeks, along with the shares of other growth companies, and particularly those that are not yet profitable. In September we looked at the ownership structure of Palantir and pointed out that the retail investors owned most of the company, which could be a double-edged sword for the company.

In September, retail investors owned 60% of the company, compared to just 24% for institutional investors. Since then the company released third quarter results that disappointed the market, and growth stocks came under pressure due to fears of rising interest rates.

Who owns Palantir now?

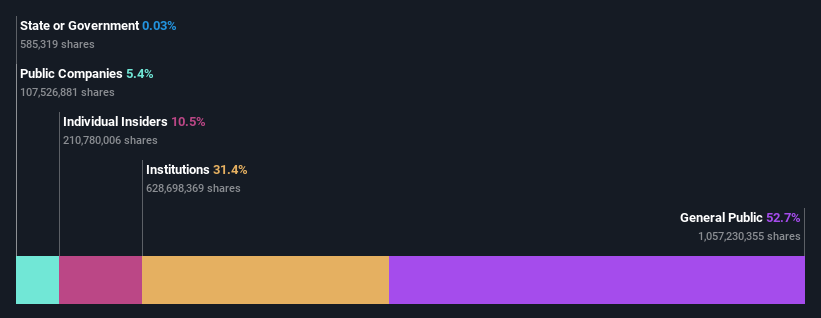

Palantir’s share price has fallen 25% since the previous analysis. As the image below illustrates, institutions have increased their share of ownership from 24% to 31.4%, while the percentage held by individual investors has fallen from 60% to about 54%. This suggets that retail investors sold shares while the price fell, while institutions took advantage of the price weakness.

See our latest analysis for Palantir Technologies

What Does The Institutional Ownership Tell Us About Palantir Technologies?

Institutions tend to take a longer-term view when investing in companies, and are less likely to react to short term news, so rising institutional ownership often results in lower volatility. In Palantir’s case, the fact that institutions have increased their ownership while the price has fallen gives us some comfort about the valuation.

As a matter of interest, our estimate of Palantir’s intrinsic value based on cash flow forecasts is $25.57. While this estimation is imperfect, it does suggest a modest discount at current levels.

Other shareholder groups

We note that hedge funds don't have a meaningful investment in Palantir Technologies. From our data, we infer that the largest shareholder is Peter Thiel (who also holds the title of Top Key Executive) with 6.9% of shares outstanding. It’s usually considered a good sign when insiders own a significant number of shares in the company, and in this case, we're glad to see a company insider play the role of a key stakeholder. In comparison, the second and third largest shareholders hold about 5.9% and 5.4% of the stock. Additionally, the company's CEO Alexander Karp directly holds 2.5% of the total shares outstanding.

In total insiders own just over 10% of the company. This is encouraging as it indicates that the company leadership’s interests are aligned with those of shareholders.

The bottom line on Palantir

Ultimately it will be earnings growth that determines the direction of Palantir’s share price. The major factor here will be sales growth for Palantir’s commercial business. Some analysts are skeptical about how well the company can grow the commercial business, but increased interest from institutional investors may indicate that this opinion is changing. You can keep track of who owns the company by referring back to the ownership breakdown and insider transactions here.

While it is well worth considering the different groups that own a company, there are other factors that are even more important. Specifically, we have identified 4 warning signs for Palantir Technologies that you should be aware of.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.

About NasdaqGS:PLTR

Palantir Technologies

Palantir Technologies Inc. builds and deploys software platforms for the intelligence community to assist in counterterrorism investigations and operations in the United States, the United Kingdom, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives