- United States

- /

- Software

- /

- NasdaqGS:PLTR

The Ownership Structure of Palantir Technologies (NYSE:PLTR) is a Double Edged Sword for the Stock

Palantir Technologies Inc . ( NYSE:PLTR ) has become a market favorite amongst retail investors, while institutional investors remain more cautious. This could lead to some big price moves if either group is proved right or wrong on the company.

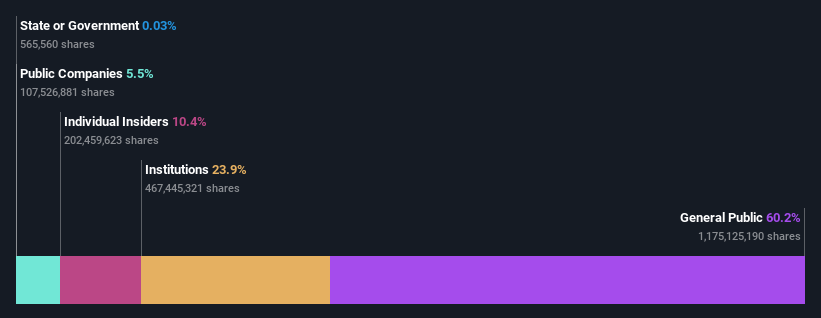

Palantir currently has a market capitalization of $52 billion. Typically, institutional investors will account for most of the shareholding of a company of this size. In Palantir’s case, retail investors own 60.2% of the company’s shares, while institutions own just 23.9% of the shares.

Institutions often take a longer-term view when they invest in a company, and they are less likely to react to short term volatility and news. Stock prices often perform well when the percentage of shares owned by institutions increases gradually over time. So, it would be a positive development if institutions turn bullish on the stock, and their share of ownership increases.

Retail investors tend to react more to volatility and news. If the outlook worsens, a large stake in the hands of retail investors can amplify the effect on the share price.

View out latest analysis for Palantir Technologies

Palantir is not currently owned by hedge funds in a significant way. On the other hand, the short float (the percentage of the company’s shares that have been sold short) is quite low, so it doesn't appear that hedge funds are betting against the company either.

Ownership by company insiders is also a promising sign for companies as it means the company’s leaders have ‘skin in the game’. In Palantir’s case, its top key executive, Peter Thiel, is the largest shareholder, holding 7.1% of shares outstanding. In comparison, the second and third largest shareholders hold about 5.5% and 5.0% of the stock. Furthermore, CEO Alexander Karp is the owner of 2.1% of the company's shares.

There has been some insider selling over the last 12 months, but these sales have not represented a meaningful percentage of insider ownership. You can click here to see if those insiders have been buying or selling.

A deeper look at our ownership data shows that the top 25 shareholders collectively hold less than half of the register, suggesting a large group of minority holders where no single shareholder has a majority. However, that would be the case if there weren't some special Class F shares issued to Peter Thiel, Alex Karp and Stephen Cohen which gives them 49.99% voting power, effectively full control over important company decisions.

The structure has received some more spotlight recently so shareholders don't appear to be passive about the issue. Regardless of the outcome, this voting structure is important to keep in mind as a potential or current shareholder.

What does the Ownership Structure of Palantir Technologies Tell Us?

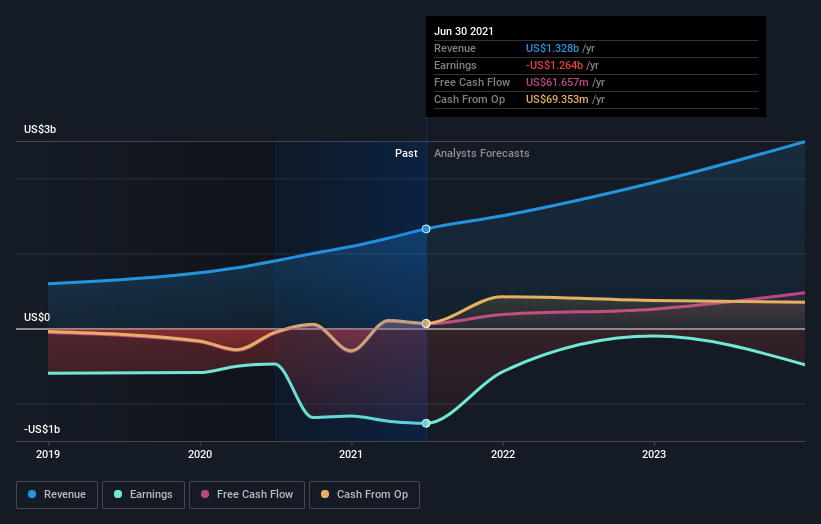

Clearly, retail investors are more optimistic than institutional investors when it comes to Palantir. Meanwhile, Wall Street analysts have a more neutral view. As you can see from the forecasts below, they expect revenue to rise steadily, while earnings are expected to remain in negative territory for the foreseeable future. Cash flows are expected to be positive, and Palantir has plenty of cash on hand , so the company is in a good position.

Our estimate of the stock’s value implies it is trading at a 26% premium - but that estimate would be very sensitive to changes in forecasts, which are also likely to change.

Until recently Palantir has provided services to government agencies rather than the private sector. This is now changing, and future growth is expected to come from the private sector. Just how successful the company will be in the private sector is difficult to quantify. Palantir has also made some rather unusual investments recently, including gold bars and several SPACs and privately owned companies.

All of this makes the company’s outlook a bit of an unknown. This may explain the divergent views. It seems retail investors believe in the company’s unconventional strategy and its management team, while analysts and institutions are looking for more tangible evidence that the company can deliver.

What this means for the share price

At some point, either institutions or retail investors will be proven right on the stock. This will probably require some kind of catalyst, either in the form of a quarterly earnings release, or news about new customers. The large stake in the hands of retail investors is a risk for the share price, but not a bearish indicator on its own. On the other hand, if institutions warm to the stock and increase their ownsership, it would create a very bullish dynamic.

Ultimately the future is most important . You can access this free report on analyst forecasts for the company .

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.

About NasdaqGS:PLTR

Palantir Technologies

Palantir Technologies Inc. builds and deploys software platforms for the intelligence community to assist in counterterrorism investigations and operations in the United States, the United Kingdom, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success