- United States

- /

- Software

- /

- NYSE:PD

PagerDuty’s Profit Turnaround And New AWS Resilience Status Might Change The Case For Investing In PD

Reviewed by Sasha Jovanovic

- In late November 2025, PagerDuty reported third-quarter results showing higher sales and a move from a loss to profitability, raised its full-year 2026 earnings guidance, and later announced it had become one of the first software partners to achieve the AWS Resilience Services Competency.

- The combination of stronger earnings, an upgraded profit outlook, and AWS recognition for resilience services highlights how PagerDuty is tying incident management, resilience engineering and cloud expertise more tightly together for enterprise customers.

- We’ll now examine how PagerDuty’s stronger profitability outlook and new AWS Resilience Services Competency shape its broader investment narrative.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

PagerDuty Investment Narrative Recap

To own PagerDuty, you need to believe that incident management and resilience will remain essential as digital infrastructure becomes more complex, and that the company can convert this role into durable, profitable growth despite slower revenue guidance. The strongest near term catalyst is its improving profitability and margin outlook, while the biggest risk remains pressure on revenue growth from seat optimization and the shift to usage based pricing. The latest earnings and AWS news do not materially change that balance.

The most relevant recent update is PagerDuty’s raised full year 2026 earnings guidance, which points to higher profitability even as revenue growth moderates. That improved margin profile matters for how investors weigh the AWS Resilience Services Competency: it suggests PagerDuty is not only deepening its role in mission critical workloads, but doing so with greater earnings leverage, which could support confidence in the business while it works through customer seat compression and pricing transitions.

Yet even with stronger profits and new AWS validation, investors should still be aware of how intensified seat optimization and usage based pricing could...

Read the full narrative on PagerDuty (it's free!)

PagerDuty’s narrative projects $572.1 million revenue and $74.9 million earnings by 2028.

Uncover how PagerDuty's forecasts yield a $18.50 fair value, a 58% upside to its current price.

Exploring Other Perspectives

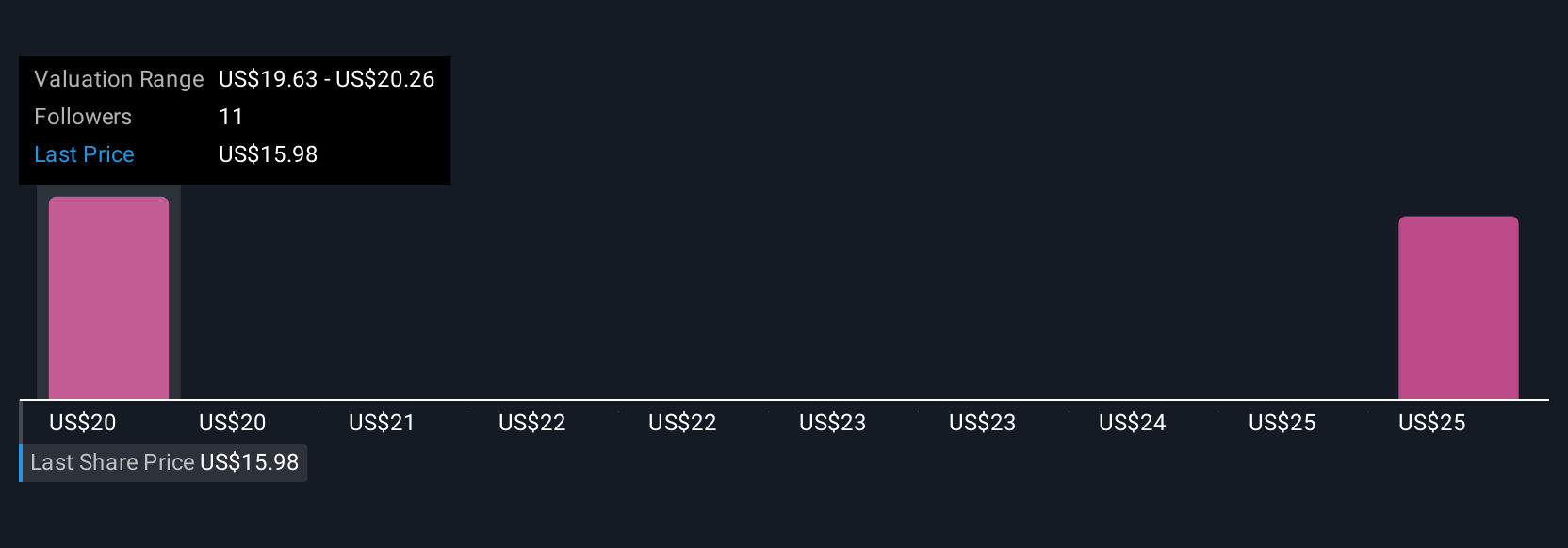

Three Simply Wall St Community valuations cluster between US$18.50 and US$26.53 per share, reflecting a wide spread in expectations. You can set these against the core risk that ongoing seat optimization and pricing changes may keep revenue growth subdued and cash flows choppy.

Explore 3 other fair value estimates on PagerDuty - why the stock might be worth over 2x more than the current price!

Build Your Own PagerDuty Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PagerDuty research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free PagerDuty research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PagerDuty's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PD

PagerDuty

Engages in the operation of a digital operations management platform in the United States and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026