- United States

- /

- Software

- /

- NYSE:PATH

Will UiPath's (PATH) Role in AI Security Standards Deepen Trust With Enterprise Clients?

- UiPath recently announced its role as a founding technical contributor to AIUC-1, an industry-wide security framework for AI agent adoption in enterprise settings, established by the Artificial Intelligence Underwriting Company in collaboration with leading security, risk, and legal experts.

- This positions UiPath as a trusted leader in AI security and compliance, enhancing its appeal among enterprise clients seeking auditable and secure automation solutions.

- We'll explore how UiPath's involvement in setting enterprise AI security standards may influence its long-term opportunities and client trust.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

UiPath Investment Narrative Recap

Investing in UiPath is ultimately about believing in the long-term growth of AI-powered automation and the company's ability to address enterprise security and compliance concerns while scaling its deployment. While UiPath's involvement in establishing the AIUC-1 security framework clearly reinforces its commitment to secure automation, this announcement has limited immediate impact on the main short-term catalysts, expanding enterprise adoption and cloud growth, or near-term risks like deal closure delays and economic uncertainty.

Of the recent company events, the September 30 expansion of the agentic automation and orchestration suite stands out for its direct relevance. This move strengthens UiPath's platform, aligning with growth initiatives in automation and supports the broader narrative around innovation as a future earnings driver, even as revenue contributions in the short term may remain modest.

Yet, despite these advances, the potential for further deal delays due to shifting customer budgets remains a risk investors should not overlook...

Read the full narrative on UiPath (it's free!)

UiPath's narrative projects $1.9 billion revenue and $243.6 million earnings by 2028. This requires 8.6% yearly revenue growth and a $311 million increase in earnings from -$67.5 million today.

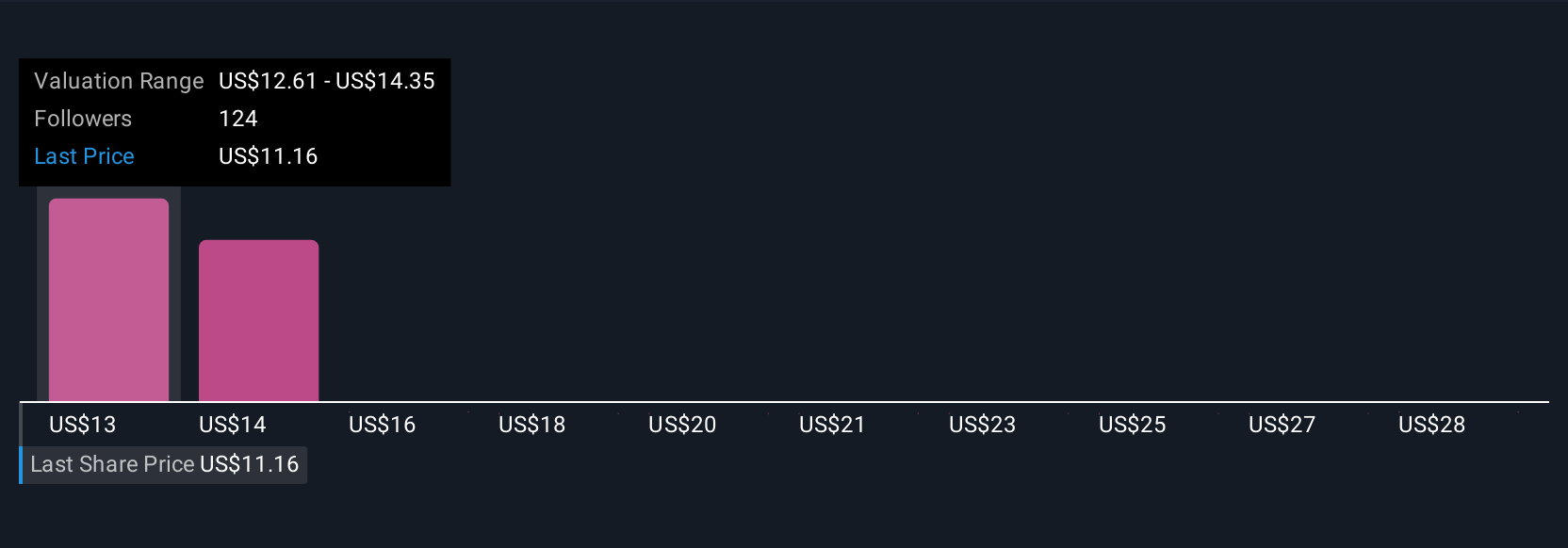

Uncover how UiPath's forecasts yield a $13.71 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Thirteen Simply Wall St Community members estimate UiPath's fair value from US$13.70 to US$30, with opinions spanning more than double the lowest estimate. Given economic uncertainty leading to cautious customer budgets, you are encouraged to compare these varied outlooks and consider how they might shape your own perspective.

Explore 13 other fair value estimates on UiPath - why the stock might be worth just $13.70!

Build Your Own UiPath Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UiPath research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free UiPath research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UiPath's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PATH

UiPath

Provides an end-to-end automation platform that offers a range of robotic process automation (RPA) solutions primarily in the United States, Romania, the United Kingdom, the Netherlands, and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Lexaria Bioscience's Breakthrough with DehydraTECH to Revolutionize Drug Delivery

SIrios Resources (SOI) is significantly undervalued on a risk-adjusted basis.

BSX after Penumbra ?

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<b>Reported:</b> Revenue growth: 2024 → 2025 sharp increase of approx. 165%. Assuming moderate annual growth of 40%, a fair value in three years would be approx. $170. Given the customer base and the story, this should be possible. I find the most valuable “property” particularly interesting, as it solves the electricity problem.