- United States

- /

- Software

- /

- NYSE:PATH

UiPath (NYSE:PATH) Showcases Agentic Automation At ViVE 2025 Conference

Reviewed by Simply Wall St

UiPath (NYSE:PATH) has been showcasing its Agentic Automation technology, particularly in healthcare, during the ViVE 2025 conference. This effort underscores the company's push to improve healthcare efficiency through automation. Despite these promising technological advancements, UiPath's share price declined by 7% over the last month. This downturn occurred in a broader context where major U.S. stock indexes experienced mixed performances, with the tech-heavy Nasdaq Composite seeing notable declines amid uncertainty around U.S. economic policies and new tariff announcements. The overall market environment has been unpredictable, with investors reacting to macroeconomic factors like tariffs announced by the Trump administration and fluctuating Treasury yields. This backdrop of market volatility, coupled with sector-specific challenges, likely played a part in UiPath's recent stock movements. Notably, the 3.6% market dip in the last week also reflects the broader tech market's pressures, further influencing PATH's total returns over the period.

Take a closer look at UiPath's potential here.

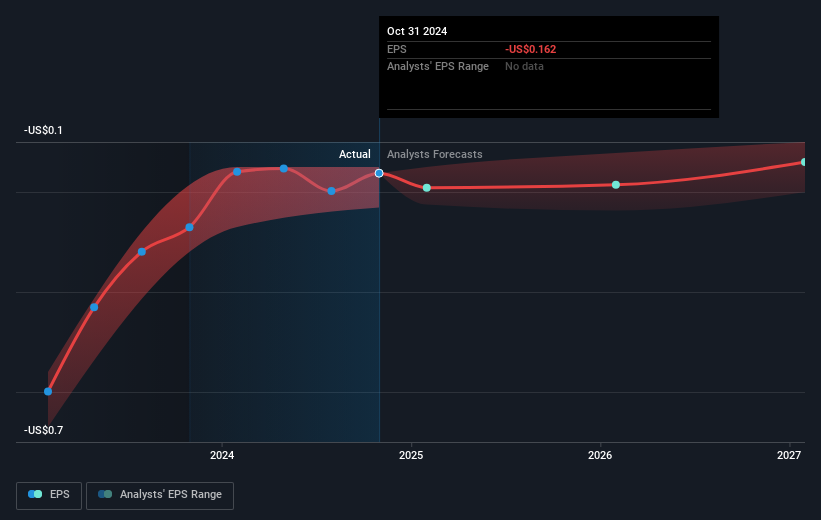

Over the last year, UiPath's total shareholder returns were a decline of 45.51%. This performance stands in sharp contrast to the broader U.S. market, which managed a 16.9% gain, and the U.S. Software industry, which returned 7.9% during the same period. Several elements contribute to this discrepancy. Notably, despite being unprofitable, UiPath has consistently shown momentum in improving its financial metrics, as seen in its earnings reports throughout 2024. For instance, the Q3 2025 earnings revealed a net loss of US$10.66 million, which indicated an improvement from previous years.

UiPath's strategic maneuvers, like the introduction of new AI features in December 2024, aimed at boosting automation accuracy, coincided with a US$492.02 million share buyback program, showcasing confidence in a rebound. Executive shifts, particularly the return of co-founder Daniel Dines as CEO in mid-2024, and partnerships with major corporations like Banco Azteca and Fujitsu, further highlight UiPath’s efforts to align its operations with industry demands. However, legal disputes, including a June class action lawsuit, likely influenced investor sentiment, contributing to the stock's decline.

- Understand the fair market value of UiPath with insights from our valuation analysis—click here to learn more.

- Assess the downside scenarios for UiPath with our risk evaluation.

- Have a stake in UiPath? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PATH

UiPath

Provides an end-to-end automation platform that offers a range of robotic process automation (RPA) solutions primarily in the United States, Romania, the United Kingdom, the Netherlands, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives