- United States

- /

- Software

- /

- NYSE:PATH

UiPath (NYSE:PATH) Director Laela Sturdy To Step Down Before 2025 Annual Meeting

Reviewed by Simply Wall St

UiPath (NYSE:PATH) saw a 26% increase in its share price over the past month. This notable rise coincided with significant developments, including the resignation of Board member Laela Sturdy. The launch of the next-generation UiPath Platform and expansion of partnerships, notably with Redis, likely contributed positively to investor sentiment. Amidst a mixed broader market, with major indexes slightly down due to tariff discussions and Federal Reserve decisions, UiPath's developments provided a clear, contrasting positive catalyst. The new platform innovations and strengthened collaborations align with market trends favoring technological advancement and AI integration, solidifying confidence in the company's trajectory.

The recent developments highlighted in the introduction could have implications for UiPath's future performance. The launch of their next-generation platform and expanded partnerships may support revenue and earnings forecasts by enhancing product offerings and customer engagement. However, this optimism comes in contrast to the company's longer-term performance, which saw its total return, including dividends, decline by 18.59% over the past three years. This decline suggests challenges that may influence investor sentiment despite recent gains.

Over the past year, UiPath's shares underperformed both the US software industry, which gained 15.2%, and the broader US market, which returned 8.2%. This underperformance could temper expectations despite recent positive catalysts. The current share price movement, increasing by 26% over the past month, narrows the gap to the analyst price target of US$12.13, which stands slightly above the current level of US$11.82. This proximity suggests the stock might be fairly valued in line with consensus forecasts. However, investors should be mindful of factors such as macroeconomic volatility and the company's transition toward SaaS, which could impact short-term revenue and earnings stability.

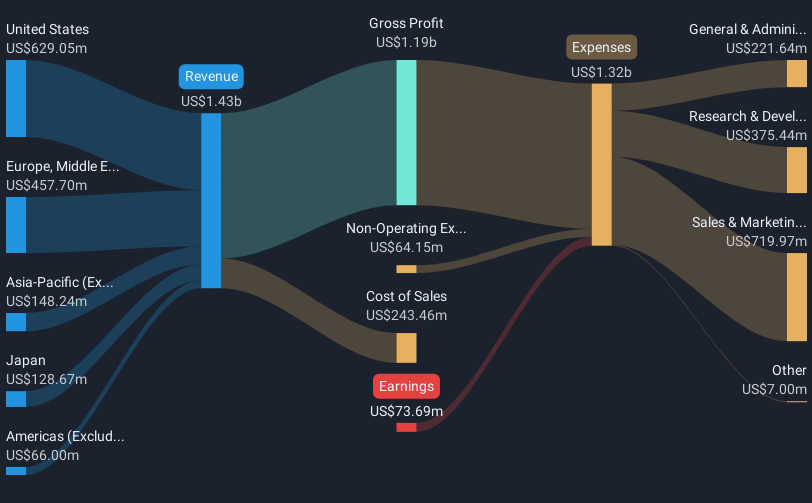

Click to explore a detailed breakdown of our findings in UiPath's financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade UiPath, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PATH

UiPath

Provides an end-to-end automation platform that offers a range of robotic process automation (RPA) solutions primarily in the United States, Romania, the United Kingdom, the Netherlands, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives