- United States

- /

- Software

- /

- NYSE:PAR

What Recent Earnings Mean for PAR Technology Stock Valuation in 2025

Reviewed by Bailey Pemberton

Thinking about what to do with PAR Technology stock right now? You are definitely not alone. The company has been drawing attention with its rollercoaster stock performance. There have been some bumps lately, but the larger story is much more interesting for investors with their eyes on value. Over just the past week, shares dipped by 1.5%, extending a tough 30 days that saw the stock slide nearly 20%. Year to date, that drop has stretched to more than 47%, and it is down 33.2% over the last year. But before you move on, it is worth noting that over the past three years, PAR Technology is actually up a solid 28.2%, which shows that this is a company that can surprise on the upside.

The market’s mood shift toward technology stocks in general, especially those in the restaurant and hospitality tech sectors, has been a factor here. Investors are reacting swiftly to sector-wide shifts, driving up volatility and often creating valuation mismatches for companies like PAR Technology. So what is the stock actually worth after these sharp price moves?

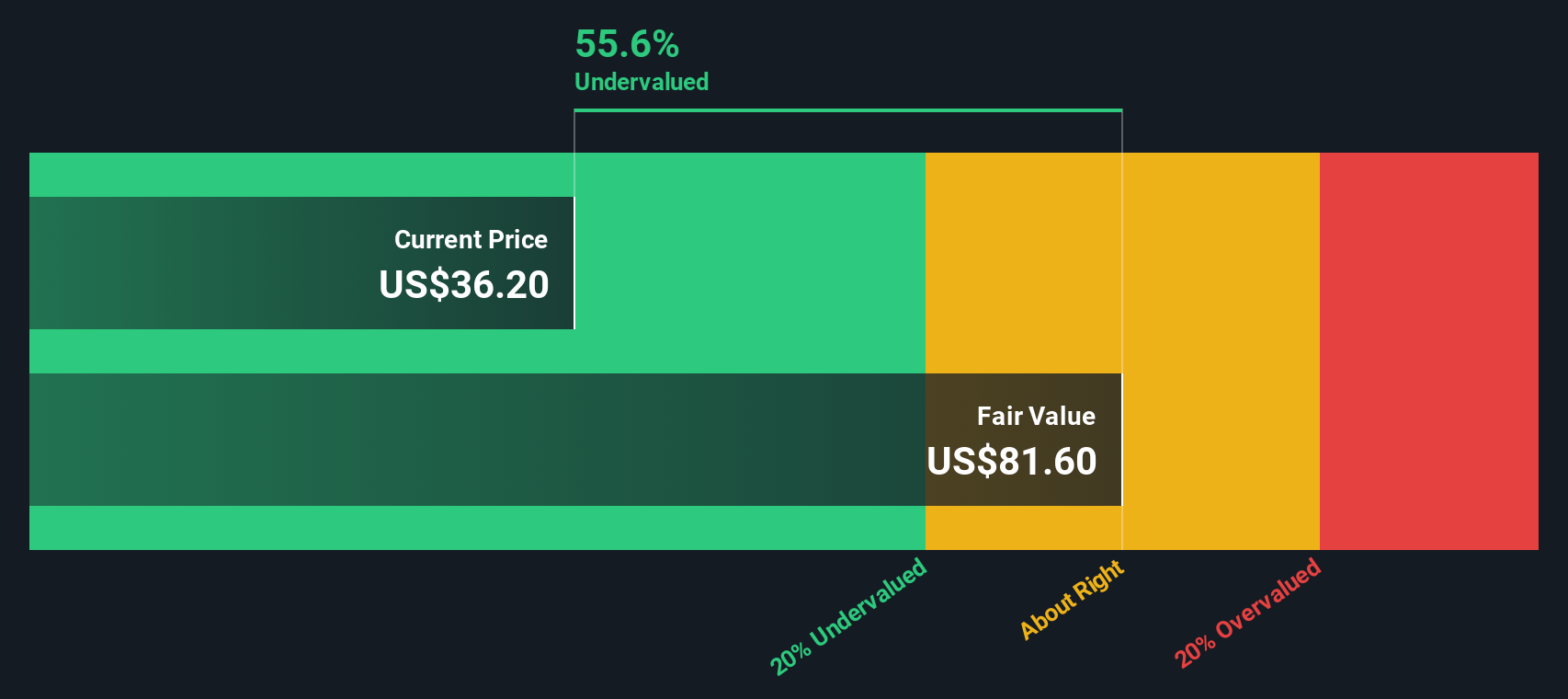

By the numbers, PAR Technology earns a valuation score of 4 out of 6, meaning it is currently undervalued in two-thirds of the checks we use to assess stock value. If you are weighing whether now is the time to buy, sell, or hold, what really matters is the method you use to judge value. Up next, let us break down each valuation approach, and stay tuned, because at the end, we will reveal an even smarter way to understand PAR’s true worth.

Why PAR Technology is lagging behind its peers

Approach 1: PAR Technology Discounted Cash Flow (DCF) Analysis

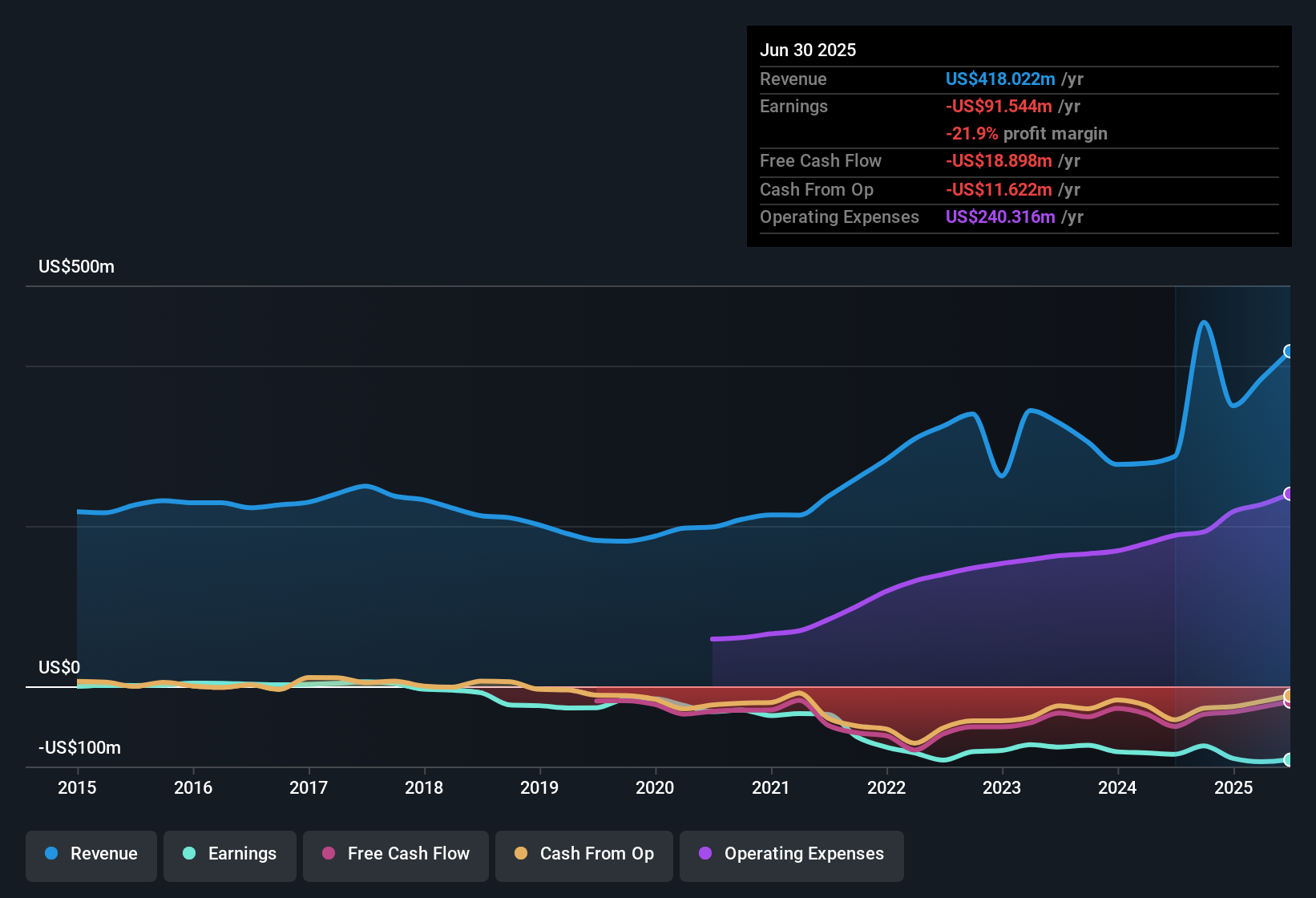

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and then discounting them back to today’s dollars, giving investors a sense of what the business is really worth right now. For PAR Technology, the model uses a two-stage approach based on Free Cash Flow to Equity.

Currently, PAR Technology’s latest twelve-month Free Cash Flow stands at -$21.57 million. While this negative figure may raise eyebrows, expectations are for a dramatic turnaround. Analysts project Free Cash Flow rising to $33.12 million by 2026, with further growth extrapolated over the next decade. By 2035, Simply Wall St’s model estimates annual Free Cash Flow could reach roughly $328.01 million. Each year’s figure is discounted back appropriately to reflect the time value of money.

All projections and valuations are reported in US dollars and are based on realistic assumptions about both growth rates and industry trends.

Bringing this all together, the DCF analysis calculates an intrinsic fair value of $81.49 per share. Compared to PAR Technology’s current share price, this suggests the stock is trading at a 53.9% discount to its calculated fair value. This signals that the company is meaningfully undervalued according to this approach.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests PAR Technology is undervalued by 53.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

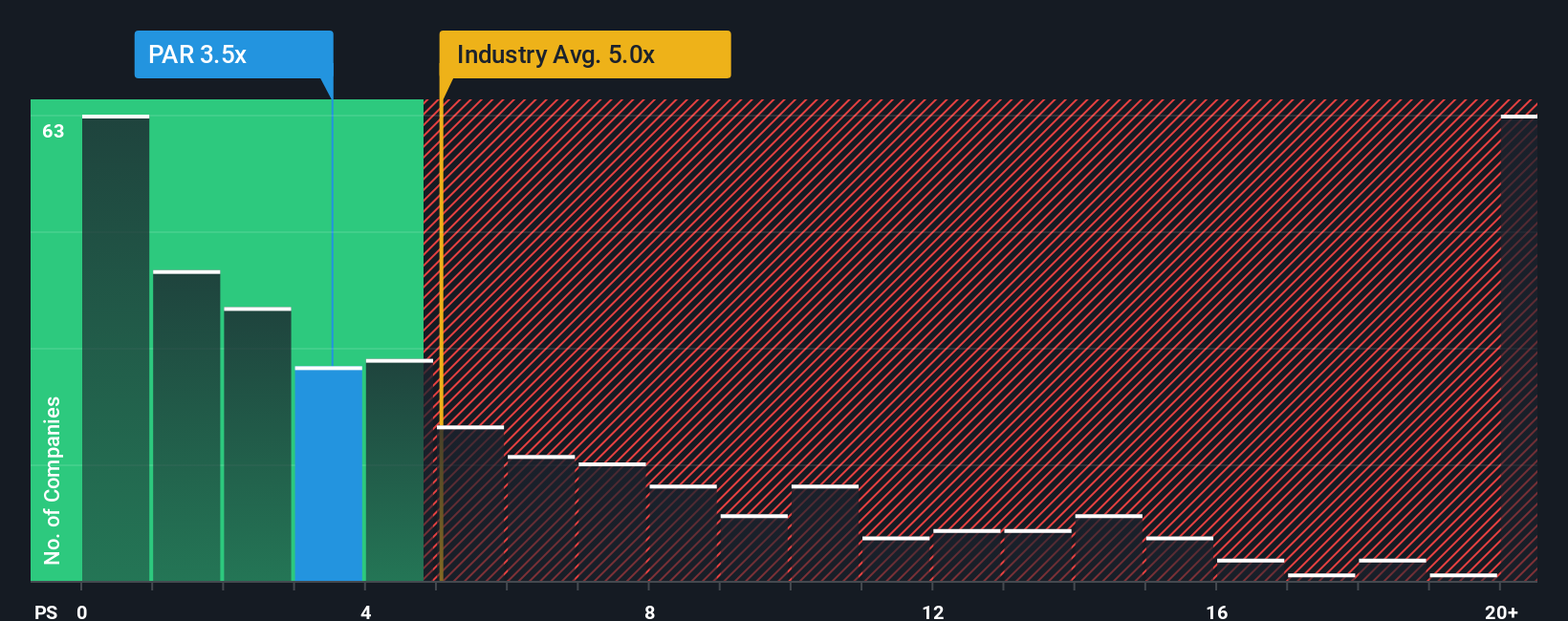

Approach 2: PAR Technology Price vs Sales

For technology companies that are not yet consistently profitable, the Price-to-Sales (P/S) ratio is often a more appropriate valuation tool than earnings-based multiples. This metric helps investors compare how the market is valuing each dollar of a company’s revenue, which is especially useful for firms reinvesting heavily for growth or in a transitional phase.

Growth expectations and business risks greatly influence what counts as a “normal” or “fair” P/S ratio. Fast-growing companies or those operating in high-potential industries typically warrant higher ratios, while riskier or slower-growth firms may deserve lower ones.

PAR Technology currently trades at a P/S ratio of 3.65x. This puts it just below the average for its software industry peers, which sits at 3.78x, and notably below the broader software industry average of 5.35x. However, Simply Wall St’s proprietary “Fair Ratio” calculation, which considers not just industry trends but also factors like PAR’s growth profile, profit margins, market capitalization, and unique risks, suggests a fair value P/S for PAR should be 2.70x.

What makes the Fair Ratio superior to a simple industry or peer average is that it customizes expectations based on all the variables that actually drive a stock’s intrinsic worth. It is a more nuanced measure of whether PAR’s current price adequately reflects its own opportunities and challenges, not just how it stacks up in the crowd.

Given PAR’s actual P/S ratio of 3.65x is above the Fair Ratio of 2.70x, this method indicates the stock is trading above what is considered fair value for where it stands today.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your PAR Technology Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a clear, personal story you build about PAR Technology, linking your expectations for future revenue, earnings, and margins to a fair value calculation, grounded in both data and your own outlook.

Rather than relying solely on models or standard ratios, Narratives let you connect the numbers to the real business story. You outline what you believe will drive the company’s success and then see how that translates into a valuation and buy or sell decision.

Narratives make this process accessible and dynamic, right on Simply Wall St’s Community page, which is used by millions of investors. They help you compare your calculated Fair Value to the current market Price and decide if PAR Technology looks promising or overvalued.

As new news or earnings releases arrive, these Narratives update automatically, so your investment reasoning stays current. For example, some investors believe PAR’s unified cloud platform will open up global markets and set a Fair Value as high as $97.00, while others are cautious, seeing risks that lead them to a Fair Value closer to $50.00. This highlights that your perspective and expectations can meaningfully shape your own narrative and investment actions.

Do you think there's more to the story for PAR Technology? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PAR

PAR Technology

Provides omnichannel cloud-based hardware and software solutions to the worldwide.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)