- United States

- /

- Software

- /

- NYSE:ORCL

Oracle (NYSE:ORCL) Surges with Hyatt Partnership and Strong Q1 Earnings, Poised for Future Growth

Reviewed by Simply Wall St

Oracle (NYSE:ORCL) is navigating a dynamic period marked by significant growth in cloud revenue and strategic partnerships, alongside challenges such as exiting the advertising business and intense competition. In the discussion that follows, we will explore Oracle's core strengths, critical weaknesses, potential growth opportunities, and key threats to provide a comprehensive overview of the company's current business situation.

Take a closer look at Oracle's potential here.

Strengths: Core Advantages Driving Sustained Success For Oracle

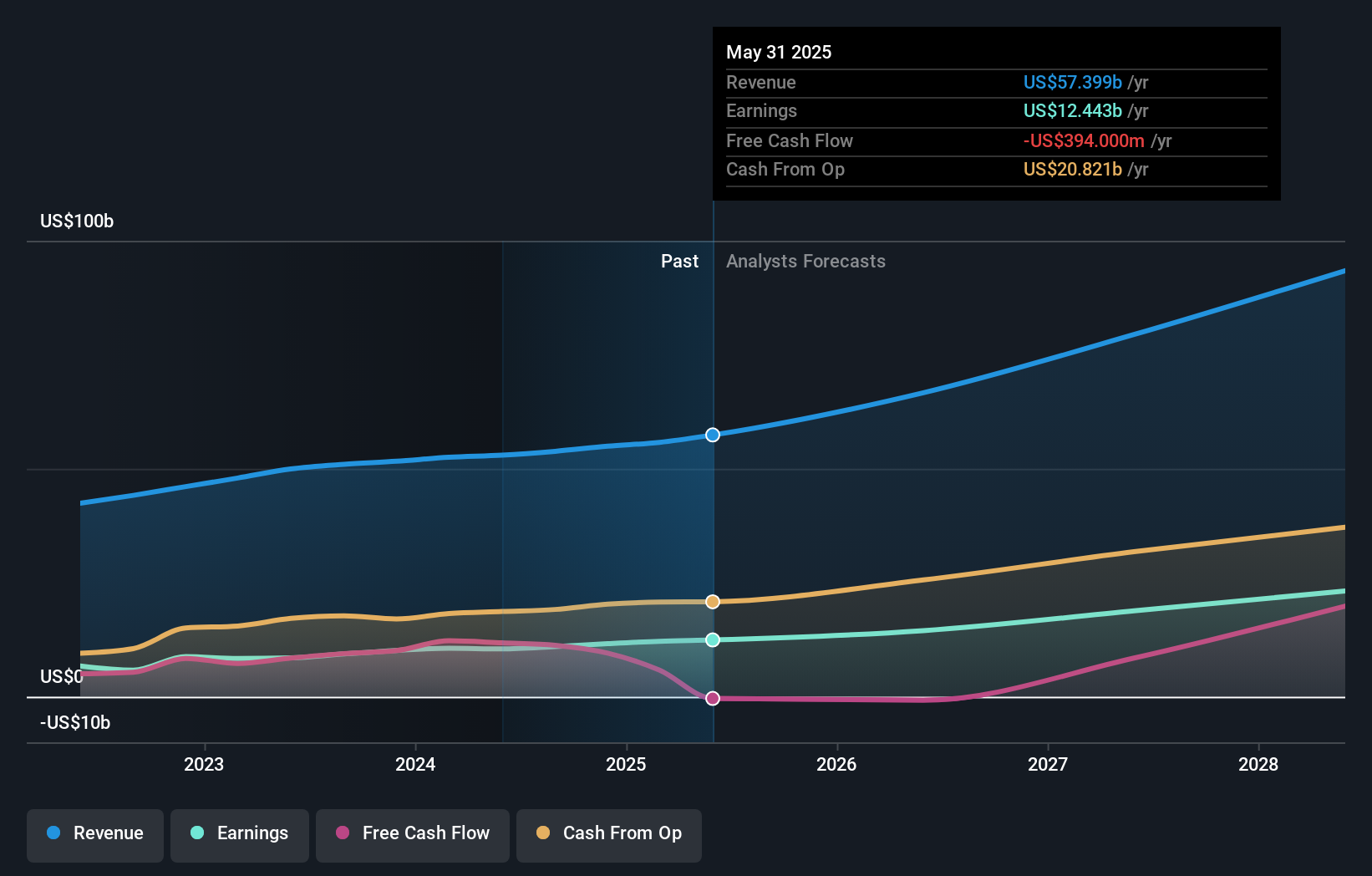

Oracle's robust revenue growth is evident, with total cloud revenue rising by 22% to $5.6 billion, as highlighted by CEO Safra Catz in the latest earnings call. This growth is complemented by an impressive earnings performance, with earnings per share surpassing the high end of guidance by $0.04. Oracle's strategic back-office SaaS applications, now generating annualized revenues of $8.2 billion, underscore its expanding customer base. Additionally, Oracle's high cash reserves of nearly $11 billion provide a strong financial cushion. The company's operational efficiency is notable, with Q1 operating income growing by 14% and an operating margin of 43%. Oracle's innovative technology, particularly its autonomous, fully self-driving database, sets it apart in the market. Despite having a high Price-To-Earnings Ratio of 42.3x compared to the industry average of 38.9x, Oracle is currently trading below its estimated fair value of $272.29, indicating potential for value appreciation.

Weaknesses: Critical Issues Affecting Oracle's Performance and Areas For Growth

Oracle faces several market challenges, including the recent exit from the advertising business, which impacted cloud applications revenue by 2% this quarter. The company's dependency on cloud services, particularly the lower margin Oracle Cloud Infrastructure (OCI), poses a risk as highlighted by analyst John DiFucci. High competition remains a significant hurdle, with Lawrence Ellison noting the intense race in the sector. Additionally, Oracle's earnings have declined by 3.7% per year over the past five years, although there has been a recent improvement with a 17.1% growth over the past year. Despite these weaknesses, Oracle's current trading below its estimated fair value suggests room for growth. For a more comprehensive look at how these weaknesses could impact Oracle's financial stability, explore our section on Oracle's Past Performance.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

Oracle's multi-cloud strategy, which includes agreements with Microsoft, Google, and AWS, enhances its market position by making it easier for customers to run Oracle databases in the cloud. The expansion of cloud regions, now totaling 85 with another 77 planned, provides significant growth potential. AI integration, particularly the migration of Fusion and NetSuite to the Autonomous database, represents a key technological advancement. The growing demand for cloud services, with a forecasted annual profit growth of 16.5%, positions Oracle to capitalize on this trend. These strategic opportunities could significantly enhance Oracle's market position and leverage its strengths to capitalize on emerging market opportunities. Learn more about how these opportunities could impact Oracle's future growth by reviewing our analysis of Oracle's Future Performance.

Threats: Key Risks and Challenges That Could Impact Oracle's Success

Cybersecurity risks remain a critical threat, with Lawrence Ellison noting the increasing frequency of successful cyber attacks. Economic factors, such as the high cost of training, also pose challenges. Regulatory challenges, including the need for approved neighbors in cloud regions, add another layer of complexity. Oracle's high level of debt, despite its strong cash reserves, could impact its financial stability. Additionally, the company's earnings growth over the past year, while positive at 17.1%, did not outperform the software industry average of 23.9%. These external factors could threaten Oracle's growth and market share, necessitating careful management and strategic planning.

Conclusion

Oracle's strong revenue growth, particularly in cloud services, and its high cash reserves position it well for future expansion and innovation, especially with its autonomous database technology. However, challenges such as high competition, dependency on lower-margin cloud services, and cybersecurity risks require strategic management. The company's multi-cloud strategy and AI integration present significant opportunities for market expansion. Despite a high Price-To-Earnings Ratio of 42.3x, Oracle's current trading below its estimated fair value of $272.29 suggests potential for value appreciation, indicating a promising outlook if it can effectively navigate its weaknesses and threats.

Next Steps

- Got skin in the game with Oracle? Elevate how you manage them by using Simply Wall St's portfolio , where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management .

- Find companies with promising cash flow potential yet trading below their fair value .

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NYSE:ORCL

Oracle

Offers products and services that address enterprise information technology environments worldwide.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives