- United States

- /

- Software

- /

- NYSE:ORCL

Oracle (NYSE:ORCL) Launches AI Centre Of Excellence In Singapore For Innovation And Training

Reviewed by Simply Wall St

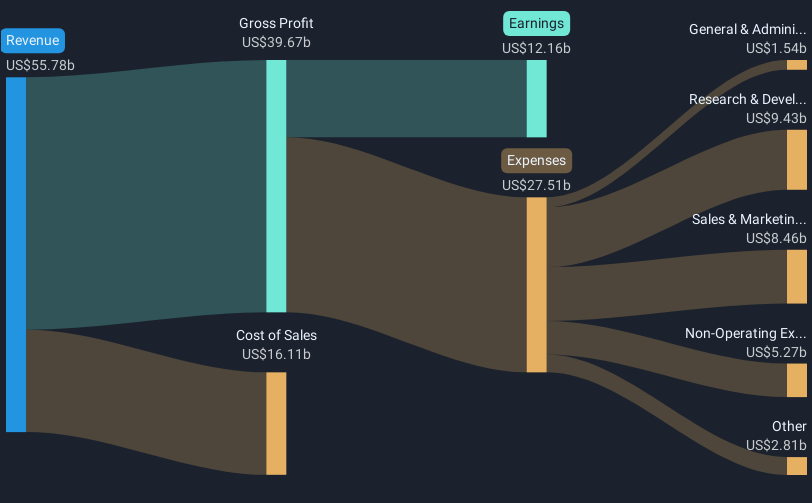

Oracle (NYSE:ORCL) faced a 6.6% decline in share price over the past week amid a broader stock market downturn, which saw the market fall by 4.4%. While Oracle reported strong earnings growth with increased revenue and net income, as well as a 25% hike in its quarterly dividend, these positives were overshadowed by larger market concerns. The tech-heavy Nasdaq and S&P 500 suffered due to uncertainty about broader economic policies and a general tech slump. Although Oracle announced the launch of its AI Centre of Excellence in Singapore, aimed at enhancing AI capabilities in Southeast Asia, the news did not cushion the company's stock from market headwinds. Major tech companies also saw declines, contributing to Oracle's underperformance relative to rising concerns about economic slowdown and recent market volatility. Despite Oracle's efforts to innovate and expand its AI offerings, it's clear the broader market context had a significant impact.

Our valuation report unveils the possibility Oracle's shares may be trading at a discount.

Over the past five years, Oracle Corporation (NYSE: ORCL) has achieved a total shareholder return of 244.13%, showcasing significant appreciation in its stock value supplemented by generous dividend policies. Several factors explain this growth. Oracle's earning announcements indicated consistent revenue and net income gains, such as a year-on-year increase in Q3 2025 revenue, reaching US$14.13 billion. Major product enhancements, like the Oracle Energy and Water Data Exchange and the new AI capabilities in Oracle Fusion Cloud HCM, underscored the company's commitment to innovation and expansion in cloud services.

Additionally, strategic partnerships, including the Oracle Interconnect for Microsoft Azure, have strengthened Oracle's position in cloud computing, expanding its integration capabilities. A series of dividend hikes, notably a 25% increase announced in March 2025, further attracted investors, contributing to Oracle's outperformance against the US Software industry and the broader market over the past year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ORCL

Oracle

Offers products and services that address enterprise information technology environments worldwide.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives