- United States

- /

- Software

- /

- NYSE:ORCL

Oracle's (NYSE:ORCL) High Debt may Actually be Good for Value, but Tread Carefully

Oracle Corporation ( NYSE:ORCL ) is estimated (but not confirmed) to post earnings results around the 9th September 2021. We wanted to make a quick overview of the balance sheet health of the company and get a better understanding of the foundation upon which Oracle will grow in the future. Additionally, companies that delay their earnings report might not have the best news for investors, and we wanted to make a good investigation beforehand.

See our latest analysis for Oracle

In this article, we will look at Oracles debt situation, how well it covers it with cash and profits, the possible benefits of higher debt, as well as how well the company converts earnings to free cash flow!

Investors that want a solid grasp of the company's fundamentals will be happy to get a clear picture from the balance-sheet aspect, and can pair it with our future growth analysis for Oracle.

How Much Debt Does Oracle Carry?

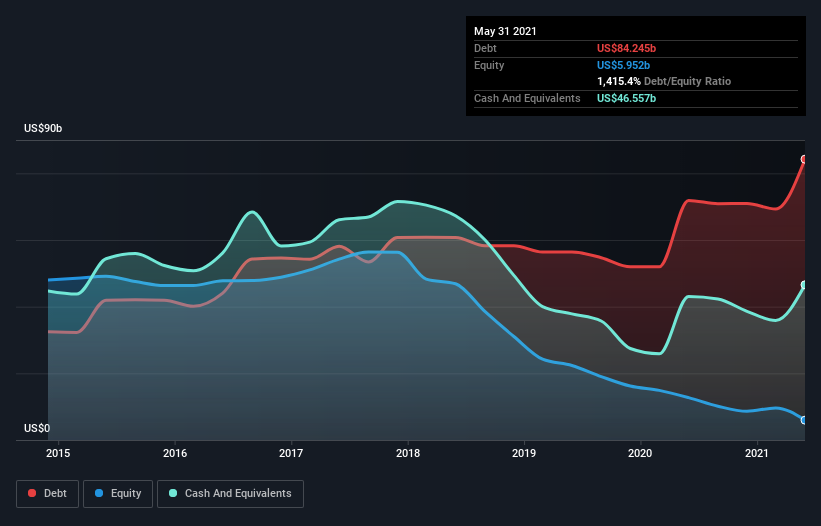

You can click the graphic below for the historical numbers, but it shows that as of May 2021 Oracle had US$84.2b of debt, an increase on US$71.9b, over one year.

I t has a cash reserve of US$46.6b, so its net debt is less, at about US$37.7b .

The image above shows us a few things. First, an increased debt to equity ratio of 1,400%, primarily as a function of the declining equity since 2018. Equity is what is left over after we subtract total assets - total liabilities, and since Oracles liabilities have been growing, we are left with a diminished book value of equity.

Knowing this, there are 2 things we should steer clear from:

- Using Return on Equity as a valid measure of returns - this will skew your analysis because equity is now lower. Instead, if looking at returns, use Return on Capital Employed (ROCE) to get a better feeling for the investing efficacy of the business.

- Using Price to Book Value of Equity as a relative measure. Again, this will show that the company is way overvalued because of the low equity number, so rather use the Price to Earnings as a better measure in the case of Oracle.

Another thing to note, is that the company may have increased value by increasing its debt level . This is a bit harder to quantify, but Oracle has gained cash for investors and the interest expenses of debt will be deducted as an expense - which will lead to a lowered effective tax rate.

How Healthy Is Oracle's Balance Sheet?

The latest balance sheet data shows that Oracle had liabilities of US$24.2b due within a year, and liabilities of US$101.0b falling due after that.

Offsetting these obligations, it had cash of US$46.6b as well as receivables valued at US$6.21b due within 12 months. So, its liabilities outweigh the sum of its cash and (near-term) receivables by US$72.4b. However, the short term liabilities are well covered by cash and accounts relivable. In other words, short term liabilities represent a 52% portion of Oracle's cash balance.

While the short term looks great, we need to take a deeper dive into long term liabilities.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short).This way, we consider both the absolute quantum of the debt, and the interest rates paid on it.

Oracle has net debt worth 2.1 times EBITDA, which isn't too much, but its interest cover looks a bit on the low side, with EBIT at only 6.6 times the interest expense.While that doesn't worry us too much, it does suggest the interest payments are somewhat of a burden. A rough analysis of Oracle's interest coverage ratio puts the company's bond rating just above investment grade at a A1/A+ equivalent rating. Unfortunately, rating companies such as S&P are putting Oracle in the "BBB+" category. If Oracle can keep growing EBIT at last year's rate of 11% over the last year, then it will find its debt load easier to manage.

Ultimately, this deficit isn't so bad because Oracle is worth a massive US$248.9b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose.But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash.So we clearly need to look at whether that EBIT is leading to corresponding free cash flow.During the last three years, Oracle generated free cash flow amounting to a very robust 87% of its EBIT , more than we'd expect. That puts it in a very strong position to pay down debt.

Our View

Oracle's impressive conversion of EBIT to free cash flow implies it has the upper hand on its debt!

Oracle has both increased its debt level and decreased its equity, but currently has enough growth and earnings power to operate comfortably.

On the plus side, this leverage can boost shareholder returns, and increase the value of the business, so it is not a negative indicator as long as the company can keep up with debt payments.

Investors should steer clear of the Price to Book ratio and the ROE metric, as both of these will be skewed because of the slowly declining equity of the company since 2018.

The balance sheet is clearly the area to focus on when you are analyzing debt.However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 2 warning signs for Oracle that you should be aware of before investing here.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:ORCL

Oracle

Offers products and services that address enterprise information technology environments worldwide.

Exceptional growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion