- United States

- /

- Software

- /

- NYSE:ORCL

Oracle (NYSE:ORCL) Expands Utility Solutions And Strengthens Global Cloud Infrastructure Offering

Reviewed by Simply Wall St

Oracle (NYSE:ORCL) recently announced enhancements to its Utilities Network Management System, focusing on advanced energy management and forecasting capabilities. Additionally, the adoption of its cloud infrastructure by various clients underscores its technological leverage in AI and industrial applications. These updates coincide with a slight upward movement in Oracle’s share price over the past week, aligning with broader market trends that saw the S&P 500 and Nasdaq edge higher. The introduction of new AI-powered solutions and strategic client partnerships may have supported Oracle's performance, even as the market experienced moderately positive momentum overall.

Buy, Hold or Sell Oracle? View our complete analysis and fair value estimate and you decide.

Oracle Corporation has delivered a very large total return of 231.54% to its shareholders over the past five years. This growth stands out especially considering Oracle's recent outperformance against the US market and the US Software industry over the past year. One essential driver has been its multi-cloud partnerships with leading tech giants like AWS, Google, and Azure, massively boosting cloud adoption and revenue potential. Oracle's expansion in cloud regions and power capacity further cements its position to capitalize on the growing AI and cloud demands.

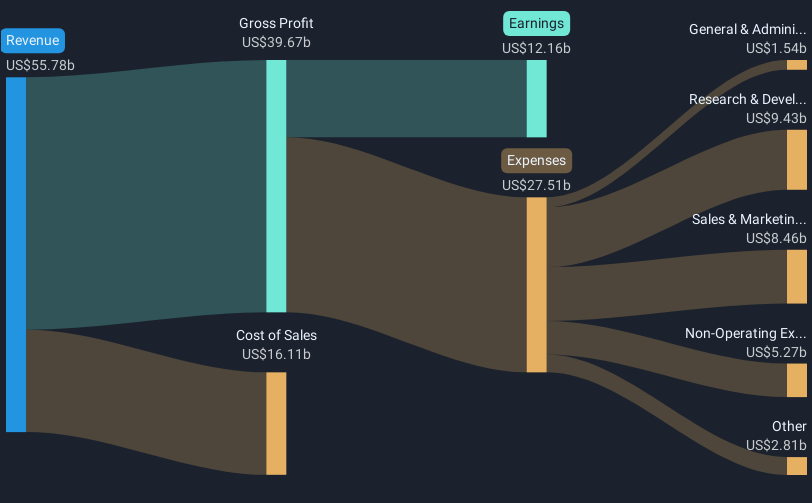

This progress aligns with Oracle's financial performance improvements, highlighted by significant revenue and earnings boosts in recent quarters. The company’s commitment to infrastructure expansion, alongside advancements in AI and analytics platforms, underscores its capacity to fulfill increasing client requirements. Additionally, Oracle's partnerships with various corporations, such as the Lloyds Banking Group and Huntsville Hospital Health System, emphasize its expanding client base and service offerings, enhancing long-term growth prospects.

Dive into the specifics of Oracle here with our thorough balance sheet health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ORCL

Oracle

Offers products and services that address enterprise information technology environments worldwide.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives