- United States

- /

- Software

- /

- NYSE:ORCL

Oracle (NYSE:ORCL) Expands Multicloud Offerings With Google Cloud Partner Program

Reviewed by Simply Wall St

Oracle (NYSE:ORCL) recently announced a significant partnership with Google Cloud, introducing a new partner program to bolster their cloud database offerings. Despite such positive strategic developments, Oracle's share price witnessed a 12% decline over the past week, a movement closely paralleling the 12% drop in the broader market indices like the S&P 500. Global market turmoil, including trade wars and tariff uncertainties, overshadowed recent corporate achievements, suggesting that the unfavorable market conditions likely played a major role in the company's stock performance, adding further pressure despite Oracle's ongoing initiatives.

We've spotted 1 weakness for Oracle you should be aware of.

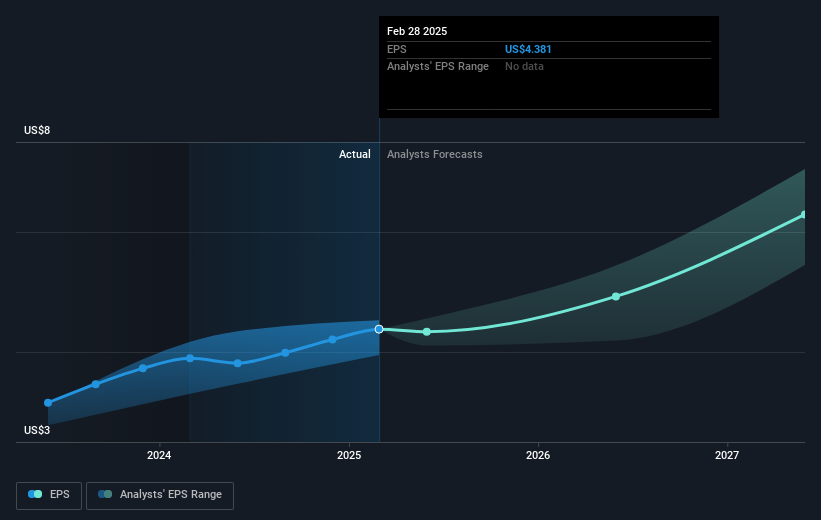

The recent partnership between Oracle and Google Cloud is poised to enhance Oracle's cloud database offerings, potentially driving revenue and earnings growth. With analysts forecasting Oracle's annual revenue to grow by 16% and earnings to $19.5 billion by 2028, this collaboration could accelerate Oracle's cloud region expansion and AI demands—key elements of its growth strategy. However, the recent 12% decrease in Oracle's share price, despite positive news, reflects the influence of broader market conditions, including global trade tensions. This volatility has eclipsed Oracle's short-term performance gains, though its longer-term outlook remains promising.

Over the past five years, Oracle's total shareholder return, including dividends, was 147.38%, highlighting substantial growth despite recent setbacks. In contrast, Oracle outperformed the US Software industry over the past year, which faced a 10.5% decline. This relative outperformance suggests resilience amid challenging market conditions. With Oracle trading at US$141.94, analysts' consensus price target of US$186.03 suggests potential upside of 23.7%, factoring in expected earnings improvements and successful multi-cloud expansions. Investors may need to weigh current market uncertainties against Oracle's long-term strategic initiatives to assess potential benefits from its evolving partnerships.

Dive into the specifics of Oracle here with our thorough balance sheet health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Oracle, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ORCL

Oracle

Offers products and services that address enterprise information technology environments worldwide.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives