- United States

- /

- Software

- /

- NYSE:ORCL

Oracle (NYSE:ORCL) Expands AI And Cloud Services With Major Client Partnerships

Reviewed by Simply Wall St

Oracle (NYSE:ORCL) recently announced a series of significant product releases and partnerships, including new cloud services aimed at the financial sector and a collaboration with IBM on AI integration. These developments, emphasizing enhanced customer service and operational efficiency, align with Oracle's strategic goals and possibly supported its stock's 16% increase over the past month. Amid a broader market trend with a moderate climb of 2% in the last week, Oracle's initiatives may have added weight to its positive stock performance, counterbalancing broader equity market fluctuations influenced by tariff concerns and other macroeconomic factors.

Be aware that Oracle is showing 1 warning sign in our investment analysis.

Oracle's recent announcements, including new cloud services for the financial sector and an AI collaboration with IBM, have potential implications for its long-term revenue and earnings forecasts. The company's focus on cloud expansion and strategic partnerships aligns with its broader growth strategy, potentially accelerating revenue. This push for cloud power and AI integration could enhance Oracle's competitive positioning and improve service delivery, supporting a brighter revenue outlook.

Over the past five years, Oracle's total shareholder return, including dividends, reached 200.32%. This long-term performance highlights significant value creation beyond the recent stock movement. Over the past year, Oracle outperformed both the US market and the US Software industry, which saw returns of 8.2% and 14.5%, respectively, indicating a robust position relative to its peers.

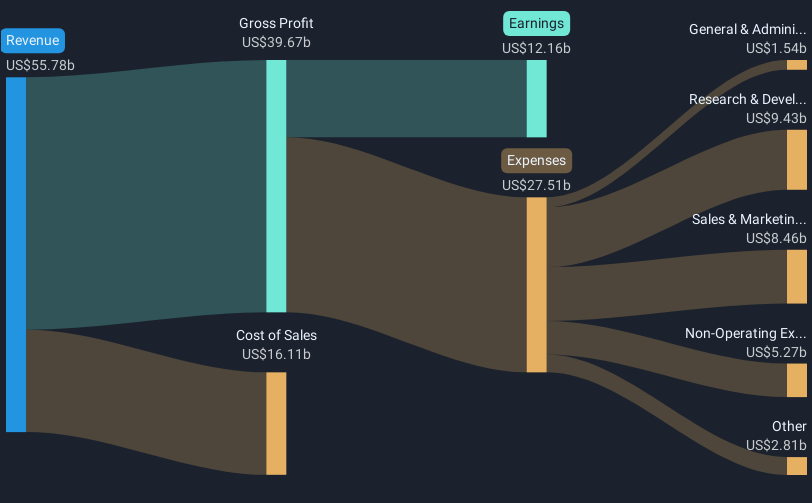

The company's current share price is US$140.79, representing a discount to the consensus price target of US$178.12, suggesting potential upside if projected growth materializes. With analysts forecasting Oracle to achieve US$86.7 billion in revenue and US$19.5 billion in earnings by 2028, the recent developments could have a positive impact on these forecasts. However, execution risks and external factors such as currency volatility could affect these projections. As always, it's important for investors to assess these scenarios based on their own expectations and market conditions.

Upon reviewing our latest valuation report, Oracle's share price might be too pessimistic.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ORCL

Oracle

Offers products and services that address enterprise information technology environments worldwide.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives