- United States

- /

- Software

- /

- NYSE:NOW

ServiceNow (NYSE:NOW) and Juniper Revolutionise Telecom with AI-Driven Network Automation

Reviewed by Simply Wall St

ServiceNow (NYSE:NOW) recently extended its collaboration with Juniper Networks, integrating AI-native networking solutions across several platforms. This partnership and other product launches seem to enhance operational efficiency and reduce costs, aligning with the company's broader ambitions to lead in AI and enterprise automation. Despite broader market indices experiencing varied performances, ServiceNow's stock rose 33% over the last month, likely reflecting investor optimism around these developments. While the S&P 500 showed modest growth, ServiceNow's substantial gains spotlight growing confidence in its strategic initiatives amid a tech-heavy investment climate.

You should learn about the 2 weaknesses we've spotted with ServiceNow.

The recent collaboration between ServiceNow and Juniper Networks is poised to influence its long-term revenue and earnings outlook. By integrating AI-native networking solutions, ServiceNow aims to enhance both operational efficiency and cost reduction, potentially appealing to a broader customer base. However, the hybrid pricing model and consumption-based monetization may initially slow revenue recognition. While these developments are likely to bolster long-term strategic goals, they could also introduce short-term volatility in earnings forecasts as the new pricing model gains traction.

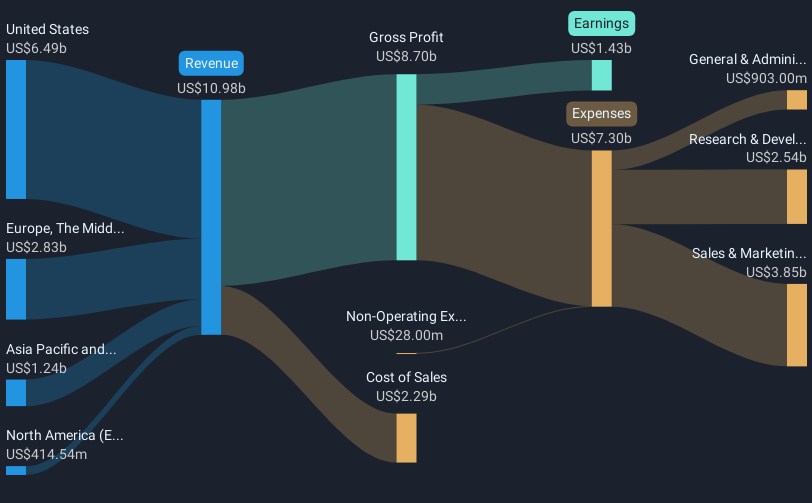

Over the past five years, ServiceNow's stock returned an impressive 164.40%, reflecting sustained investor confidence. In contrast, its performance over the past year outpaced the US Software industry by surpassing the industry's 16.4% increase. Despite a recent rise of 33% in the last month, the stock is trading at a 5.57% discount to its consensus fair value of US$1,083. This gains attention because, even with optimistic investor sentiment, future revenue of US$17.8 billion would need to align with conservative projections, given a forecasted 17.5% annual growth rate over the next three years.

Learn about ServiceNow's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade ServiceNow, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NOW

ServiceNow

Provides cloud-based solution for digital workflows in the North America, Europe, the Middle East and Africa, Asia Pacific, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives