- United States

- /

- Software

- /

- NYSE:NOW

ServiceNow (NOW): Exploring Valuation as Federal GSA Expands Adoption of Its AI Platform

Reviewed by Simply Wall St

Most Popular Narrative: 17.8% Undervalued

According to the most widely followed narrative, ServiceNow trades well below its estimated fair value, suggesting significant upside potential. Analysts see the stock as undervalued when considering its future earnings and expansion prospects, even after a period of share price volatility.

Expansion into CRM and industry workflows, supported by AI-powered improvements, could significantly boost earnings by capturing higher-value deals and expanding the company’s addressable market. Strategic growth in the public sector, particularly with government transformation initiatives, positions ServiceNow for substantial long-term opportunities. This could potentially lead to revenue stability and growth amidst uncertain economic conditions.

How does ServiceNow’s valuation stack up against the boldest analyst bets? The secret behind the bullish price target: aggressive assumptions about future growth and margins. Want to know which earnings leaps and profit benchmarks have analysts so confident? Explore the details of this narrative and discover the surprising math behind ServiceNow’s supposed discount.

Result: Fair Value of $1,142.59 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, overseas uncertainty and heavy reliance on U.S. federal contracts could introduce volatility and challenge assumptions behind ServiceNow’s current undervalued thesis.

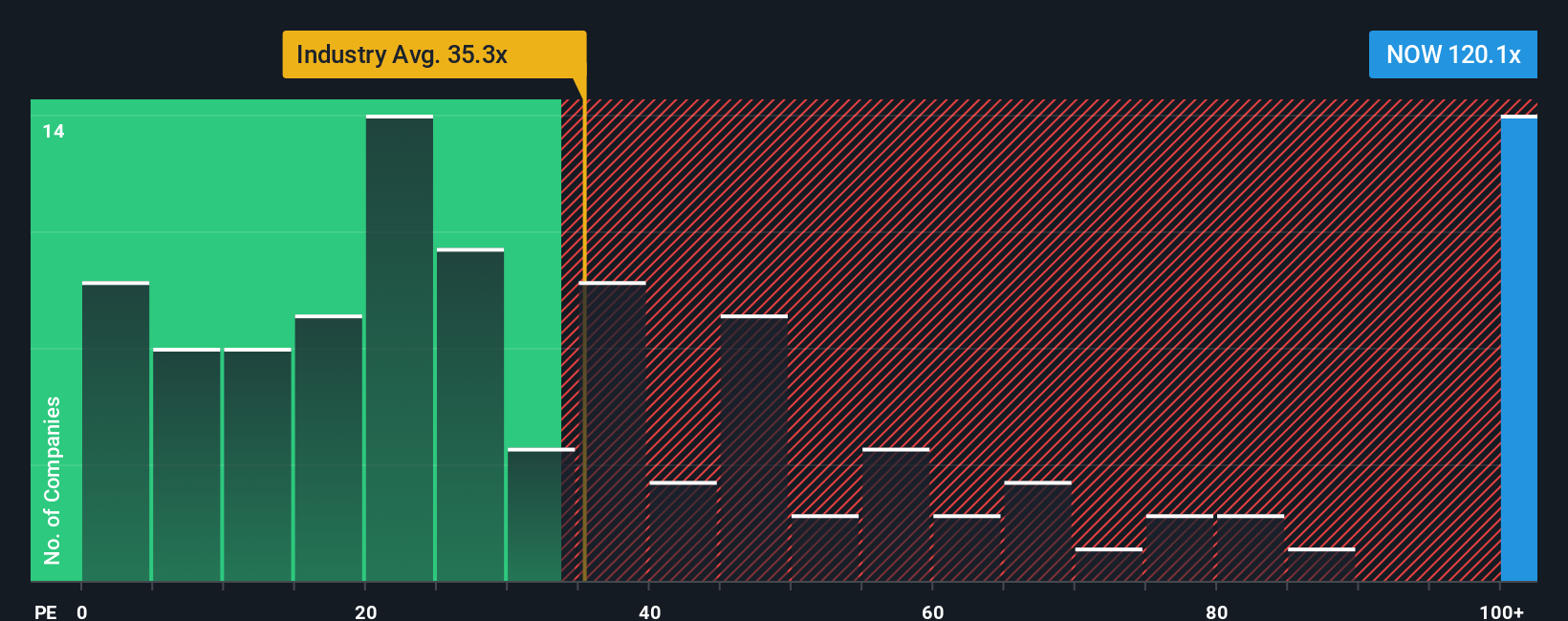

Find out about the key risks to this ServiceNow narrative.Another View: What Do Valuation Ratios Suggest?

While some say ServiceNow is undervalued based on its future growth, a look at its price-to-earnings ratio compared to the broader software industry tells a different story. Does this premium signal strength or does it raise red flags?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding ServiceNow to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own ServiceNow Narrative

If the current outlook does not align with your perspective or you enjoy digging into the details yourself, you can craft your own full story in just a few minutes. Do it your way.

A great starting point for your ServiceNow research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep their options open. Don’t let opportunity pass by. Expand your horizons with strategies aimed at growth, value, and innovation.

- Unlock potential gains by targeting overlooked companies tapping into emerging markets and robust financials through our penny stocks with strong financials.

- Tap into the wave of healthcare breakthroughs powered by artificial intelligence with our healthcare AI stocks.

- Amplify your returns and stability with a portfolio focused on higher-yielding opportunities found in our dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:NOW

ServiceNow

Provides cloud-based solution for digital workflows in the North America, Europe, the Middle East and Africa, Asia Pacific, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)