- United States

- /

- Software

- /

- NYSE:NOW

How ServiceNow’s Volatile 2025 Performance Shapes Its True Investment Value

Reviewed by Bailey Pemberton

Sizing up what to do with ServiceNow stock these days is enough to give any investor pause. If you’ve been following along, you know the stock has been on a bit of a rollercoaster lately. In the past week alone, shares dipped by 2.6%, and they’ve fallen 3.8% over the last month. It's not just a short-term trend. The stock is also down 15.7% year-to-date and has slipped 5.3% in the past twelve months. Yet, step back for a moment and look at the bigger picture. Over the last three years, ServiceNow has shot up by a remarkable 160%, and it’s gained nearly 70% in five years. Clearly, there’s been plenty of longer-term growth working in the company’s favor.

So, what explains these ups and downs? Shifts in tech market sentiment and broader swings among high-growth cloud companies have definitely played a role. News around tech sector momentum, changes in the interest rate environment, and the ongoing digital transformation push have all impacted how investors feel about ServiceNow’s risks and opportunities.

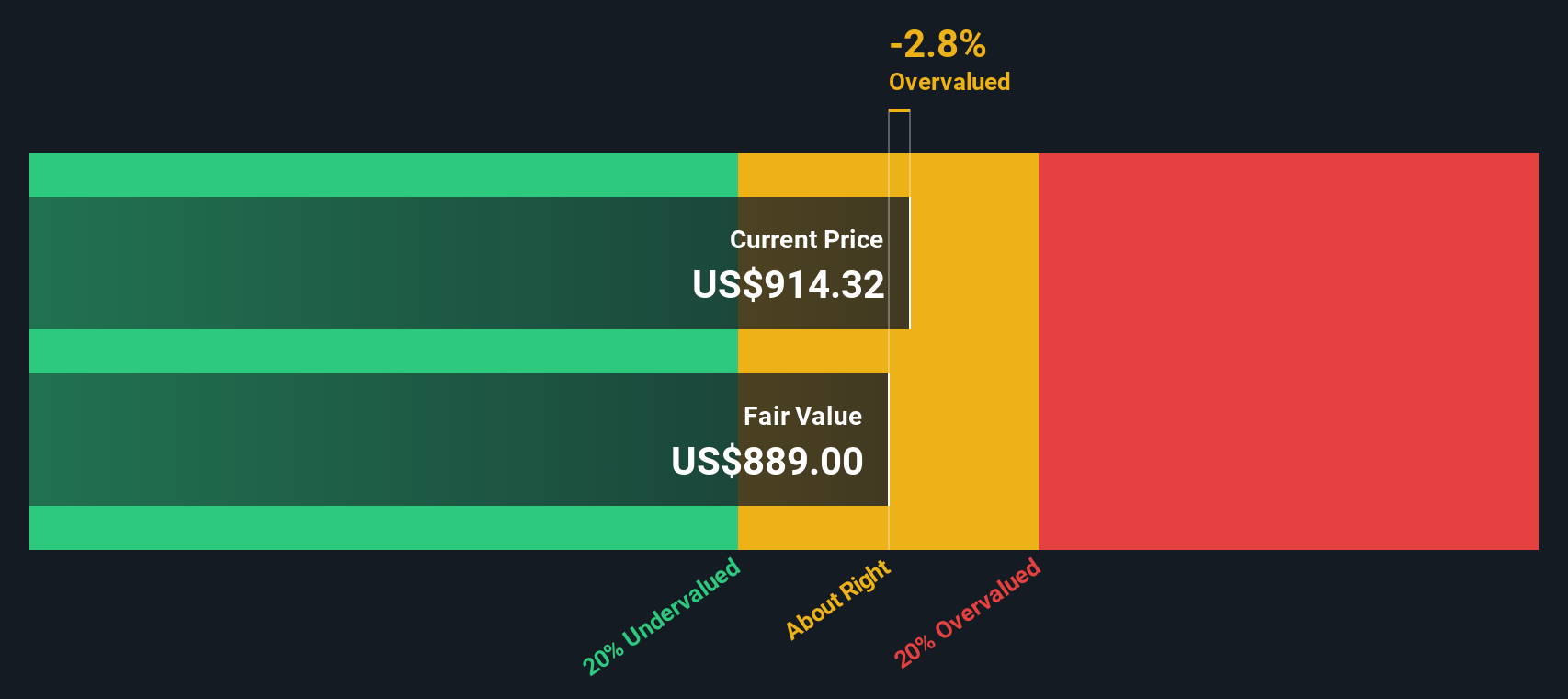

But the real question is: after such a wild ride, is ServiceNow currently undervalued or is the recent dip justified? According to our valuation model, the company scores a 2 out of 6 when it comes to undervalued checks, signaling that while there’s value to be found, it’s not a slam-dunk bargain just yet.

Next, let’s dive into the classic valuation methods that investors use to weigh growth stories like ServiceNow. Later, I’ll share a smarter angle for thinking about value in a high-flying stock market.

ServiceNow scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: ServiceNow Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) method is a popular valuation tool that estimates what a company is worth today based on predictions about how much cash it will generate in the future. Essentially, it takes ServiceNow's expected future cash flows and discounts them back to their value in today's dollars using a reasonable rate.

ServiceNow's latest reported Free Cash Flow (FCF) stands at approximately $3.76 billion. Analysts forecast this figure to rise steadily, projecting it will reach about $9.04 billion annually by 2029. Going further, extended projections (extrapolated by Simply Wall St) estimate FCF could top $14.32 billion per year by 2035. These projections reflect robust anticipated growth in the company's underlying business, though only the next five years of estimates are based directly on analyst forecasts.

According to our 2 Stage Free Cash Flow to Equity DCF model, the fair value per share for ServiceNow comes to $888.94. With the intrinsic discount registering at just 0.0%, the DCF approach suggests the stock is trading very close to its calculated fair value. That means, at current levels, there is not a major mismatch between ServiceNow's price and its future cash flow prospects.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out ServiceNow's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: ServiceNow Price vs Earnings

The Price-to-Earnings (PE) ratio is one of the most widely used metrics for valuing profitable companies because it directly compares a company’s market value to its annual net earnings. For firms like ServiceNow, which consistently generate positive earnings, the PE ratio gives investors a straightforward way to gauge whether the stock price accurately reflects its profit power.

Growth expectations and perceived risk shape what counts as a “normal” PE ratio for any stock. Companies with higher expected growth and lower risk typically justify higher PE ratios, since investors are willing to pay more for access to superior future earnings. Conversely, firms facing headwinds or slower growth trends command lower ratios.

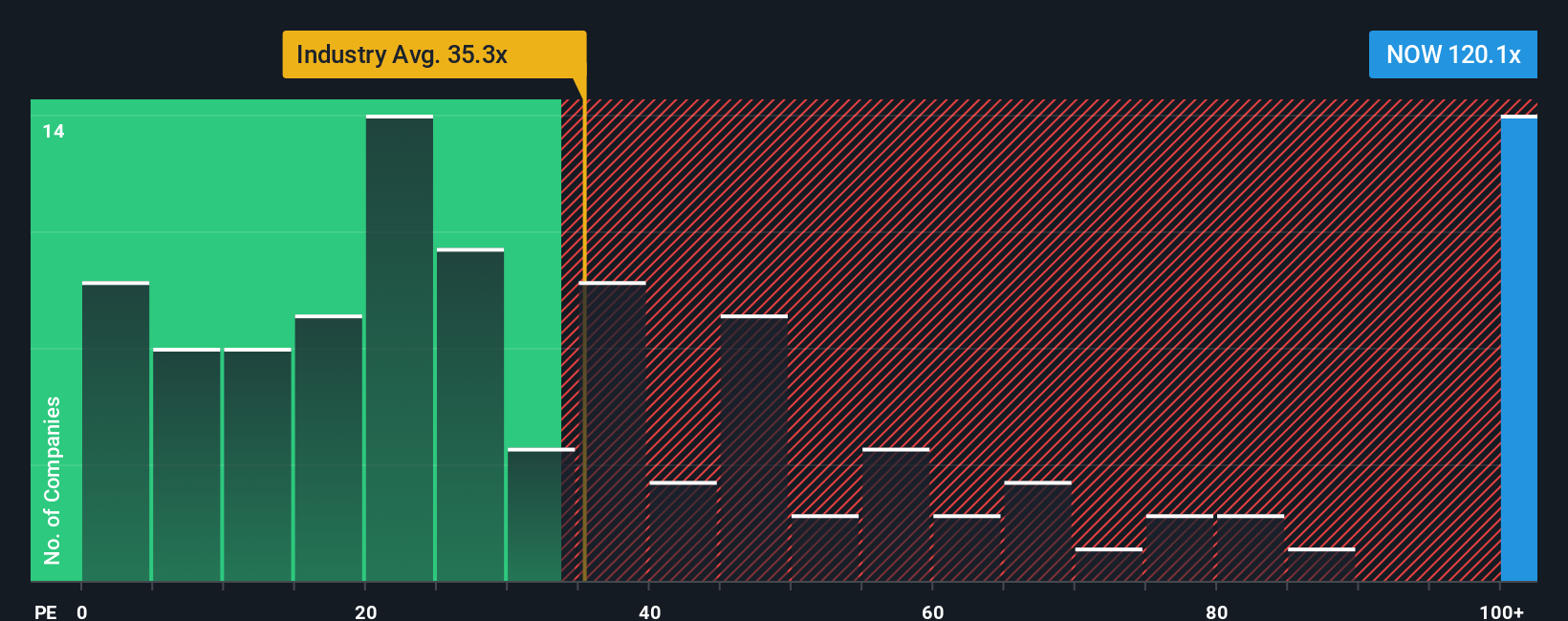

ServiceNow is currently trading at a lofty PE ratio of 111x. For context, this is well above the software industry average of about 35x and also noticeably higher than the peer average of 62x. That suggests investors are banking on ServiceNow to deliver strong and sustained earnings expansion ahead of its peers.

However, raw comparisons only tell part of the story. Simply Wall St’s proprietary “Fair Ratio” distills company-specific factors such as actual earnings growth, profit margins, industry group, market capitalization, and risk profile into a tailored benchmark for each stock. For ServiceNow, the Fair Ratio is 50.16x, meaning that, based on all relevant fundamentals, a PE near 50x would be considered fair for the business today. This method is more insightful than simple peer or industry average analysis because it captures the unique blend of drivers affecting ServiceNow’s value.

With the actual PE (111x) far above the Fair Ratio (50.16x), the numbers suggest ServiceNow stock is trading at a significant premium to what would be considered its fair value on earnings multiples alone.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your ServiceNow Narrative

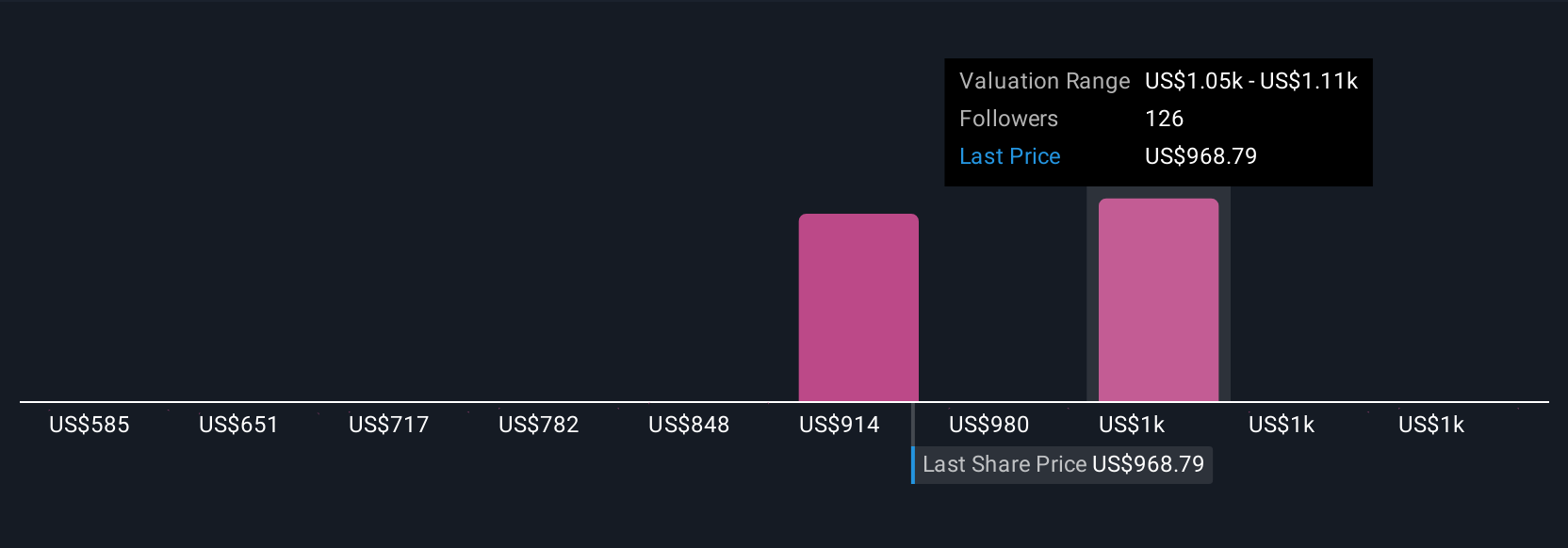

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a straightforward but powerful tool that allows you to build your own story about a company by connecting your perspective on its business drivers and future prospects to clear financial forecasts and a specific fair value estimate.

Unlike traditional valuation metrics, Narratives link together the business context, your assumptions (such as revenue growth, earnings, and profit margins), and a resulting fair value, so you can visualize how your view stacks up against the current share price. Narratives are not only simple to craft, but also highly accessible, since millions of investors on Simply Wall St share them on the Community page, making it easy to learn from others and refine your thinking.

Crucially, Narratives are updated dynamically; whenever fresh financials or major news breaks, your narrative and its fair value refresh instantly, helping you stay a step ahead of market moves. This makes it much easier to decide if now is the time to buy, sell, or hold by comparing your fair value to the live market price.

For instance, when it comes to ServiceNow, some investors are extremely optimistic, assigning fair values as high as $1,300, while the most cautious set targets as low as $716, highlighting just how much the narrative you construct can influence your investment decision.

Do you think there's more to the story for ServiceNow? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NOW

ServiceNow

Provides cloud-based solution for digital workflows in the North America, Europe, the Middle East and Africa, Asia Pacific, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion