- United States

- /

- Software

- /

- NYSE:NOW

How Investors Are Reacting To ServiceNow (NOW) Securing Major Federal AI Modernization Deal with GSA

Reviewed by Simply Wall St

- Earlier this week, the U.S. General Services Administration (GSA) announced a OneGov agreement with ServiceNow to empower AI-first modernization across federal agencies, offering substantial discounts on ServiceNow's IT service management products and platform capabilities.

- This move highlights ServiceNow's growing public sector footprint, with the company's AI platform now positioned to accelerate government workflow transformation and broaden federal adoption of advanced automation technologies.

- We'll examine how ServiceNow's expanded presence in federal modernization initiatives may influence its investment narrative and future government opportunities.

Find companies with promising cash flow potential yet trading below their fair value.

ServiceNow Investment Narrative Recap

To believe in ServiceNow as a shareholder, you have to have confidence in its AI-driven digital workflow platform gaining further adoption across both public and private sectors. The recent OneGov agreement with the U.S. GSA highlights ServiceNow's momentum in federal modernization, directly supporting its most important short-term catalyst: expanded federal sector growth. However, since the new discounts offered are sizable, the impact on margins is a risk to watch closely, though the headline effect seems more about market access than material near-term earnings changes.

Among recent announcements, ServiceNow’s partnership with Aria Systems and Tenon to deliver CRM and AI-driven billing solutions to Germany’s UGG shows continued global diversification and workflow integration outside the U.S. government sector. This complements the federal contracts by demonstrating ServiceNow’s ability to scale advanced workflow tools for large infrastructure providers, further supporting its ambition to expand its total addressable market beyond legacy ITSM.

By contrast, investors should also be aware of how deep discounts to federal customers could pressure ServiceNow’s...

Read the full narrative on ServiceNow (it's free!)

ServiceNow's narrative projects $20.3 billion revenue and $3.3 billion earnings by 2028. This requires 18.9% yearly revenue growth and a $1.6 billion earnings increase from $1.7 billion today.

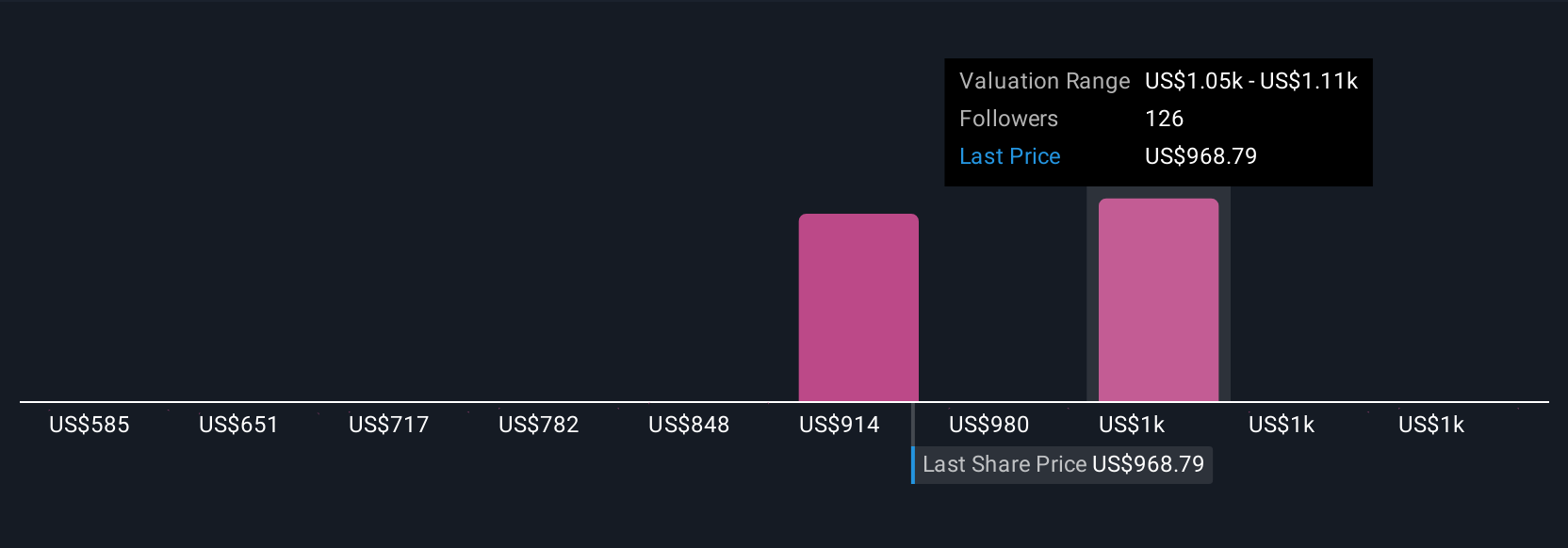

Uncover how ServiceNow's forecasts yield a $1143 fair value, a 25% upside to its current price.

Exploring Other Perspectives

While baseline estimates suggest steady revenue growth, the highest analyst forecasts previously anticipated annual revenue gains near 22.8 percent and earnings hitting US$4.2 billion by 2028, driven by assertive AI expansion and flexible pricing. It’s important to understand these reflect a significantly more optimistic scenario than consensus, and major government deals like the new GSA agreement could shift these projections, for better or worse. Always consider a range of perspectives before deciding where you stand.

Explore 16 other fair value estimates on ServiceNow - why the stock might be worth 39% less than the current price!

Build Your Own ServiceNow Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ServiceNow research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ServiceNow research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ServiceNow's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 30 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NOW

ServiceNow

Provides cloud-based solution for digital workflows in the North America, Europe, the Middle East and Africa, Asia Pacific, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives