- United States

- /

- Tech Hardware

- /

- NYSE:PSTG

High Growth Tech Stocks To Watch In December 2024

Reviewed by Simply Wall St

The United States market has remained flat over the last week, but it has experienced a significant rise of 31% over the past 12 months, with earnings expected to grow by 15% per annum in the coming years. In this context, identifying high growth tech stocks involves looking for companies that demonstrate strong potential for innovation and expansion within this optimistic economic environment.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 23.83% | 24.32% | ★★★★★★ |

| Ardelyx | 25.47% | 69.63% | ★★★★★★ |

| Sarepta Therapeutics | 24.00% | 42.51% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.35% | 70.33% | ★★★★★★ |

| Clene | 79.31% | 60.16% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Alkami Technology | 21.94% | 98.60% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 243 stocks from our US High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

TaskUs (NasdaqGS:TASK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TaskUs, Inc. offers digital outsourcing services across the Philippines, the United States, India, and internationally with a market cap of $1.36 billion.

Operations: The company generates revenue primarily from its direct marketing segment, which contributes $955.01 million.

TaskUs has demonstrated a robust pattern of growth, with earnings expanding by 18% over the past year, outpacing the Professional Services industry's average of 10.8%. This trend is set to continue with an anticipated earnings growth of 22.1% annually, significantly ahead of the US market forecast of 15.5%. Moreover, TaskUs's recent strategic alliance with Red Points enhances its service offering in digital fraud prevention—a critical area as IP violations globally account for losses around $2 trillion annually. This partnership not only positions TaskUs at the forefront of AI-driven brand protection but also promises to enhance trust and safety for clients while potentially reducing operational costs through automation and advanced detection technologies.

- Click here and access our complete health analysis report to understand the dynamics of TaskUs.

Gain insights into TaskUs' historical performance by reviewing our past performance report.

Cloudflare (NYSE:NET)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Cloudflare, Inc. is a cloud services provider offering various services to businesses globally, with a market capitalization of $38.77 billion.

Operations: The company generates revenue primarily from its Internet Telephone segment, which reported $1.57 billion in revenue.

Cloudflare is navigating a trajectory of expansion, underscored by a 28.2% increase in sales to $1.21 billion over the recent nine months, reflecting robust demand for its services. The firm's commitment to innovation is evident from its R&D spend ratio, which has consistently aligned with industry growth dynamics, fostering advancements in cybersecurity and edge computing solutions. Notably, Cloudflare's strategic moves—including the appointment of Chirantan CJ Desai as President of Product & Engineering—signal its focus on scaling operations and enhancing product offerings to meet evolving digital needs. This strategy is complemented by significant investments in European markets such as Portugal, aiming to bolster its global footprint and service capabilities across the region.

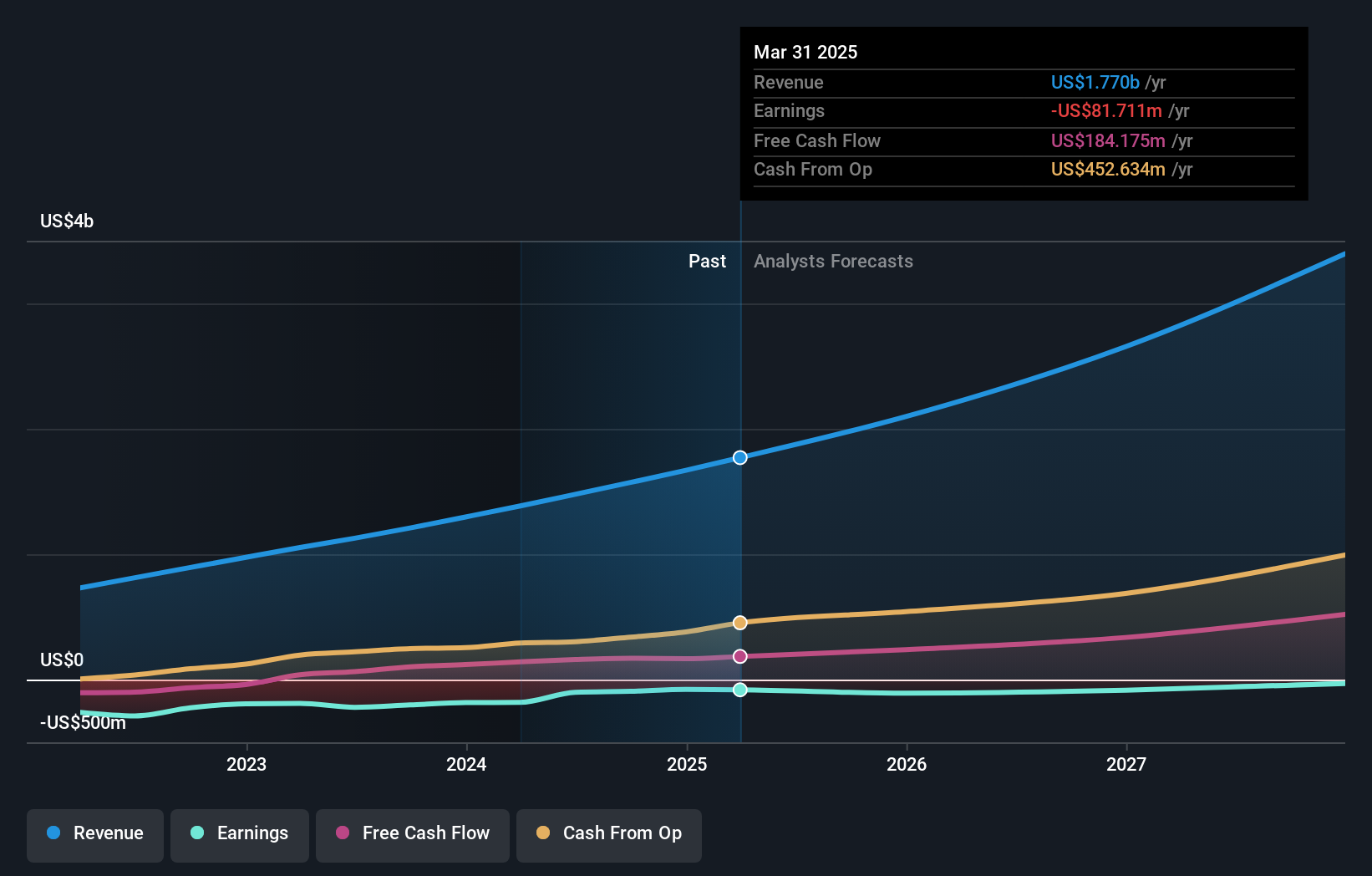

Pure Storage (NYSE:PSTG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pure Storage, Inc. provides data storage and management technologies, products, and services globally with a market cap of $21.27 billion.

Operations: Pure Storage focuses on delivering data storage and management solutions worldwide. Its revenue model primarily revolves around selling innovative storage hardware and software products, alongside offering subscription-based services. The company's financials reflect its strategic emphasis on product sales and recurring service revenues.

Pure Storage is making significant strides in the high-growth tech sector, particularly through its recent collaboration with Kioxia to enhance data storage solutions for hyperscale environments. This partnership aims to address the limitations of traditional HDDs by offering a platform that promises ultra-fast performance and scalability while reducing power consumption. Financially, Pure Storage reported a robust revenue increase to $831.07 million in Q3 2024, up from $762.84 million the previous year, demonstrating a solid growth trajectory. Moreover, R&D investments remain a priority for Pure Storage, aligning with its commitment to innovation and future readiness in storage technology—a sector critical to handling the exponential data growth in digital economies.

- Delve into the full analysis health report here for a deeper understanding of Pure Storage.

Evaluate Pure Storage's historical performance by accessing our past performance report.

Where To Now?

- Gain an insight into the universe of 243 US High Growth Tech and AI Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSTG

Pure Storage

Engages in the provision of data storage and management technologies, products, and services in the United States and internationally.

Flawless balance sheet with high growth potential.