The United States market has experienced a positive trend recently, with a 1.6% increase over the last week and a 12% rise in the past year, while earnings are projected to grow by 14% annually. In this environment, identifying high growth tech stocks can be crucial for investors seeking opportunities that align with these upward trends and robust earnings forecasts.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 26.38% | 39.09% | ★★★★★★ |

| Ardelyx | 20.57% | 59.97% | ★★★★★★ |

| Legend Biotech | 26.73% | 58.77% | ★★★★★★ |

| Travere Therapeutics | 25.82% | 65.45% | ★★★★★★ |

| TG Therapeutics | 26.46% | 38.75% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.65% | 61.11% | ★★★★★★ |

| AVITA Medical | 27.28% | 60.66% | ★★★★★★ |

| Alkami Technology | 20.54% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 35.16% | 60.26% | ★★★★★★ |

| Lumentum Holdings | 21.59% | 110.32% | ★★★★★★ |

Click here to see the full list of 234 stocks from our US High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Jabil (NYSE:JBL)

Simply Wall St Growth Rating: ★★★★☆☆

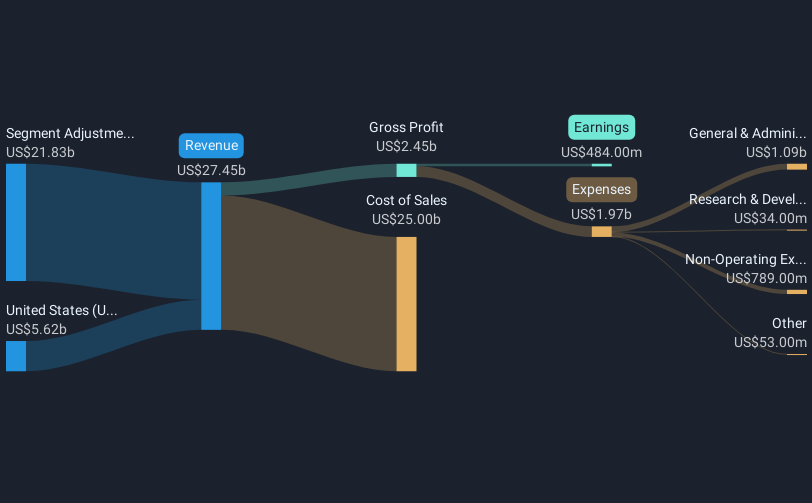

Overview: Jabil Inc. offers manufacturing services and solutions on a global scale, with a market capitalization of approximately $18.01 billion.

Operations: Jabil Inc. operates as a global provider of manufacturing services and solutions.

Jabil's recent strategic movements, including the appointment of tech veteran Sujatha Chandrasekaran to its board and its aggressive push into next-gen photonics with the launch of 1.6T transceivers, underscore its commitment to innovation in high-growth sectors like AI and high-speed data communications. Despite a challenging fiscal quarter with net income falling to $117 million from $927 million year-over-year, Jabil is positioning itself strongly for future growth with expected annual earnings growth at a robust 30.3%. The firm's R&D focus is evident from its expansion into new markets such as humanoid robotics through a collaboration with Apptronik, enhancing operational efficiencies and paving the way for advanced manufacturing solutions globally.

- Click here to discover the nuances of Jabil with our detailed analytical health report.

Gain insights into Jabil's past trends and performance with our Past report.

Cloudflare (NYSE:NET)

Simply Wall St Growth Rating: ★★★★★☆

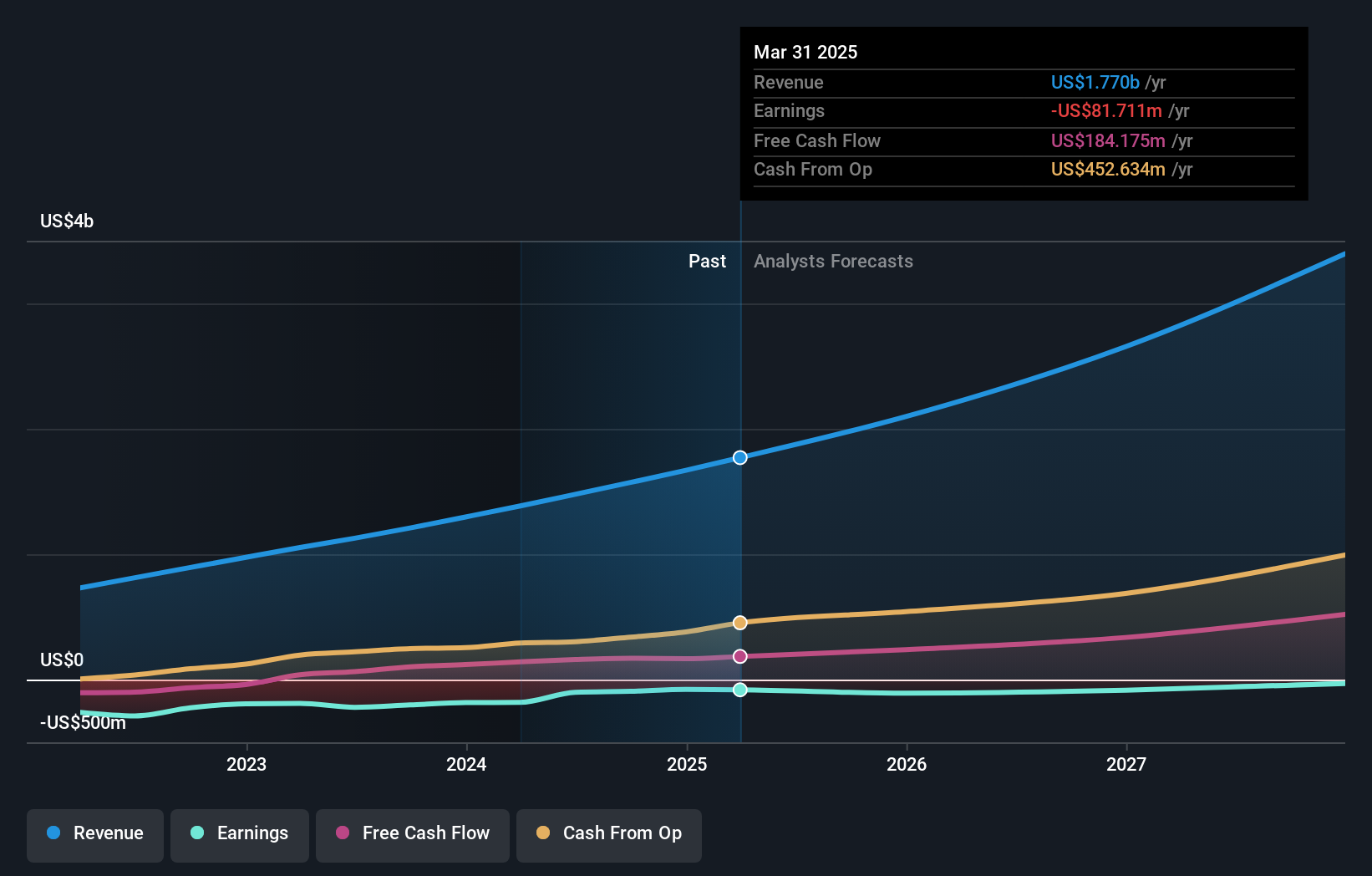

Overview: Cloudflare, Inc. is a cloud services provider offering various solutions to businesses globally, with a market cap of $54.48 billion.

Operations: The company generates revenue primarily through its Internet Telephone segment, which accounts for $1.77 billion.

Amidst a dynamic tech landscape, Cloudflare stands out with its robust growth and strategic partnerships. In Q1 2025, the company saw a significant revenue jump to $479.09 million from $378.6 million in the previous year, despite a slight increase in net loss to $38.45 million. Looking ahead, Cloudflare projects Q2 revenues between $500 million and $501 million, emphasizing its confidence in sustained growth. The company's recent collaboration with TekStream expands its cybersecurity footprint, offering comprehensive digital resilience solutions that leverage Cloudflare’s advanced security technologies. This partnership not only broadens Cloudflare's market reach but also enhances its product offerings in critical areas like zero trust architectures—essential for today's hybrid work environments where security is paramount.

- Take a closer look at Cloudflare's potential here in our health report.

Understand Cloudflare's track record by examining our Past report.

Pure Storage (NYSE:PSTG)

Simply Wall St Growth Rating: ★★★★★☆

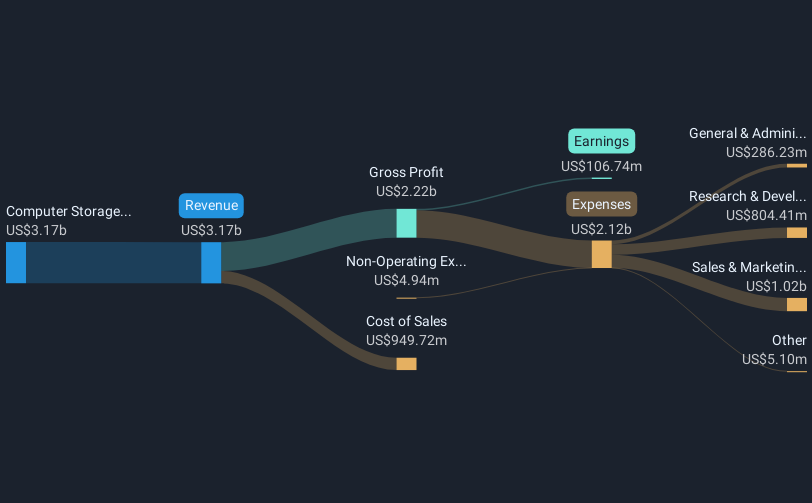

Overview: Pure Storage, Inc. focuses on delivering data storage and management solutions globally, with a market capitalization of approximately $18.50 billion.

Operations: Pure Storage generates revenue primarily from its computer storage devices segment, which accounts for $3.17 billion. The company provides data storage and management technologies and services both in the United States and internationally.

Amid rapid advancements in storage solutions for AI and high-performance computing, Pure Storage is making significant strides with its latest offering, FlashBlade//EXA. This platform, designed to break the metadata bottleneck typical of large-scale AI workloads, has demonstrated potential read performance exceeding 10 terabytes per second. Additionally, Pure Storage's recent partnerships with industry leaders like Nutanix and Varonis Systems underscore its commitment to integrating cutting-edge cybersecurity and data management technologies. These collaborations not only enhance the company's product portfolio but also position it strategically within the evolving tech landscape where security and efficiency are paramount.

- Get an in-depth perspective on Pure Storage's performance by reading our health report here.

Examine Pure Storage's past performance report to understand how it has performed in the past.

Summing It All Up

- Dive into all 234 of the US High Growth Tech and AI Stocks we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Jabil, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JBL

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives