- United States

- /

- IT

- /

- NYSE:NET

Cloudflare AI Push Faces Valuation Concerns And Recent Share Weakness

- Cloudflare (NYSE:NET) has acquired the Astro web framework team to expand tools for content creators and developers.

- The company has also acquired Human Native, an AI data marketplace, to strengthen its AI-focused offerings.

- Cloudflare has expanded its partnership with JD Cloud with a goal of reducing AI latency by up to 80% for customers.

Cloudflare runs a global cloud platform that helps developers and businesses deliver content and applications closer to users. With AI workloads growing, the company is moving deeper into tools that help developers build, deploy, and scale AI driven services. The latest acquisitions and partnership updates fit into that push toward more data, faster inference, and support for modern web apps.

For investors, these moves matter because they extend what Cloudflare can offer to AI builders and content creators directly on its network. A key consideration is how effectively the company can translate these product expansions into broader customer adoption and usage over time, especially as demand for AI infrastructure and data tooling continues to evolve.

Stay updated on the most important news stories for Cloudflare by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Cloudflare.

How Cloudflare stacks up against its biggest competitors

Quick Assessment

- ❌ Price vs Analyst Target: At US$173.30, Cloudflare trades below the US$231.95 analyst target, which implies potential upside but also a wide target range from US$117 to US$300.

- ❌ Simply Wall St Valuation: The stock is flagged as overvalued, trading about 101% above Simply Wall St's estimated fair value.

- ❌ Recent Momentum: The 30 day return is about a 14.2% decline, indicating recent weakness despite the AI focused news.

Check out Simply Wall St's in depth valuation analysis for Cloudflare.

Key Considerations

- 📊 The Astro and Human Native deals plus the JD Cloud expansion broaden Cloudflare's AI and developer toolkit, which could influence how customers use its network over time.

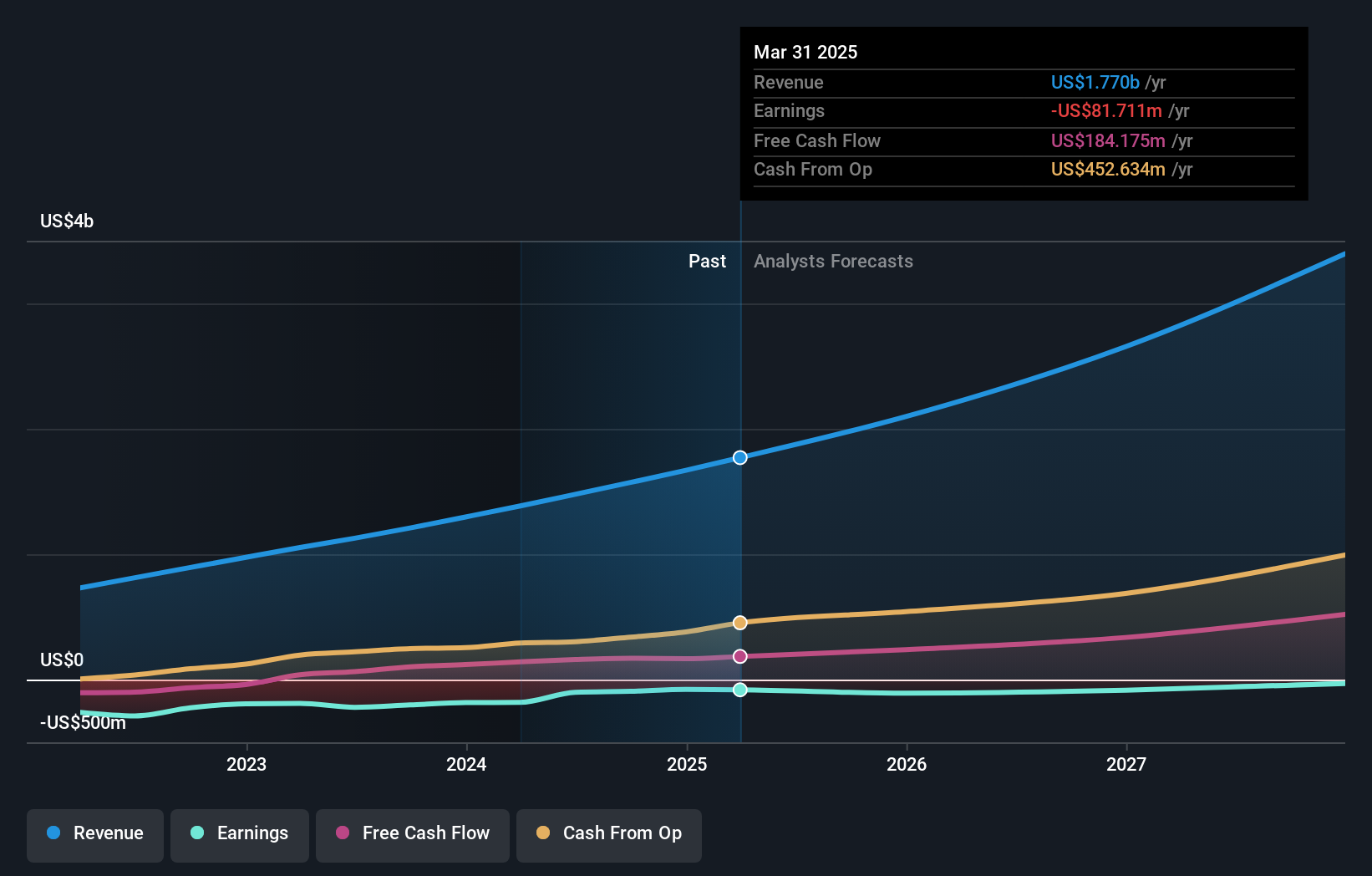

- 📊 It may be useful to monitor how AI related products affect revenue, margin trends and usage metrics, especially with the current P/E ratio reflecting a loss making position and a high industry P/E benchmark of about 27.6.

- ⚠️ One flagged risk is significant insider selling in the past 3 months, which some investors may weigh more heavily when the shares are assessed as overvalued.

Dig Deeper

For the full picture including more risks and potential rewards, check out the complete Cloudflare analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NET

Cloudflare

Operates as a cloud services provider that delivers a range of services to businesses worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Norwegian Air Shuttle's revenue will grow by 73.56% and profitability will soar

Nova Ljubljanska Banka d.d. future looks bright with a profit margin change of 38%

Viohalco S.A. (VIO.AT): Greece's Leading Integrated Metals Processor

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Undervalued Key Player in Magnets/Rare Earth

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!