- United States

- /

- Software

- /

- NYSE:MLNK

Denise Cox’s Appointment as Chief Customer Officer Might Change The Case For Investing In MLNK

Reviewed by Simply Wall St

- Earlier this month, MeridianLink, Inc. appointed Denise Cox as Chief Customer Officer, bringing over 20 years of experience leading customer-focused teams at global technology companies including Olo, Omnicell, Cisco, and NetApp.

- Cox’s background in transforming post-sales functions and boosting customer loyalty in complex, regulated industries positions her to enhance MeridianLink’s customer outcomes and operational capabilities.

- We will explore how Cox’s focus on elevating customer experience may influence MeridianLink’s longer-term business outlook and investment narrative.

MeridianLink Investment Narrative Recap

To be a shareholder in MeridianLink, it's important to believe the company can broaden its recurring revenue base by deepening relationships with mid-sized financial institutions and successfully adapting its platform to evolving digital banking needs. The appointment of Denise Cox as Chief Customer Officer appears positive for strengthening client retention and satisfaction, but does not materially alter the immediate catalyst: accelerating adoption of MeridianLink’s automated lending and data solutions amid ongoing digital transformation, nor does it eliminate the key risks from volume uncertainty in core verticals.

Among recent announcements, the launch of enhancements to the MeridianLink Engage platform in August 2024 stands out as most relevant. Since Engage aims to improve marketing automation and customer communications for financial institutions, Cox’s arrival could help unite post-sales delivery and ongoing client engagement, potentially supporting stronger cross-sell and up-sell activity, a top revenue catalyst referenced by management. Longer term, integrating superior customer experiences may reinforce retention against intensifying software competition.

By contrast, investors should be aware that ongoing consolidation of MeridianLink’s core client base, community banks and credit unions, could significantly affect future revenue…

Read the full narrative on MeridianLink (it's free!)

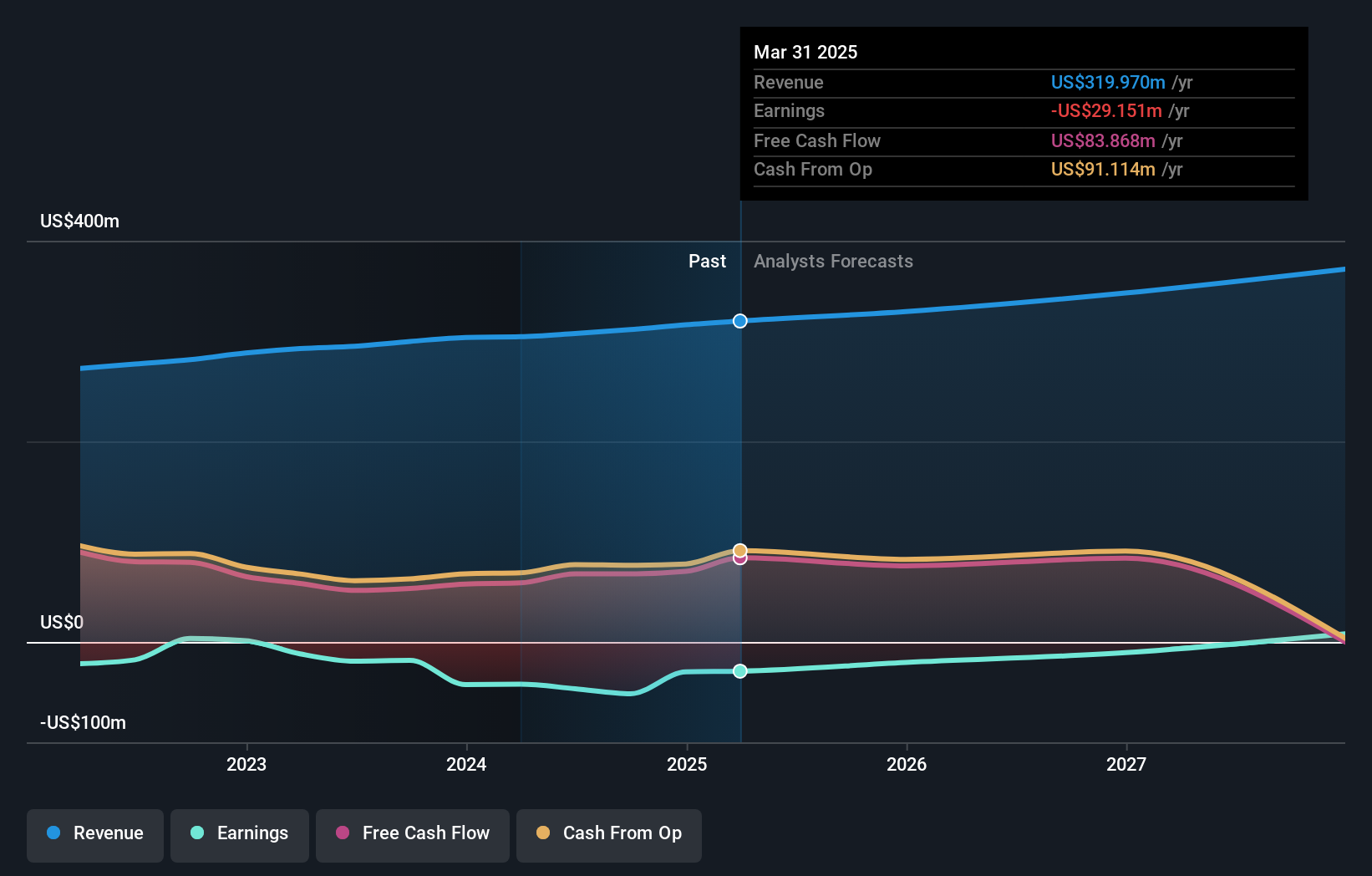

MeridianLink's outlook anticipates $374.7 million in revenue and $49.6 million in earnings by 2028. This scenario assumes annual revenue growth of 5.4% and a $78.8 million increase in earnings from the current -$29.2 million.

Uncover how MeridianLink's forecasts yield a $19.08 fair value, a 17% upside to its current price.

Exploring Other Perspectives

All Simply Wall St Community fair value estimates for MeridianLink stand at US$10.14, based on one user’s analysis. While consensus sees automation and digital adoption as growth drivers, the risk of client consolidation remains a material headwind for the company’s performance. Check out other viewpoints on what this could mean for MeridianLink’s outlook.

Build Your Own MeridianLink Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MeridianLink research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free MeridianLink research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MeridianLink's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MLNK

MeridianLink

A software-as-a service company, provides software solutions for banks, credit unions, mortgage lenders, specialty lending providers, and consumer reporting agencies in the United States.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives