- United States

- /

- Software

- /

- NasdaqGS:NTNX

High Growth Tech Stocks In The United States To Watch

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet over the past 12 months, it has risen by an impressive 23%, with earnings anticipated to grow by 15% per annum in the coming years. In this context of steady growth and future potential, identifying high-growth tech stocks involves looking for companies with innovative products and robust business models that can capitalize on these favorable market conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.36% | 24.28% | ★★★★★★ |

| Ardelyx | 21.09% | 55.29% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| Bitdeer Technologies Group | 51.49% | 122.94% | ★★★★★★ |

| TG Therapeutics | 29.48% | 43.58% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.62% | 56.70% | ★★★★★★ |

| Blueprint Medicines | 23.52% | 55.88% | ★★★★★★ |

| Travere Therapeutics | 30.52% | 61.89% | ★★★★★★ |

Click here to see the full list of 233 stocks from our US High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Cipher Mining (NasdaqGS:CIFR)

Simply Wall St Growth Rating: ★★★★★☆

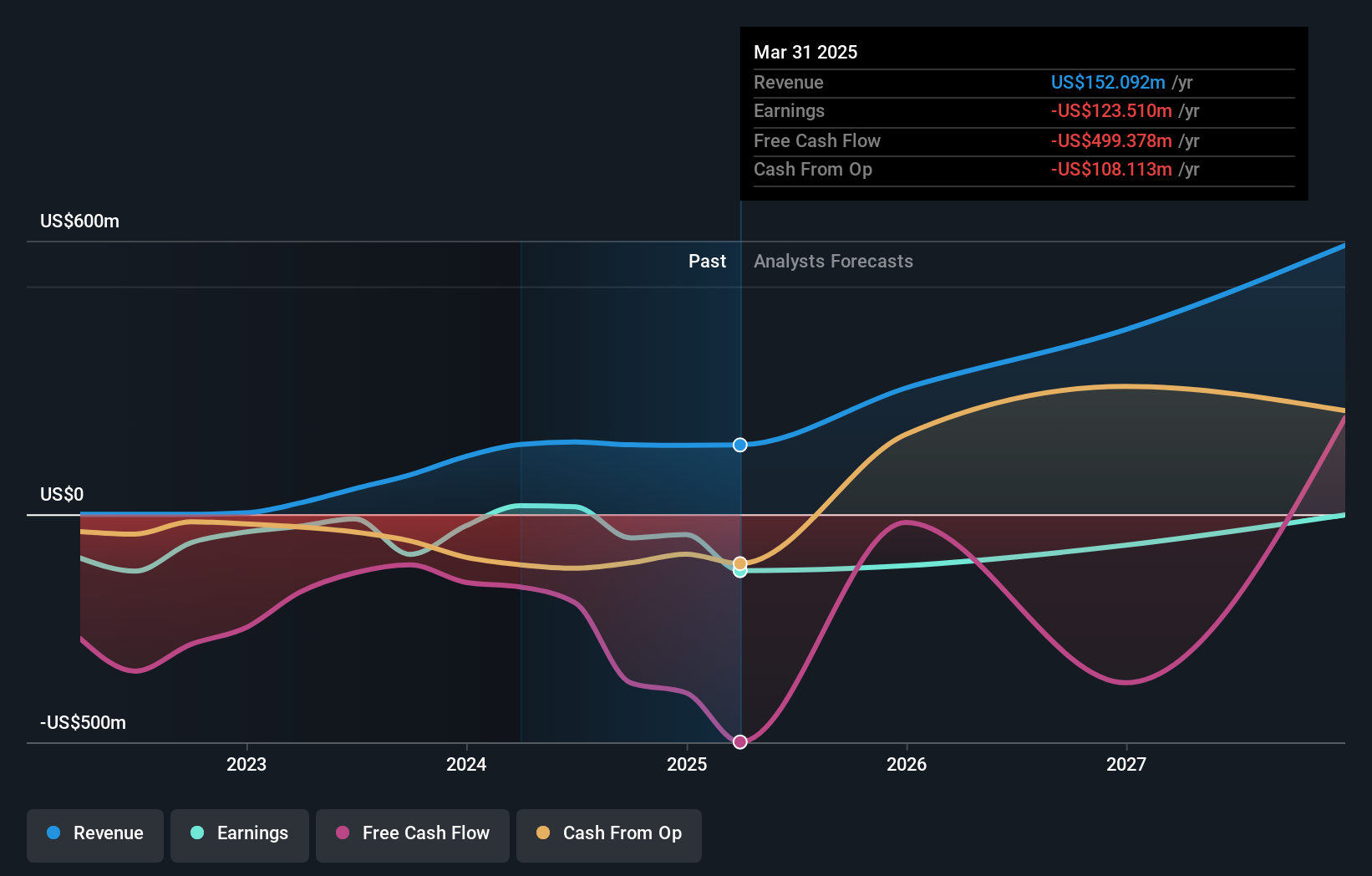

Overview: Cipher Mining Inc., along with its subsidiaries, focuses on developing and operating large-scale bitcoin mining data centers in the United States, with a market capitalization of $2.04 billion.

Operations: Cipher Mining Inc. generates revenue primarily from its data processing operations, amounting to $152.47 million. The company is involved in the industrial-scale mining of bitcoin through its data centers located in the United States.

Cipher Mining's recent strategic maneuvers, including a significant private placement and expansion into a new Texas site, underscore its aggressive growth trajectory in the burgeoning cryptocurrency mining sector. With an annual revenue forecast growth of 59.1%, Cipher is outpacing the US market average significantly. The company's operations in January 2025 alone resulted in 219 BTC mined and an operational hash rate of 13.5 EH/s, reflecting robust production capabilities. However, despite these promising figures, potential investors should note the company's current unprofitability and recent shareholder dilution which may influence long-term value. Recent earnings forecasts suggest a dramatic surge with expectations set at an increase of 113.76% per year, positioning Cipher potentially ahead of many peers within tech industries where innovation cycles are rapid and capital-intensive. This projection aligns with their substantial investment in R&D as part of their strategy to enhance technological capabilities and efficiency in crypto mining—a sector notorious for its high energy demands and need for advanced processing power.

- Unlock comprehensive insights into our analysis of Cipher Mining stock in this health report.

Gain insights into Cipher Mining's past trends and performance with our Past report.

Nutanix (NasdaqGS:NTNX)

Simply Wall St Growth Rating: ★★★★★☆

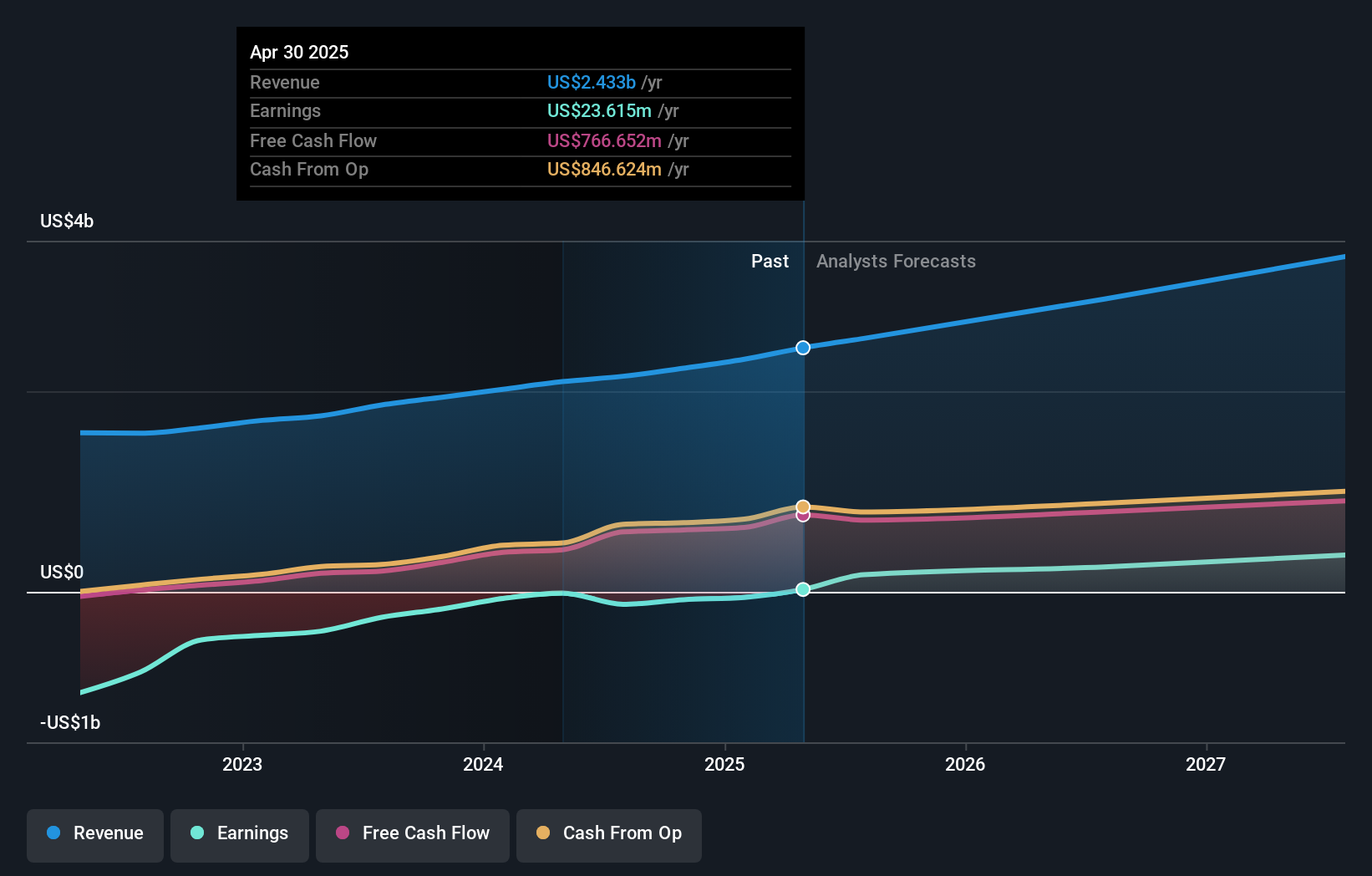

Overview: Nutanix, Inc. offers an enterprise cloud platform across various global regions including North America, Europe, the Asia Pacific, the Middle East, Latin America, and Africa with a market capitalization of approximately $18.43 billion.

Operations: Nutanix generates revenue primarily from its Internet Software & Services segment, totaling approximately $2.23 billion. The company operates within the enterprise cloud platform industry across multiple global regions.

Nutanix's recent integration with Traefik Labs, enhancing its Kubernetes Platform with advanced API and AI Gateway capabilities, underscores its strategic focus on facilitating seamless hybrid multicloud and AI-driven environments. This move is pivotal as it enhances enterprise agility in deploying, managing, and securing applications across diverse infrastructures—critical in today's rapidly evolving tech landscape. Moreover, Nutanix's robust R&D investment aligns with its forward-looking approach; the company has prioritized innovation to stay ahead in a competitive market where efficient data management and cloud interoperability are key. With an expected annual revenue growth of 13% and earnings poised to surge by 92% annually, Nutanix is strategically expanding its technological footprint while addressing the complex needs of modern enterprises.

- Delve into the full analysis health report here for a deeper understanding of Nutanix.

Gain insights into Nutanix's historical performance by reviewing our past performance report.

Kyndryl Holdings (NYSE:KD)

Simply Wall St Growth Rating: ★★★★☆☆

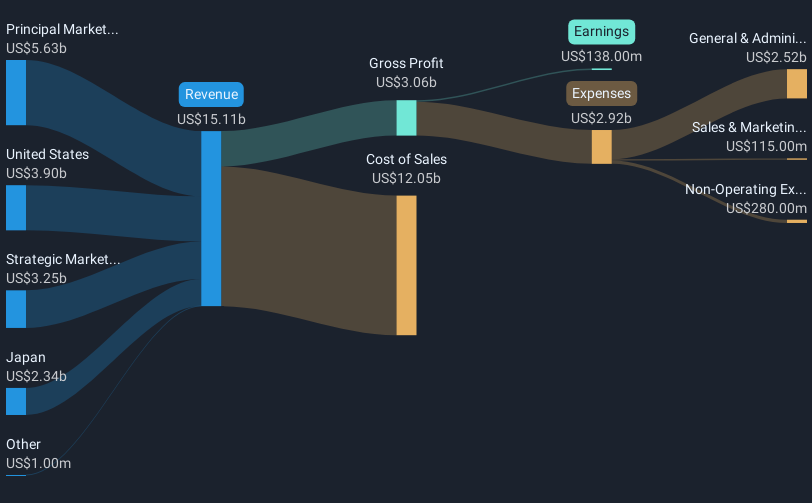

Overview: Kyndryl Holdings, Inc. is a global technology services company specializing in IT infrastructure services, with a market capitalization of approximately $8.82 billion.

Operations: Kyndryl Holdings generates revenue primarily from four geographic segments: Japan ($2.34 billion), United States ($3.90 billion), Principal Markets ($5.63 billion), and Strategic Markets ($3.25 billion). The company focuses on providing IT infrastructure services globally, leveraging its expertise in technology services to support diverse client needs across these regions.

Kyndryl Holdings' strategic alliance with Nokia to enhance data center networking solutions marks a significant step in addressing the evolving needs of global enterprises. This collaboration leverages Kyndryl's expertise in hybrid cloud environments and Nokia's robust networking infrastructure, aiming to modernize data centers with advanced security and automation technologies. Despite modest revenue growth projections of 1.1% annually, Kyndryl's recent share repurchase of $30 million underscores its commitment to shareholder value. Moreover, its engagement as a RISE with SAP delivery partner by Microsoft reflects confidence in Kyndryl’s capabilities to support complex digital transformations, positioning it well within the tech modernization trend that is critical for future growth.

- Click here to discover the nuances of Kyndryl Holdings with our detailed analytical health report.

Understand Kyndryl Holdings' track record by examining our Past report.

Turning Ideas Into Actions

- Investigate our full lineup of 233 US High Growth Tech and AI Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nutanix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTNX

Nutanix

Provides an enterprise cloud platform in North America, Europe, the Asia Pacific, the Middle East, Latin America, and Africa.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives