- United States

- /

- Software

- /

- NYSE:IOT

What the Latest Supply Chain AI Partnership Means for Samsara’s Stock Valuation in 2025

Reviewed by Simply Wall St

If you have been eyeing Samsara's stock lately, you are not alone. This is one ticker that tends to spark debates, whether you are thinking about jumping in or just weighing your options. Over the past year, Samsara has seen some dramatic shifts. Though the stock price has dropped about 20% in the last twelve months and is down nearly 25% year-to-date, that does not always tell the full story about the company's potential or how the market views its risk. Curious observers will also notice a huge contrast when looking back a few years, as Samsara's three-year return stands at an impressive 110%. Clearly, this is a business with serious growth in its DNA, and recent news around digital transformation in supply chains continues to keep the company in the spotlight.

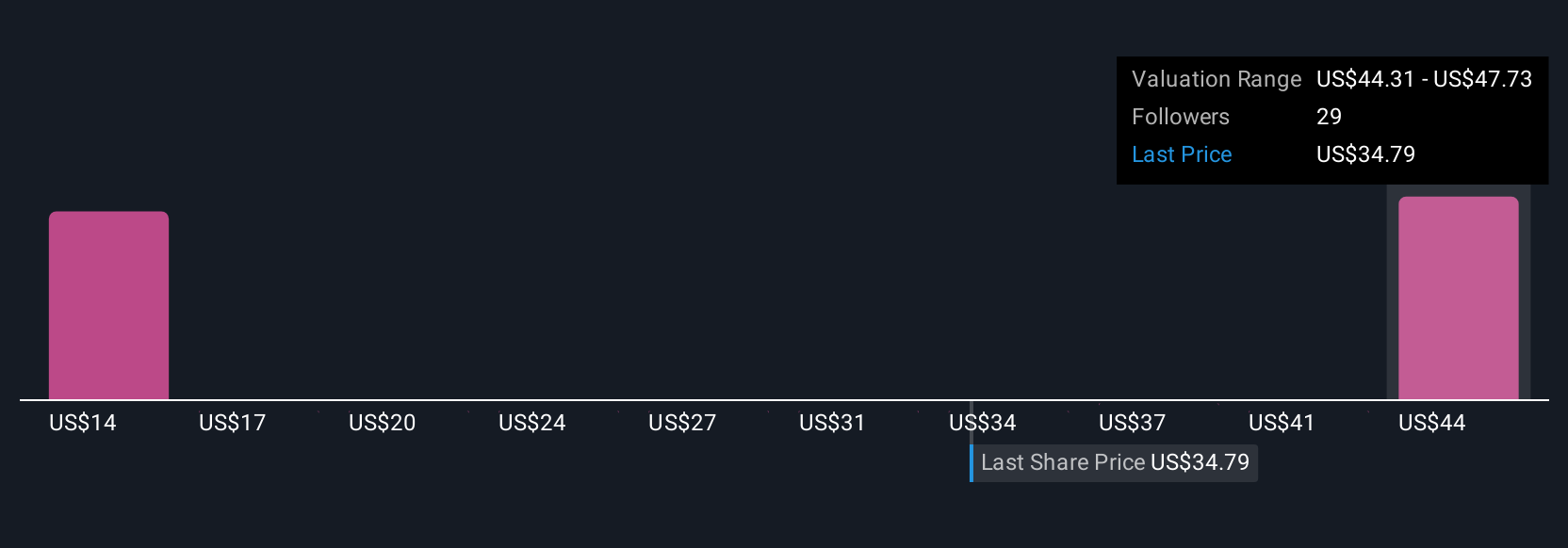

So, what does this rollercoaster performance mean for those trying to figure out if Samsara is still a buy, or if there is fresh risk on the horizon? That is where valuation becomes crucial. While analysts peg the stock's fair price around $47.73, which is 44.6% above the last close, Samsara only checks the box as undervalued in one out of six standard valuation methods, giving it a current value score of just 1. That score might seem low, but valuation is never just about the numbers on paper.

Next, let’s break down how those valuation scores are calculated and what they might miss, before getting to an even smarter way to think about whether Samsara is actually undervalued right now.

Samsara delivered -20.0% returns over the last year. See how this stacks up to the rest of the Software industry.Approach 1: Samsara Cash Flows

A Discounted Cash Flow (DCF) model is a popular way to estimate what a company is really worth by forecasting the cash it will generate in the future and then translating those future cash flows into today’s money value. For Samsara, the latest available numbers put its current Free Cash Flow (FCF) at $134.27 million. According to projections, this figure could climb steadily, reaching about $622 million by 2035. Analysts expect strong growth over the next decade.

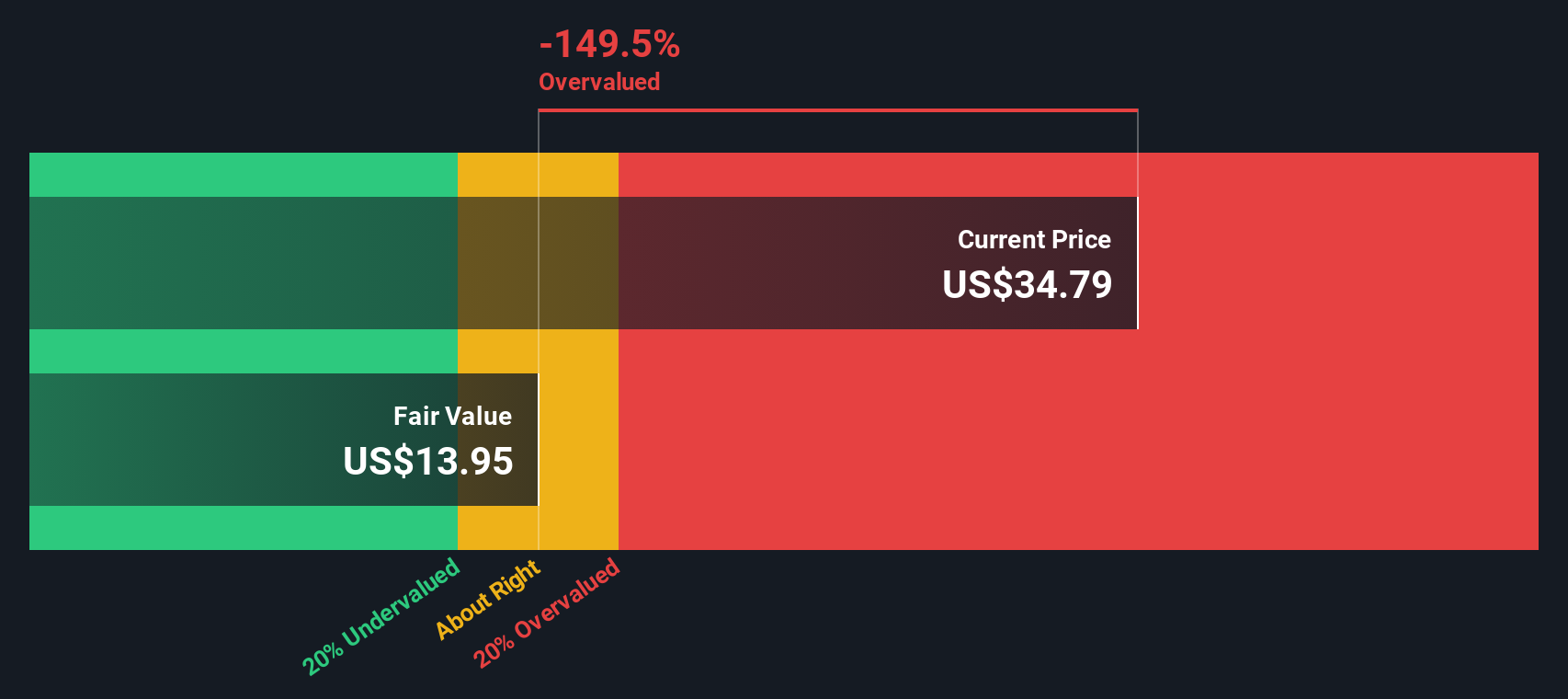

When these forecasts are run through a two-stage Free Cash Flow to Equity model, Samsara's intrinsic value is estimated at approximately $13.97 per share. Comparing this figure to the recent market price shows Samsara trading about 136.2% overvalued based on this method. This suggests the market is pricing in significantly more optimism than the cash flow outlook alone would support.

Result: OVERVALUED

Approach 2: Samsara Price vs Sales

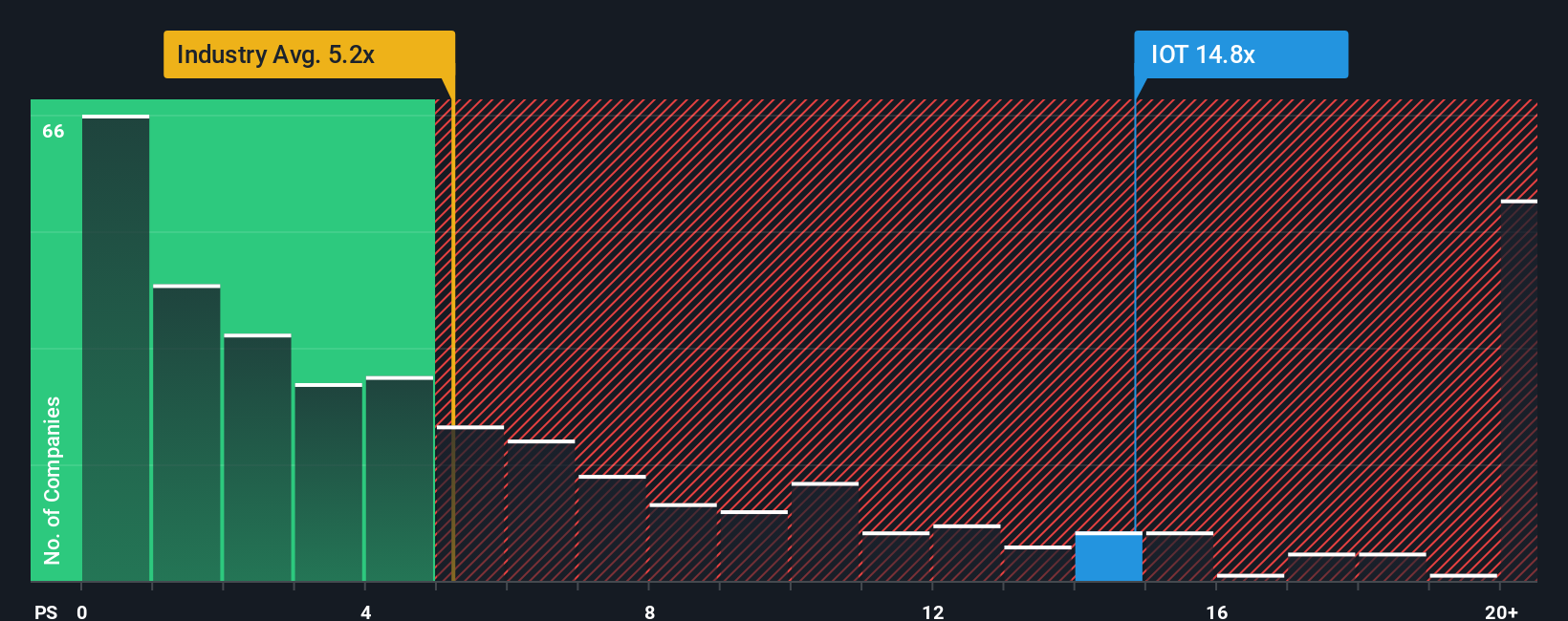

For companies that are not yet profitable or are investing heavily in future growth, the Price-to-Sales (P/S) ratio is often considered a suitable valuation metric. It highlights how much investors are willing to pay for each dollar of a company's revenue, making it especially useful when profits are not the best indicator of business health.

Growth expectations and risk play a major role in determining what a "normal" or "fair" P/S ratio looks like. When a company is growing faster than its peers or is perceived as less risky, investors are often willing to pay a higher multiple. In contrast, if future sales growth is uncertain or the market is crowded, a lower P/S is generally warranted.

Samsara's current P/S is 14.07x, which is notably higher than the industry average of 4.84x and also exceeds the average of key software peers at 10.08x. Simply Wall St's proprietary Fair Ratio, which accounts for Samsara's sector, growth prospects, profit margins, and size, is calculated at 12.34x. This suggests Samsara is trading at a P/S about 1.73 points above what would be considered fair value for its profile.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Samsara Narrative

Instead of relying solely on numbers, a Narrative helps you tell the story behind a company's future by connecting your perspective—what you believe about Samsara's business, growth, and risks—to the hard numbers like estimated revenues, margins, and fair value.

A Narrative bridges the gap between what you see happening in the real world and how those developments translate into financial forecasts. On Simply Wall St, Narratives make this process easy and accessible, guiding millions of investors to put their own views front and center while instantly seeing how those stories impact fair value calculations.

With Narratives, you can quickly determine if now is the right time to buy or sell by comparing your fair value estimate to Samsara’s current price, and as new data or news arrives, your Narrative and valuation are updated automatically.

For example, you might be bullish on Samsara, choosing to believe a price target as high as $60 if you expect rapid AI-driven expansion, or you could be more skeptical and lean towards $38 if you see risks in slow tech adoption—your Narrative shapes your investment decision.

Corrected Version Without Em Dashes:Upgrade Your Decision Making: Choose your Samsara Narrative

Instead of relying solely on numbers, a Narrative helps you tell the story behind a company's future by connecting your perspective (what you believe about Samsara's business, growth, and risks) to the hard numbers like estimated revenues, margins, and fair value.

A Narrative bridges the gap between what you see happening in the real world and how those developments translate into financial forecasts. On Simply Wall St, Narratives make this process easy and accessible, guiding millions of investors to put their own views front and center while instantly seeing how those stories impact fair value calculations.

With Narratives, you can quickly determine if now is the right time to buy or sell by comparing your fair value estimate to Samsara’s current price. As new data or news arrives, your Narrative and valuation are updated automatically.

For example, you might be bullish on Samsara, choosing to believe a price target as high as $60 if you expect rapid AI-driven expansion. Alternatively, you could be more skeptical and lean towards $38 if you see risks in slow tech adoption. Your Narrative shapes your investment decision.

Do you think there's more to the story for Samsara? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IOT

Samsara

Provides solutions to connect physical operations data to its connected operations platform in the United States and internationally.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives