- United States

- /

- Software

- /

- NYSE:IOT

Samsara (IOT): Assessing Valuation Following Board Appointment of Gary Steele and HERE Technologies Partnership

Reviewed by Simply Wall St

When Samsara (IOT) announced that Gary Steele, a veteran tech executive behind the transformation of companies like Splunk and Proofpoint, would join its Board of Directors, investors sat up and took notice. Hot on the heels of a strategic partnership with HERE Technologies to bolster Samsara’s geolocation and routing capabilities, these moves combine high-profile leadership with real product expansion. While hiring board members rarely triggers major market reactions in isolation, bringing an experienced operator like Steele on board comes at a time of heightened focus on scaling AI-powered solutions for physical operations. It is exactly the sort of signal that can prompt investors to reexamine the growth story here.

Against this backdrop, Samsara’s share price has had a volatile ride. Despite rapid revenue growth, the stock is down 17% over the past year, with momentum fading after a weaker run over the past month and quarter. Even so, the company has delivered remarkable expansion since going public three years ago, with a gain of 127%, supported by a steady cadence of new product launches and high-profile partnerships such as the recent deal with HERE. The appointment of Steele clearly fits with Samsara’s pattern of laying ambitious foundations for future growth, but the market’s current caution is hard to ignore.

After a year of underperformance and renewed strategic moves, is Samsara’s recent dip a buying opportunity for investors, or is the market simply pricing in ambitious growth assumptions?

Most Popular Narrative: 27.1% Undervalued

According to community narrative, Samsara is viewed as significantly undervalued, with analysts suggesting considerable upside potential relative to its current share price.

Samsara is experiencing strong growth in annual recurring revenue (ARR), evidenced by a 32% year-over-year increase. This growth is primarily driven by their success in landing large enterprise customers, indicating future revenue expansion opportunities with existing clients. Impact: Revenue growth.

Curious what’s fueling these ambitious projections? There is a bold vision built around aggressive revenue expansion and margin improvements. This marks the beginning of an attention-grabbing growth thesis. Want to see why analysts think this future profit machine should trade at levels usually reserved for the tech elite? Explore the underlying financial assumptions powering this verdict.

Result: Fair Value of $47.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, slower than expected adoption of new AI products or disruptions from leadership changes could challenge Samsara’s ambitious growth story and dampen valuation upside.

Find out about the key risks to this Samsara narrative.Another View: A Different Way to Value Samsara

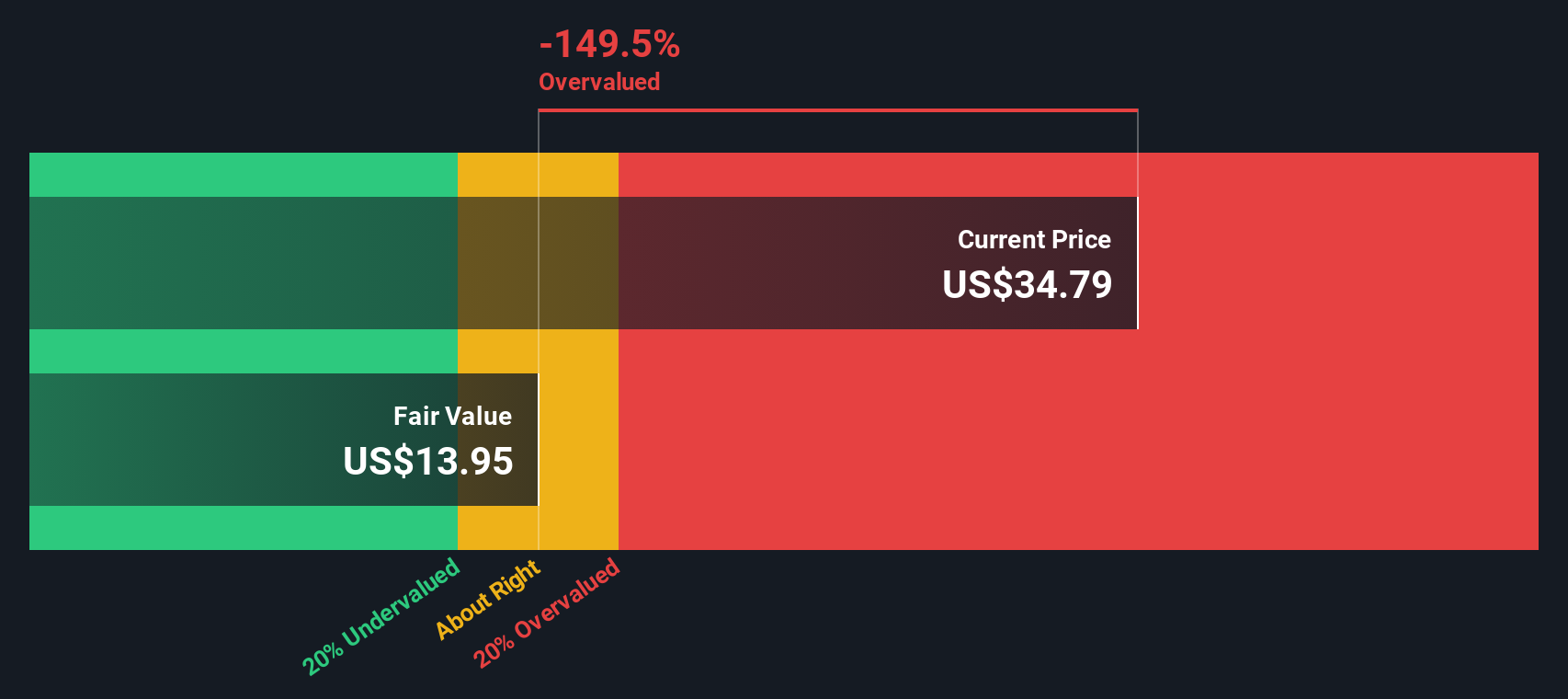

Looking at Samsara from our DCF model, the numbers paint a very different picture. Instead of highlighting value, this approach suggests the shares could actually be overvalued at current prices. Which view better fits the company's real prospects?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Samsara Narrative

If you have a different take or want to dive into the numbers yourself, building your own perspective takes just a few minutes. do it your way.

A great starting point for your Samsara research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more smart investment ideas?

Don’t just stop at Samsara when there are so many compelling opportunities waiting for you. Make your next move with confidence using the Simply Wall Street Screener. These are investment angles you won’t want to overlook:

- Tap into the world of AI innovation by checking out which companies are leading the pack in artificial intelligence, and catch the next wave of growth through AI penny stocks.

- Capture reliable income with stocks offering generous yields greater than 3%, and grow your returns faster with dividend stocks with yields > 3%.

- Uncover unique value by zeroing in on healthcare pioneers that are harnessing AI to transform patient care, all with healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IOT

Samsara

Provides solutions to connect physical operations data to its connected operations platform in the United States and internationally.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives