- United States

- /

- Software

- /

- NYSE:IOT

Samsara (IOT): Assessing Valuation After Trade War Fears Spark Market Volatility

Reviewed by Kshitija Bhandaru

Recent comments from President Donald Trump about possible tariffs on Chinese imports have rattled markets, pushing major indices lower and sparking volatility in several stocks, including Samsara (IOT).

See our latest analysis for Samsara.

While Samsara's share price tumbled 8% in a single day following renewed trade tensions, the bigger picture is mixed. Momentum has faded in recent months, with year-to-date share price return at -16%, and a steep 27% total shareholder loss over the past year, which contrasts with an impressive three-year total return of 235%.

If the sudden swings in tech stocks have you scanning for fresh opportunities, now is a great moment to discover fast growing stocks with high insider ownership

With shares now trading at a meaningful discount to analyst price targets, the crucial question is whether Samsara’s growth prospects are underestimated by the market or if all future potential is already reflected in the price.

Most Popular Narrative: 23% Undervalued

Samsara’s most widely followed narrative pegs fair value at $48.20, compared to a recent close of $36.86. This sets up a compelling debate over whether market skepticism is masking future upside.

Samsara is experiencing strong growth in annual recurring revenue (ARR), evidenced by a 32% year-over-year increase. This growth is primarily driven by their success in landing large enterprise customers, indicating future revenue expansion opportunities with existing clients. Impact: Revenue growth.

Want to know which bold revenue milestones analysts are betting on? This fair value hinges on rapid expansion and a much richer profit profile than today. Curious how these financial leaps translate into a powerful price target? See which core assumptions could fuel the next leg higher.

Result: Fair Value of $48.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slow adoption in key sectors and increased competition from AI-driven rivals could challenge Samsara’s projected growth and reduce market confidence.

Find out about the key risks to this Samsara narrative.

Another View: What Do the Multiples Say?

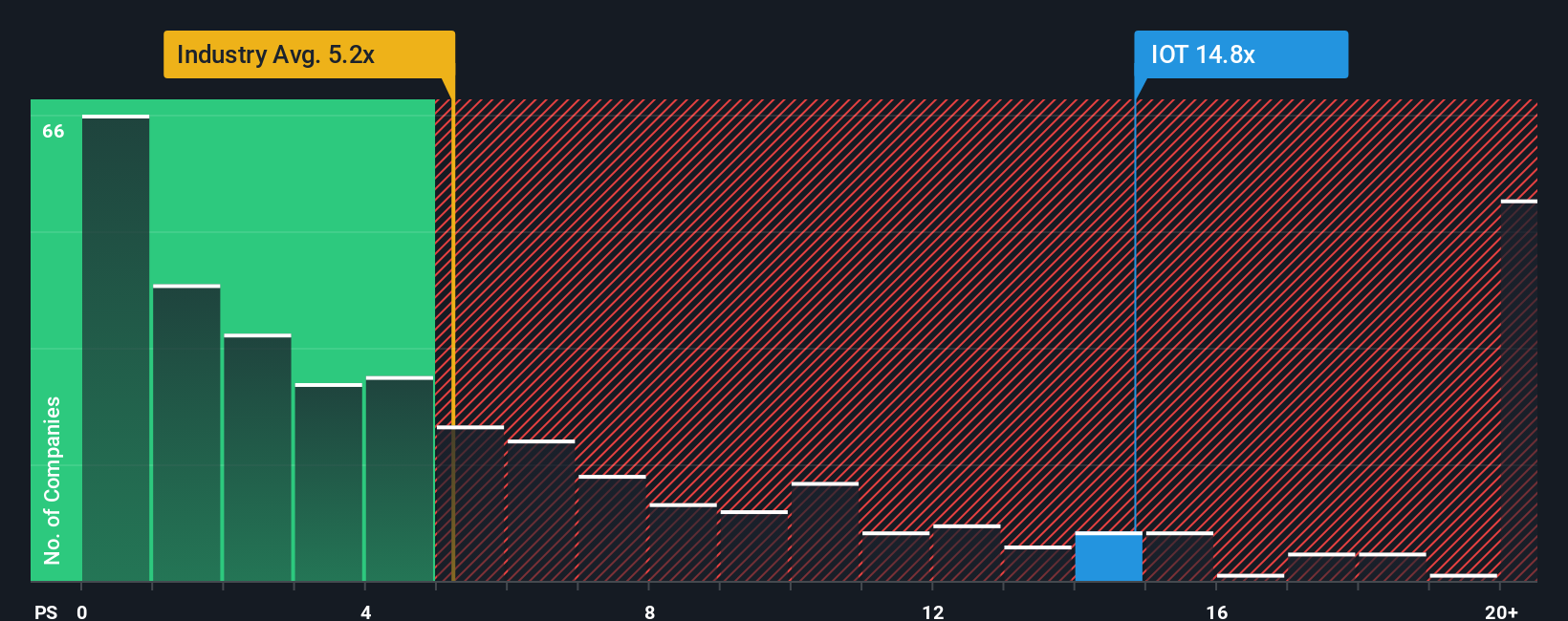

While the analyst consensus suggests Samsara is undervalued, looking at the price-to-sales ratio tells a different story. Samsara trades at 14.8x sales, nearly triple the industry average of 5x and well above the fair ratio of 11.5x. This substantial gap raises questions about whether today’s price factors in too much optimism or possible future growth.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Samsara Narrative

You can always dive into the numbers and craft your own perspective. Creating a personalized take on Samsara takes just a few minutes. Do it your way

A great starting point for your Samsara research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Opportunity favors the bold, and Simply Wall Street makes it easy to spot hidden gems and powerful trends before everyone else. Let smarter stock screening put you ahead of the curve.

- Unlock the potential of tomorrow’s healthcare leaders by checking out these 33 healthcare AI stocks where innovation is already transforming patient care.

- Maximize your search for value by targeting these 898 undervalued stocks based on cash flows that are primed for growth based on solid cash flow fundamentals.

- Go beyond crypto headlines and get an edge by focusing on these 79 cryptocurrency and blockchain stocks which are fueling real change in digital finance and blockchain adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IOT

Samsara

Provides solutions to connect physical operations data to its connected operations platform in the United States and internationally.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives