- United States

- /

- Software

- /

- NYSE:IOT

How Investors May Respond To Samsara (IOT) Adding Gary Steele and Partnering With HERE Technologies

Reviewed by Simply Wall St

- Samsara Inc. recently announced the appointment of Gary Steele, former CEO of Splunk and President at Cisco, to its Board of Directors, effective September 1, 2025, and HERE Technologies disclosed its new partnership with Samsara to deliver mapping and geolocation services within the Samsara Platform.

- The addition of Steele, a respected leader known for scaling SaaS operations, and the integration of advanced location technology underscore Samsara’s push to enhance innovation and strengthen its market position in connected operations and fleet management.

- We'll examine how the partnership with HERE Technologies signals Samsara's intent to accelerate platform capabilities and client value.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Samsara Investment Narrative Recap

Investors interested in Samsara need to see long-term opportunity in digitizing and optimizing physical operations, driven by AI and cloud-based innovations for fleet management and logistics. The appointment of Gary Steele to the Board and the HERE Technologies partnership offer positive signals for execution and product advancement, though neither materially changes the biggest near-term catalyst, adoption and monetization of AI-powered products, or alleviates the main risk, which remains unpredictable enterprise sales cycles. The mapping integration with HERE Technologies is especially relevant now, as enhanced platform capabilities could influence customer value and tangible ARR growth if adoption accelerates. Yet, in contrast to this innovation focus, investors should be aware of how unpredictability in enterprise sales cycles continues to challenge short-term revenue visibility, and...

Read the full narrative on Samsara (it's free!)

Samsara’s outlook anticipates $2.4 billion in revenue and $318.6 million in earnings by 2028. Achieving this requires 21.2% annual revenue growth and an earnings increase of $439.3 million from the current earnings of -$120.7 million.

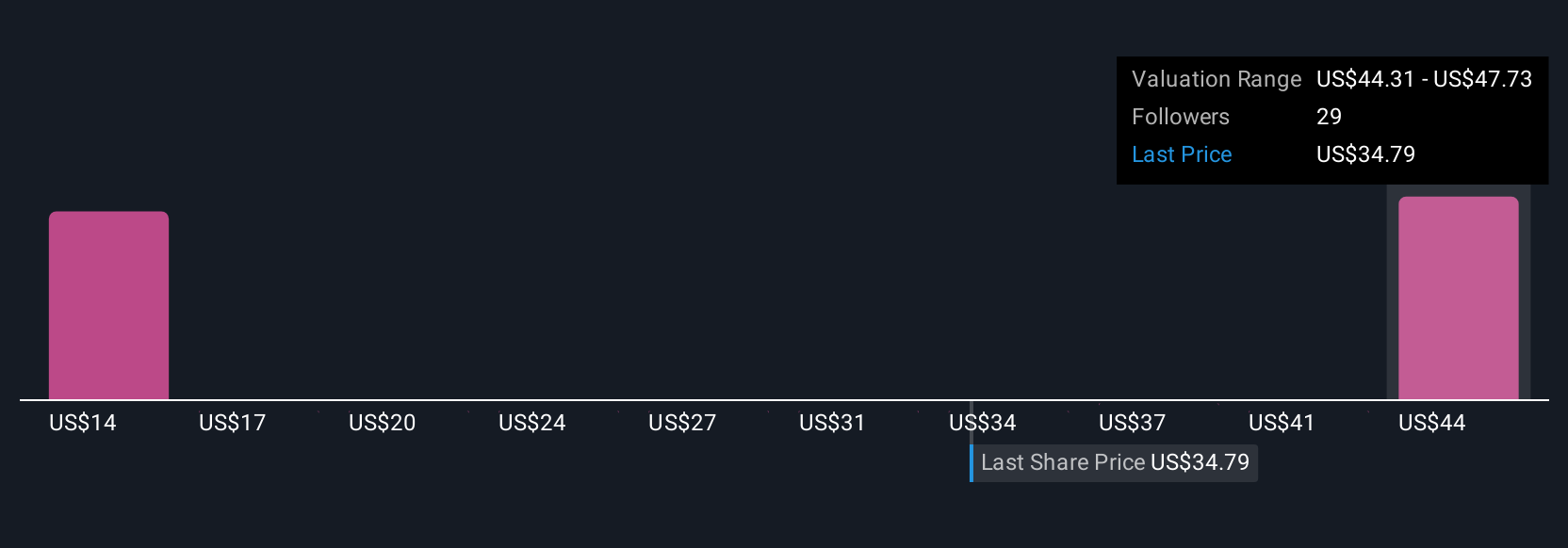

Uncover how Samsara's forecasts yield a $47.73 fair value, a 37% upside to its current price.

Exploring Other Perspectives

Seven community fair value estimates for Samsara range from US$13.51 to US$47.73, underscoring sharply differing expectations among individual contributors in the Simply Wall St Community. As some anticipate faster AI integration and ARR expansion, others remain mindful of the unpredictability in sales cycles that impacts short-term results, showing how wide these views can be.

Explore 7 other fair value estimates on Samsara - why the stock might be worth less than half the current price!

Build Your Own Samsara Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Samsara research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Samsara research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Samsara's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IOT

Samsara

Provides solutions to connect physical operations data to its connected operations platform in the United States and internationally.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives