- United States

- /

- Software

- /

- NYSE:HUBS

What HubSpot (HUBS)'s GenAI Summit Debut and OpenAI Partnership Means for Shareholders

Reviewed by Sasha Jovanovic

- Earlier this month, HubSpot presented at the GenAI Summit 2025 in San Francisco, highlighting its new integration with OpenAI’s ChatGPT ecosystem and unveiling AI-driven features for enterprise users.

- This collaboration with OpenAI underscores HubSpot’s evolving role in the enterprise AI landscape, as institutions and technology partners are increasingly recognizing its adaptability through advanced automation and platform integrations.

- We'll explore how HubSpot’s focus on AI integrations and automation tools may shape its investment narrative moving forward.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

HubSpot Investment Narrative Recap

To be a HubSpot shareholder today, you need to believe in the company’s ability to leverage AI integration and automation to remain indispensable as customers move away from traditional channels like SEO. The recent GenAI Summit announcement solidifies HubSpot’s innovation credentials, but the biggest risk remains rapid disruption in customer acquisition via generative AI, this news does not materially reduce that uncertainty in the short term.

Among the recent announcements, HubSpot’s integration with OpenAI’s ChatGPT ecosystem directly aligns with its focus on AI-driven solutions and could accelerate platform stickiness, addressing the need for new lead sources amidst evolving buyer behavior. This partnership showcases how HubSpot is pushing deeper into AI to potentially mitigate risk from declining organic search traffic and data fragmentation.

But investors should also be aware that, in contrast to these advancements, HubSpot’s future is still exposed to ...

Read the full narrative on HubSpot (it's free!)

HubSpot's narrative projects $4.6 billion revenue and $388.4 million earnings by 2028. This requires 17.1% yearly revenue growth and a $400.3 million earnings increase from the current -$11.9 million.

Uncover how HubSpot's forecasts yield a $695.33 fair value, a 58% upside to its current price.

Exploring Other Perspectives

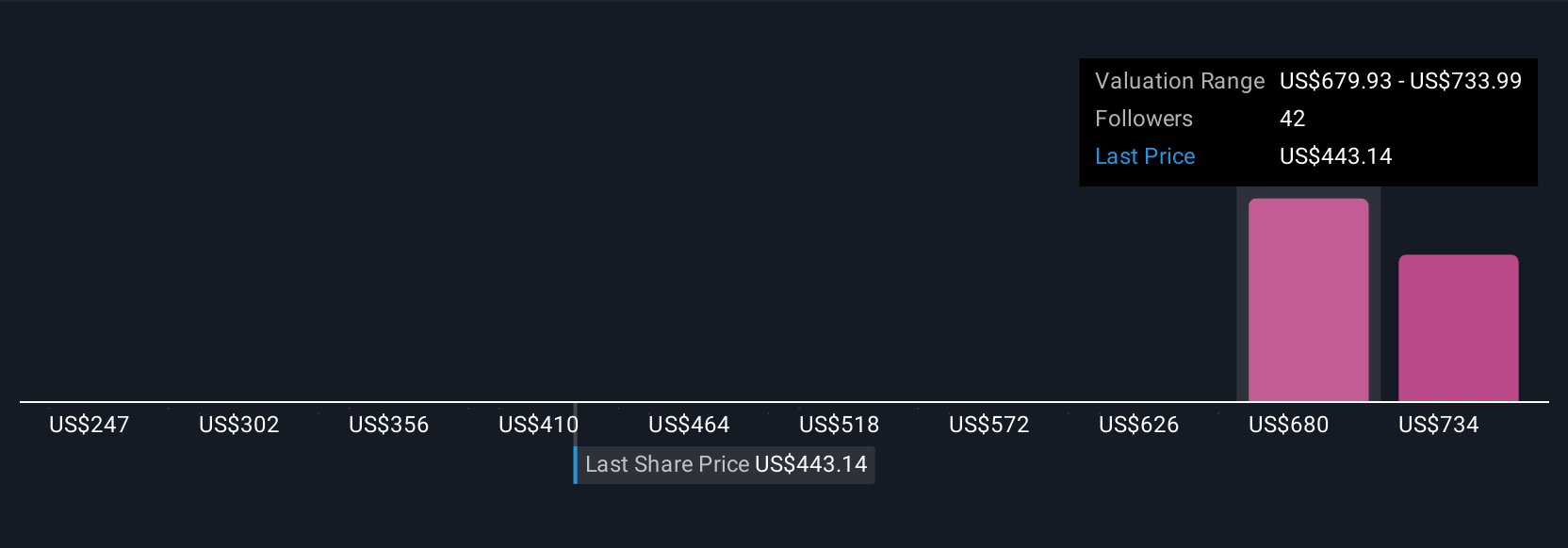

Ten individual fair value estimates from the Simply Wall St Community range widely from US$243.84 to US$744.28 per share. While many expect expanded AI integrations to drive revenue, risks from shifting customer acquisition channels could challenge this outlook, explore these varying perspectives to see how opinions differ.

Explore 10 other fair value estimates on HubSpot - why the stock might be worth as much as 69% more than the current price!

Build Your Own HubSpot Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your HubSpot research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free HubSpot research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HubSpot's overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if HubSpot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HUBS

HubSpot

Provides a cloud-based customer relationship management (CRM) platform for businesses in the Americas, Europe, and the Asia Pacific.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion