- United States

- /

- Software

- /

- NYSE:GWRE

Linonia’s New Stake Might Change the Case for Investing in Guidewire Software (GWRE)

Reviewed by Sasha Jovanovic

- On September 26, 2025, Linonia Partnership LP acquired an additional 848,127 shares of Guidewire Software, raising its total holdings to 4,244,437 shares and representing 30.01% of its portfolio.

- This substantial increase by a major institutional investor highlights growing institutional confidence in Guidewire Software’s future and its position within the insurance technology sector.

- We'll examine what Linonia's heightened investment means for Guidewire's outlook as cloud adoption and AI gain industry momentum.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Guidewire Software Investment Narrative Recap

Being a Guidewire shareholder is about believing in the accelerating shift of insurance platforms to the cloud and the company’s potential to deepen its role through analytics and AI. Linonia Partnership’s expanded stake is a clear vote of confidence, but it does not materially change the near-term catalyst, the pace of cloud adoption among P&C insurers, or the execution risks tied to this shift.

Among Guidewire’s recent updates, the collaboration with Capgemini and Nomura Research Institute to adapt PolicyCenter for the Japanese insurance market is especially relevant. This aligns directly with Guidewire’s growth catalysts, particularly global expansion and the push to establish cloud solutions in new markets.

Yet, in contrast to the optimism around institutional investment, investors should be aware of risks such as Guidewire’s ongoing execution challenge in the industry’s cloud transition, which could...

Read the full narrative on Guidewire Software (it's free!)

Guidewire Software's narrative projects $1.7 billion in revenue and $191.6 million in earnings by 2028. This requires 15.1% yearly revenue growth and a $157 million earnings increase from the current $34.6 million.

Uncover how Guidewire Software's forecasts yield a $268.38 fair value, a 15% upside to its current price.

Exploring Other Perspectives

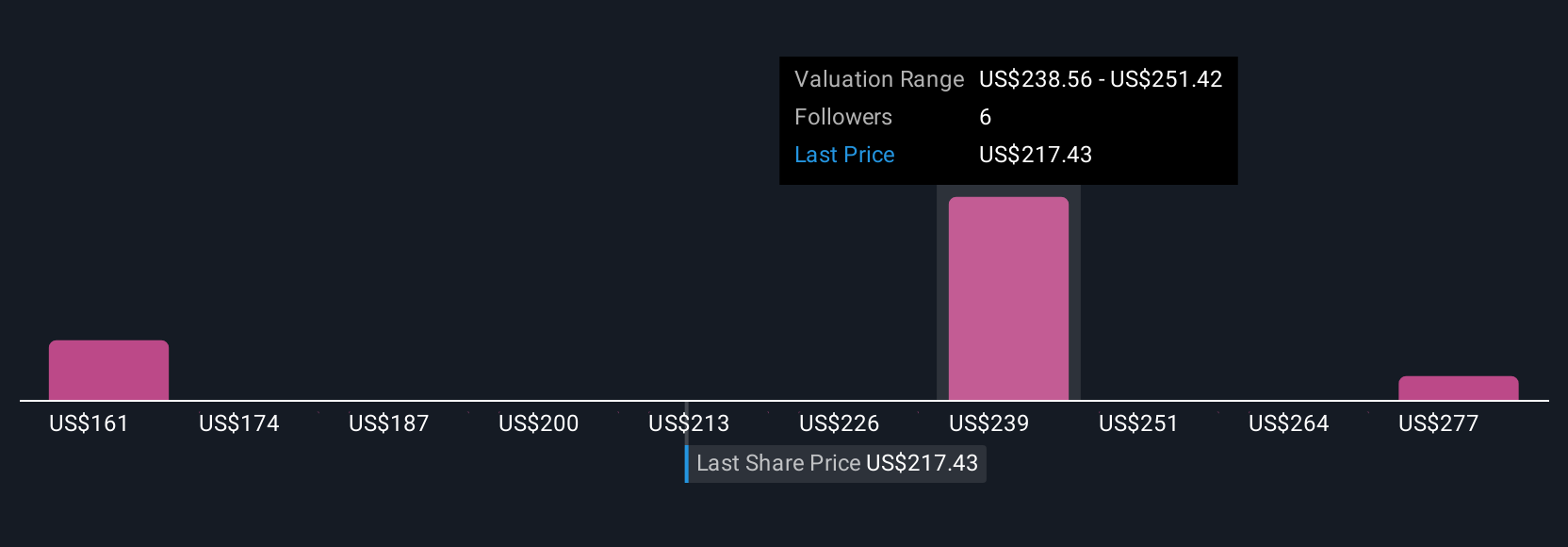

Simply Wall St Community fair value estimates for Guidewire range from US$141.80 to US$305, with three distinct views represented. As cloud migration remains a critical catalyst, differing outlooks among community members reveal how future performance expectations shape valuation opinions.

Explore 3 other fair value estimates on Guidewire Software - why the stock might be worth as much as 31% more than the current price!

Build Your Own Guidewire Software Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Guidewire Software research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Guidewire Software research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Guidewire Software's overall financial health at a glance.

No Opportunity In Guidewire Software?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GWRE

Guidewire Software

Provides a platform for property and casualty (P&C) insurers worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives