- United States

- /

- Software

- /

- NYSE:GWRE

Guidewire Software (NYSE:GWRE) Surges 12% Over Past Week With Mammoth Release

Reviewed by Simply Wall St

Guidewire Software (NYSE:GWRE) recently announced the release of Mammoth, its new solution aimed at improving underwriting capabilities in the insurance industry. Furthermore, partnerships with firms like HDI Global Insurance and Frankenmuth Insurance to implement cloud-based systems have been highlighted in recent client announcements. While the company's stock rose 12% over the past week, surpassing broad market gains of 8%, the positive momentum might be connected to such strategic moves. Market trends were mixed, with technology experiencing a downturn, yet Guidewire managed to outperform, likely due to these company-specific developments.

Rare earth metals are the new gold rush. Find out which 22 stocks are leading the charge.

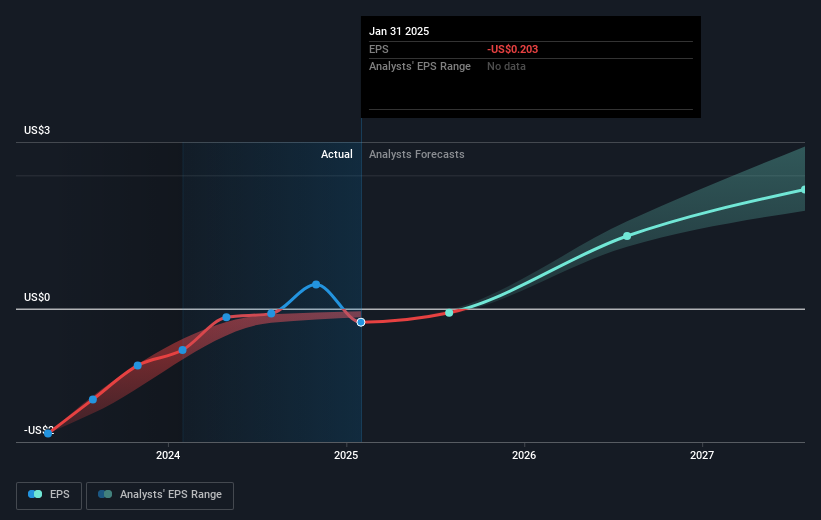

The recent introduction of Mammoth by Guidewire Software potentially positions the company to capture a larger share of the growing demand for enhanced underwriting solutions. By partnering with companies like HDI Global Insurance and Frankenmuth Insurance, Guidewire aligns itself with the industry's shift towards cloud-based systems. This could bolster both revenue and earnings forecasts as more insurers seek to modernize their operations with cloud technology. Analysts currently anticipate a revenue growth of 15.3% annually for the next three years, signaling positive expectations despite potential risks such as execution challenges in transitioning to the cloud.

Over the longer term, Guidewire's total shareholder return, consisting of both share price appreciation and dividends, was 127.11% over the five-year period. This impressive performance surpasses the one-year return for both the US Software industry and the US Market, illustrating the company's resilience in a competitive environment. While the past week's 12% share price increase is significant, it is still trading below the consensus price target of US$210.72, representing potential upside based on analyst projections. With current shares at US$172.73, investors appear optimistic, yet cautious, as they consider future revenue and earnings growth relative to market conditions and internal developments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GWRE

Guidewire Software

Provides a platform for property and casualty (P&C) insurers worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives