- United States

- /

- Software

- /

- NYSE:GWRE

Guidewire Software (GWRE) Expands Cloud Transition With LahiTapiola Partnership

Reviewed by Simply Wall St

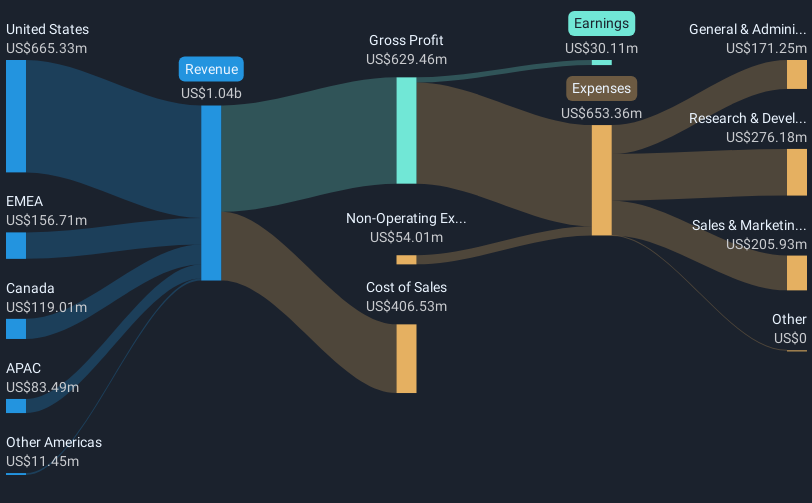

Guidewire Software (GWRE) experienced a 20% price increase over the past month. A major catalyst was LahiTapiola’s decision to extend its partnership by transitioning to the Guidewire Cloud Platform, enhancing its operational agility and innovation. Additionally, Guidewire reported strong fourth-quarter earnings, with revenue rising to USD 357 million and net income to USD 52 million, which likely bolstered investor confidence. This performance aligned with market trends, as tech-heavy indices like the Nasdaq hit all-time highs amid an encouraging economic backdrop. These elements collectively supported the upward momentum in Guidewire's share price.

Be aware that Guidewire Software is showing 2 possible red flags in our investment analysis.

Find companies with promising cash flow potential yet trading below their fair value.

The recent developments surrounding Guidewire Software, including LahiTapiola’s move to the Guidewire Cloud Platform and the company's strong quarterly earnings, have potential implications for its future growth trajectory. As the insurance industry gravitates towards cloud-based solutions, Guidewire's revenues are likely to benefit from increased platform adoption and global market expansion. The strategic emphasis on analytics and AI could enhance service offerings, impacting both revenue and profit margins positively over time.

Over the longer term, Guidewire's total shareholder return, including stock price appreciation and dividends, was 278.36% over three years, reflecting significant growth and momentum in its operations and market perception. Comparatively, over the past year, Guidewire outperformed the US Software industry, which returned 29.3%, indicating solid relative performance and investor confidence during this period.

Furthermore, the current share price of US$255.96 is marginally discounted to the analyst price target of US$268.38, suggesting room for further potential gains. The news of cloud adoption and strong earnings results offers an encouraging outlook, aligning with existing revenue and earnings forecasts. However, it's essential to remain mindful of execution risks and market-specific challenges that may influence these projections. Overall, Guidewire's recent developments appear to support its upward trajectory, both in terms of operational performance and market valuation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GWRE

Guidewire Software

Provides a platform for property and casualty (P&C) insurers worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)