- United States

- /

- Software

- /

- NasdaqGM:RPD

High Growth Tech Stocks Including Arcturus Therapeutics Holdings And Two Others

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a 2.2% drop, yet it is up 24% over the past year with earnings forecast to grow by 15% annually. In this context of fluctuating yet promising growth, identifying high-growth tech stocks such as Arcturus Therapeutics Holdings requires an understanding of their potential to capitalize on technological advancements and market opportunities amidst these dynamic conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.13% | 24.28% | ★★★★★★ |

| Ardelyx | 25.47% | 69.63% | ★★★★★★ |

| Sarepta Therapeutics | 24.09% | 42.97% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.34% | 70.30% | ★★★★★★ |

| Clene | 77.61% | 59.19% | ★★★★★★ |

| TG Therapeutics | 34.86% | 56.98% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 237 stocks from our US High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Arcturus Therapeutics Holdings (NasdaqGM:ARCT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Arcturus Therapeutics Holdings Inc. is a late-stage clinical company specializing in messenger RNA medicines and vaccines, targeting infectious diseases and rare liver and respiratory conditions, with a market cap of $419.31 million.

Operations: Arcturus Therapeutics Holdings generates revenue primarily through the research and development of medical applications, amounting to $160.40 million. The company's focus is on developing vaccines and treatments for infectious diseases, as well as rare liver and respiratory conditions.

Arcturus Therapeutics Holdings, amid a landscape where tech and biotech converge, is navigating through challenging yet promising times. With a robust annual revenue growth rate of 35.2%, the company outpaces the U.S. market average of 9.1%. Despite current unprofitability, earnings are projected to surge by 70.84% annually, positioning Arcturus on a path to profitability within three years—a pace considered above average in its sector. The firm's engagement in high-profile healthcare conferences and recent FDA green light for its innovative sa-mRNA vaccine candidate ARCT-2304 highlight its active role in pioneering advanced medical technologies. These developments not only enhance its industry standing but also promise substantial future growth potential, leveraging cutting-edge science to meet urgent global health needs.

Rapid7 (NasdaqGM:RPD)

Simply Wall St Growth Rating: ★★★★☆☆

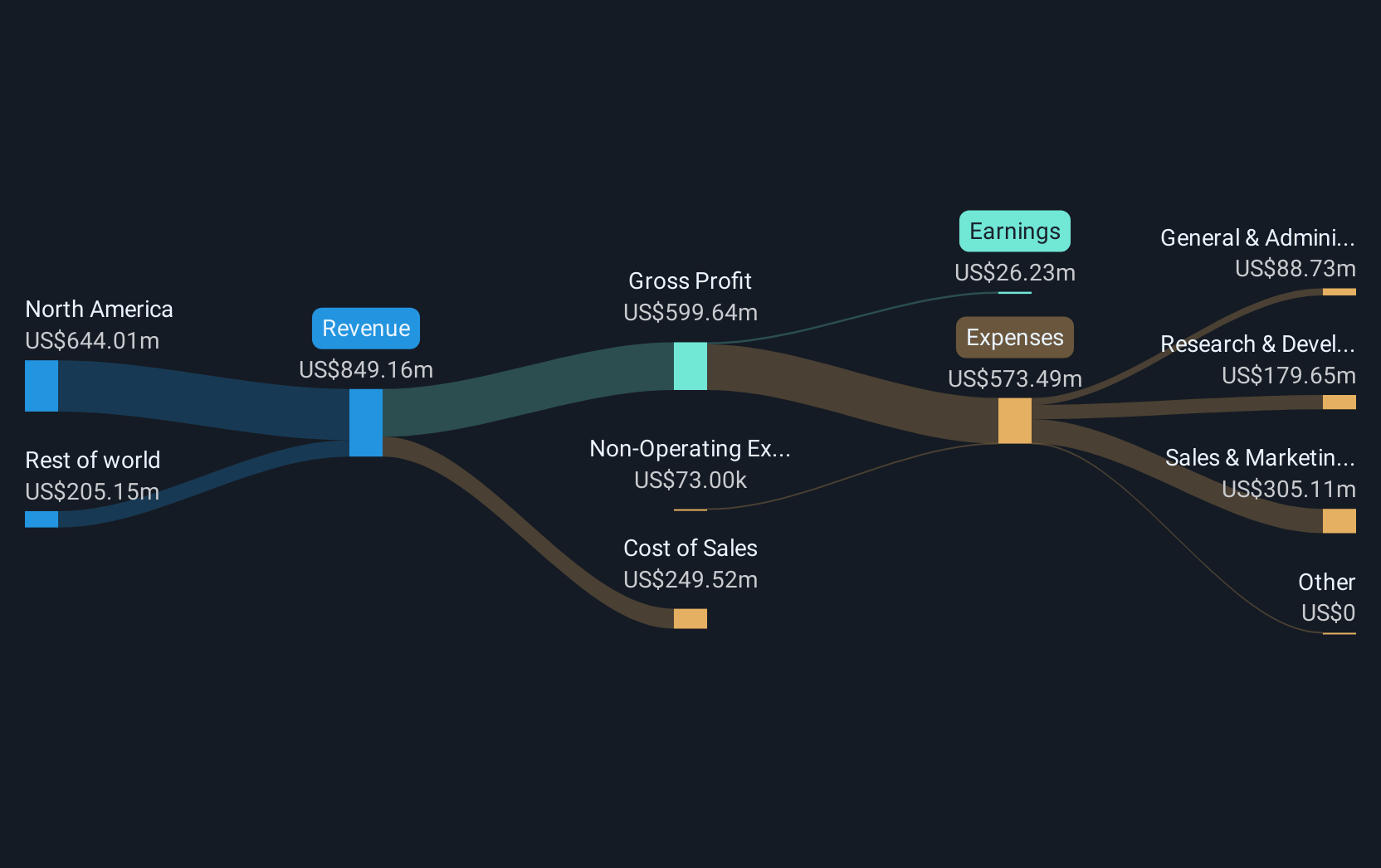

Overview: Rapid7, Inc. offers cybersecurity solutions through its Rapid7, Nexpose, and Metasploit brands and has a market cap of $2.49 billion.

Operations: The company generates revenue primarily from its Security Software & Services segment, totaling $833.01 million. Its business model focuses on providing comprehensive cybersecurity solutions through its established brands.

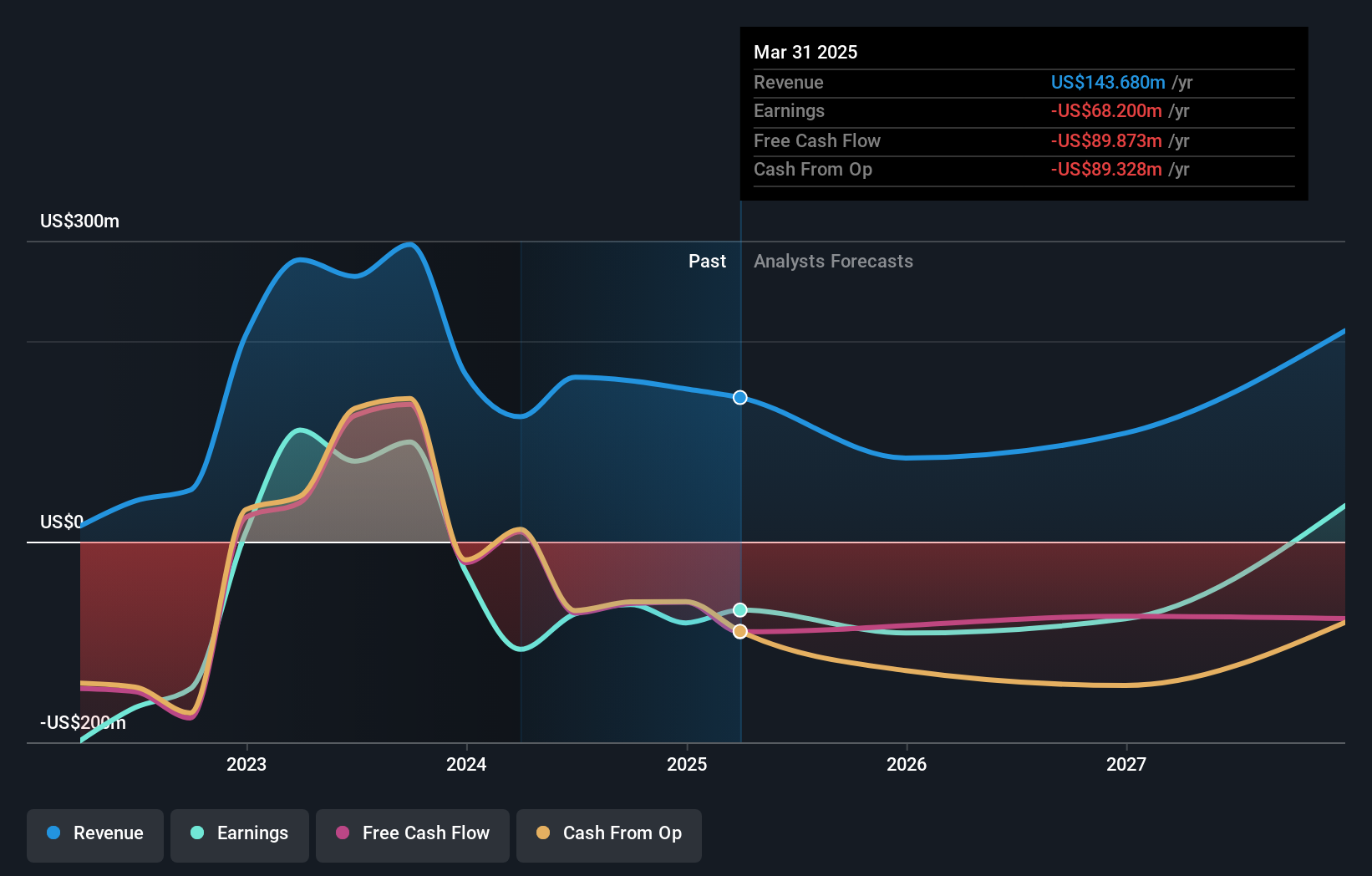

Rapid7 has shifted positively, reporting a net income of $16.55 million this quarter compared to a net loss last year, reflecting substantial operational improvements and effective cost management. The company's annual earnings are projected to grow by 21.1%, outpacing the US market projection of 15.2%. Furthermore, Rapid7's commitment to innovation is evident in its R&D spending, which remains robust at $214.65 million annually, ensuring continuous enhancement of its cybersecurity solutions and services. This strategic focus on R&D not only strengthens its product offerings but also solidifies its position in the competitive tech landscape by adapting swiftly to evolving security needs.

- Navigate through the intricacies of Rapid7 with our comprehensive health report here.

Examine Rapid7's past performance report to understand how it has performed in the past.

Globant (NYSE:GLOB)

Simply Wall St Growth Rating: ★★★★☆☆

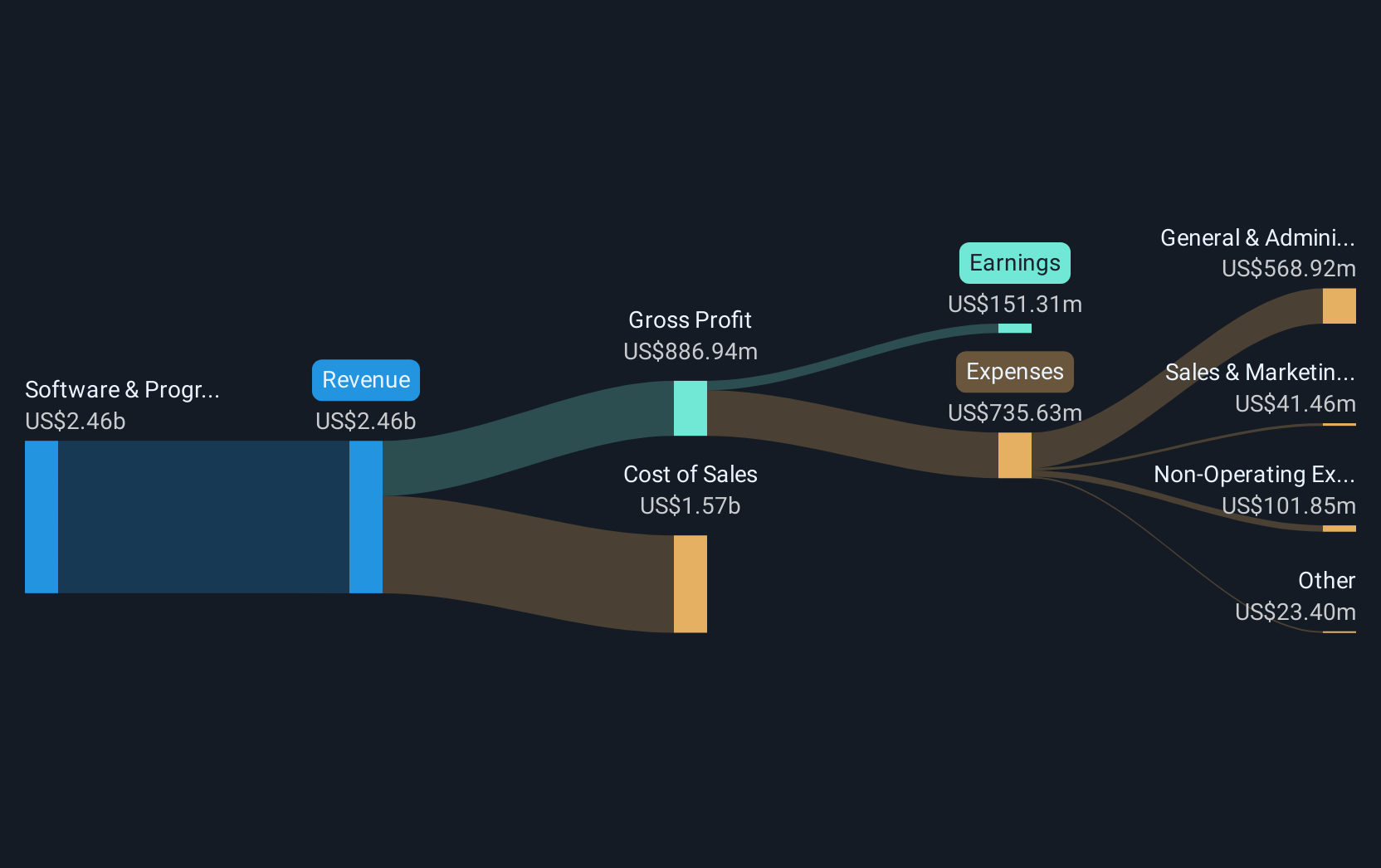

Overview: Globant S.A. is a global provider of technology services, with a market capitalization of approximately $9.56 billion.

Operations: Globant generates revenue primarily from its Software & Programming segment, amounting to $2.35 billion.

Globant's recent strategic partnership with Faros AI underscores its commitment to enhancing software development efficiency through advanced AI tools, positioning it well within the high-growth tech sector. This collaboration is set to boost developer productivity and software quality, which aligns with industry trends predicting a significant increase in the adoption of engineering intelligence platforms. Financially, Globant has demonstrated robust growth with a 13.2% annual revenue increase and an impressive 21.1% forecast in earnings growth per year, outpacing the broader US market’s expectations. Additionally, their R&D investment remains a cornerstone of their strategy, ensuring continuous innovation and competitive edge in technology solutions.

- Delve into the full analysis health report here for a deeper understanding of Globant.

Gain insights into Globant's past trends and performance with our Past report.

Key Takeaways

- Unlock more gems! Our US High Growth Tech and AI Stocks screener has unearthed 234 more companies for you to explore.Click here to unveil our expertly curated list of 237 US High Growth Tech and AI Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RPD

Rapid7

Provides cybersecurity software and services under the Rapid7, Nexpose, and Metasploit brand names.

Reasonable growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives