Many Fastly, Inc. (NYSE:FSLY) insiders ditched their stock over the past year, which may be of interest to the company's shareholders. When evaluating insider transactions, knowing whether insiders are buying is usually more beneficial than knowing whether they are selling, as the latter can be open to many interpretations. However, shareholders should take a deeper look if several insiders are selling stock over a specific time period.

While we would never suggest that investors should base their decisions solely on what the directors of a company have been doing, we would consider it foolish to ignore insider transactions altogether.

Fastly Insider Transactions Over The Last Year

In the last twelve months, the biggest single sale by an insider was when the CEO & Director, Todd Nightingale, sold US$579k worth of shares at a price of US$8.84 per share. We generally don't like to see insider selling, but the lower the sale price, the more it concerns us. The good news is that this large sale was at well above current price of US$7.00. So it may not tell us anything about how insiders feel about the current share price.

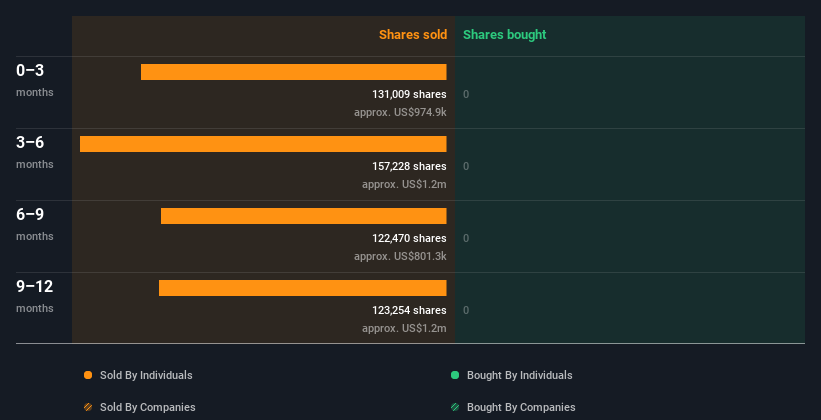

Insiders in Fastly didn't buy any shares in the last year. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. By clicking on the graph below, you can see the precise details of each insider transaction!

See our latest analysis for Fastly

If you like to buy stocks that insiders are buying, rather than selling, then you might just love this free list of companies. (Hint: Most of them are flying under the radar).

Insiders At Fastly Have Sold Stock Recently

The last quarter saw substantial insider selling of Fastly shares. Specifically, insiders ditched US$999k worth of shares in that time, and we didn't record any purchases whatsoever. In light of this it's hard to argue that all the insiders think that the shares are a bargain.

Insider Ownership Of Fastly

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. I reckon it's a good sign if insiders own a significant number of shares in the company. Insiders own 7.3% of Fastly shares, worth about US$74m. This level of insider ownership is good but just short of being particularly stand-out. It certainly does suggest a reasonable degree of alignment.

What Might The Insider Transactions At Fastly Tell Us?

Insiders sold Fastly shares recently, but they didn't buy any. And there weren't any purchases to give us comfort, over the last year. Insiders own shares, but we're still pretty cautious, given the history of sales. We're in no rush to buy! So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. While conducting our analysis, we found that Fastly has 2 warning signs and it would be unwise to ignore them.

But note: Fastly may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

If you're looking to trade Fastly, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:FSLY

Fastly

Operates an edge cloud platform for processing, serving, and securing its customer’s applications in the United States, the Asia Pacific, Europe, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives