- United States

- /

- Software

- /

- NYSE:FICO

Why Fair Isaac (FICO) Is Up 21.9% After Launching Direct Access Program for Mortgage Lenders

Reviewed by Sasha Jovanovic

- In early October 2025, Fair Isaac announced the FICO Mortgage Direct License Program, allowing mortgage lenders and resellers to access FICO credit scores directly, bypassing the traditional reliance on Experian, Equifax, and TransUnion. This new approach introduces alternate pricing, eliminates credit bureau mark-ups, and is positioned to reshape cost dynamics and transparency across the mortgage industry.

- This move highlights a shift in market power, giving Fair Isaac greater control over score distribution and potentially challenging the established role and revenue streams of major credit bureaus.

- We'll examine how Fair Isaac's direct-to-lender program, enabling resellers to bypass credit bureaus, influences the investment narrative going forward.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Fair Isaac Investment Narrative Recap

To own Fair Isaac, investors need confidence in the durability of its credit scoring dominance, especially amid growing regulatory and competitive headwinds. The FICO Mortgage Direct License Program could amplify both opportunity and risk: it positions FICO for greater margin capture and direct customer access, but it also brings sharper competitive scrutiny and potential for regulatory shifts. The most critical near-term catalyst is FICO’s ability to execute this new distribution model without driving lenders toward alternative scoring systems, while the biggest risk remains heightened competition and regulatory change in the mortgage credit ecosystem.

The recent introduction of FICO Score 10 with Buy Now, Pay Later (BNPL) data, expected to roll out to lenders by fall 2025, offers another example of FICO’s efforts to extend its relevance as alternative credit data gains traction. As direct distribution disrupts the traditional role of bureaus, the company’s capability to deliver innovation, like integrating BNPL, matters more than ever in sustaining lender relationships and shaping borrower outcomes.

But investors should also be mindful that even as FICO reshapes industry economics, regulatory developments could still shift the competitive playing field...

Read the full narrative on Fair Isaac (it's free!)

Fair Isaac's outlook projects $2.9 billion in revenue and $1.1 billion in earnings by 2028. This is based on a 14.3% annual revenue growth rate and a $467 million increase in earnings from the current $632.6 million.

Uncover how Fair Isaac's forecasts yield a $1913 fair value, a 3% upside to its current price.

Exploring Other Perspectives

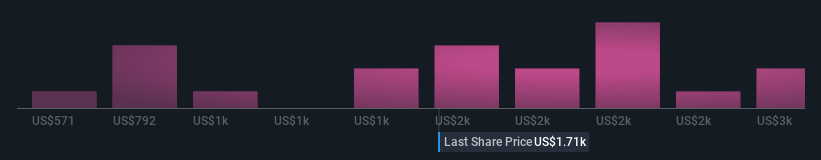

Simply Wall St Community contributors valued Fair Isaac from US$1,005 to US$2,628 across 21 fair value estimates, reflecting broad opinions from deep discount to premium. While viewpoints vary, the potential for regulatory changes driving adoption of competitor scoring models introduces a significant variable in FICO’s future.

Explore 21 other fair value estimates on Fair Isaac - why the stock might be worth 46% less than the current price!

Build Your Own Fair Isaac Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fair Isaac research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Fair Isaac research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fair Isaac's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FICO

Fair Isaac

Provides analytics software in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Solid track record with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026