- United States

- /

- Software

- /

- NYSE:FICO

Fair Isaac (NYSE:FICO) Unveils AI-Driven FICO Marketplace For Enhanced Business Intelligence

Reviewed by Simply Wall St

Fair Isaac (NYSE:FICO) recently launched the FICO® Marketplace, a platform designed to enhance access to data and analytics providers, which potentially enhanced investor interest. This launch coincided with the company's impressive Q2 2025 earnings report, revealing significant year-on-year revenue and net income growth. Concurrently, macroeconomic factors, such as awaited Fed decisions and trade discussions, contributed to broader market fluctuations. The company's 23% share price growth over the last month aligns with these developments, further aided by strong partnerships and client implementations like those with iA Financial Group and dacadoo, reinforcing its market position against a relatively flat broader market.

We've discovered 1 weakness for Fair Isaac that you should be aware of before investing here.

Find companies with promising cash flow potential yet trading below their fair value.

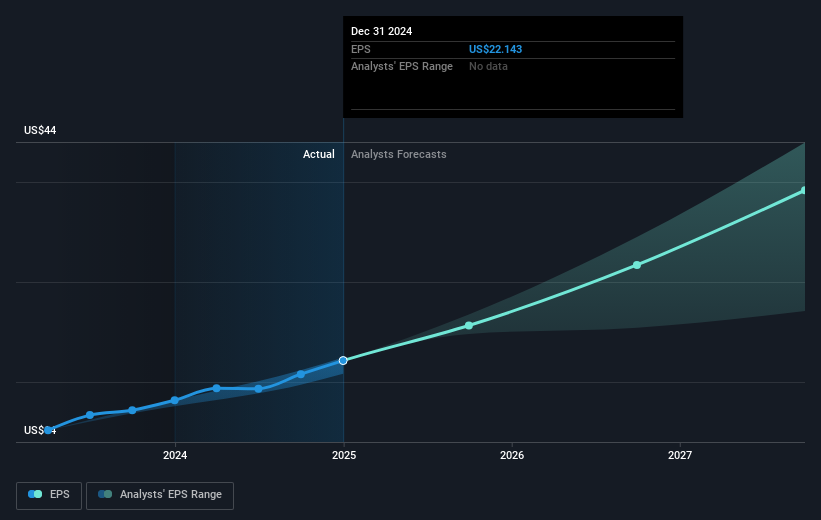

The launch of FICO® Marketplace and its robust Q2 2025 earnings report play pivotal roles in shaping future revenue and earnings forecasts. By enhancing access to data and analytics services, FICO potentially positions itself to tap into new revenue streams, supporting its ongoing international expansion. The recent advances in partnerships and products like the FICO Score Mortgage Simulator are viewed as means to bolster mortgage origination rates, possibly offsetting dependency risks in the Americas. This strategic positioning aligns with analyst expectations of a 16.1% annual revenue growth, capitalizing on industry-wide demand for advanced analytics solutions.

Over the past five years, Fair Isaac has achieved an impressive total shareholder return of 486.17%, underscoring its long-term growth trajectory. This performance starkly contrasts with the past year's broader market, where FICO's return surpassed the US Software industry average, which delivered a lower growth rate of 14% in the last year. Such performance provides investors a gauge of the company's robust market standing over a significant period.

Additionally, the current share price of US$1,961.5 presents itself as a 2.7% discount to analysts' consensus price target of US$2,116.96, indicating room for potential growth. While the past month's 23% price surge is aligned with recently released positive news, reaching the analysts' target suggests a belief among experts that FICO continues to offer intrinsic value, assuming market conditions stay favorable without escalated macroeconomic risks affecting its forecasted earnings of US$1 billion by 2028.

Explore historical data to track Fair Isaac's performance over time in our past results report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Fair Isaac, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FICO

Fair Isaac

Develops software with analytics and digital decisioning technologies that enable businesses to automate, enhance, and connect decisions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives