- United States

- /

- Software

- /

- NYSE:FICO

Fair Isaac (FICO): Valuation Check After Strong Q4 Earnings Beat and Scores Revenue Growth

Reviewed by Simply Wall St

Fair Isaac (FICO) just turned in a stronger than expected fourth quarter, with scores revenue leading a solid jump in overall sales and adjusted earnings comfortably clearing Wall Street estimates, a reassuring signal for long term holders.

See our latest analysis for Fair Isaac.

The latest beat comes after a volatile year, with regulatory headlines knocking sentiment mid summer. However, the recent rally and strong 90 day share price return of 17.4% suggest momentum is rebuilding despite a still negative 1 year total shareholder return.

If FICO's rebound has you rethinking where growth could come from next, this is a good moment to explore high growth tech and AI stocks that are reshaping software and analytics markets.

Yet with Fair Isaac still down sharply over 12 months but trading about 13% below analyst targets, investors face a key question: Is the stock quietly undervalued here, or has the market already priced in its next leg of growth?

Most Popular Narrative: 11.5% Undervalued

With the narrative fair value sitting around $2,031.78 versus Fair Isaac's last close near $1,798.53, the story leans toward upside and leans heavily on long term structural drivers.

The ongoing transition to SaaS and cloud-based delivery, evidenced by double-digit growth in FICO Platform ARR and emphasis on conversion to next-generation AI-driven decisioning solutions, is increasing recurring revenues, supporting margin expansion and greater earnings predictability.

Want to see how this shifts the numbers over the next few years? The narrative quietly bakes in faster scaling, richer margins, and a premium earnings multiple. Curious how far those assumptions stretch and what has to go right for them to hold? Read on before the market fully prices that in.

Result: Fair Value of $2031.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could unravel if mortgage scoring shifts to rivals, or if software growth keeps lagging, pressuring both margins and FICO’s premium valuation.

Find out about the key risks to this Fair Isaac narrative.

Another Take on Value

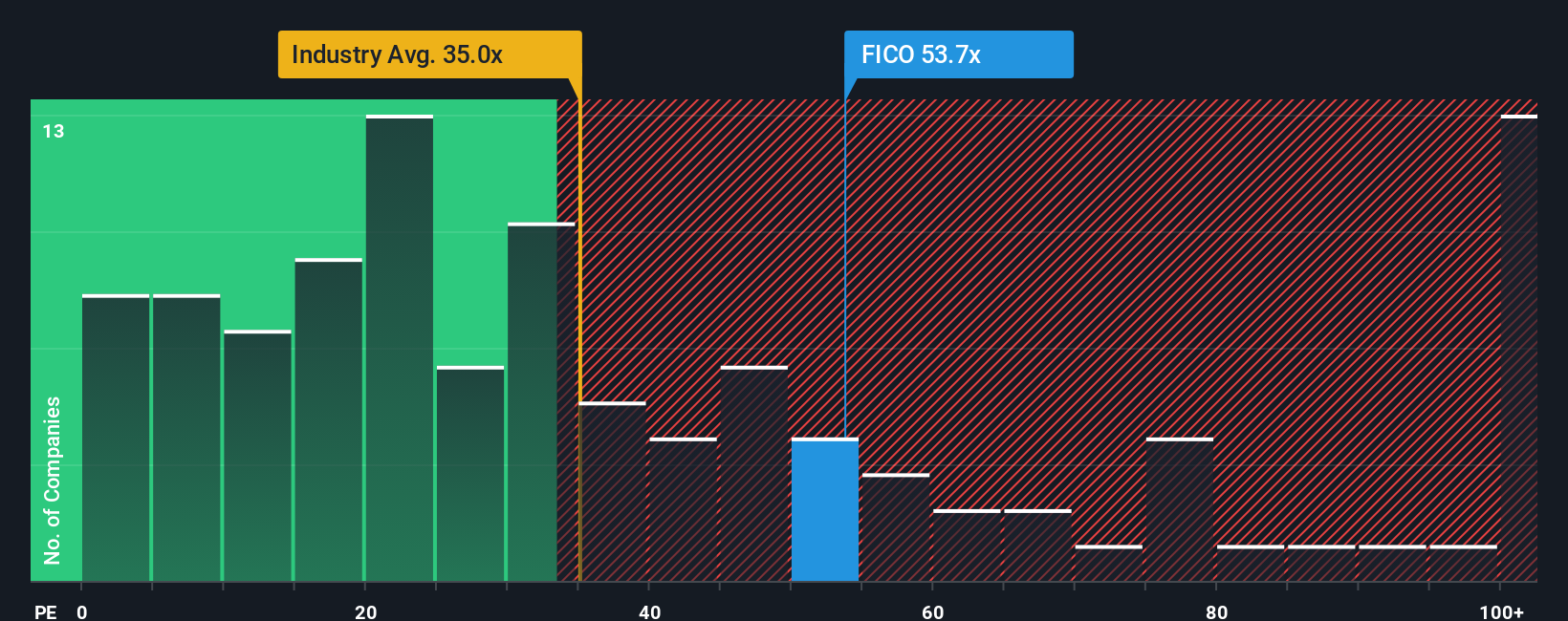

On earnings, the picture flips. FICO trades on a rich 64.4x price to earnings ratio versus 31.4x for the US software industry, 46.1x for peers, and a 38.5x fair ratio. That premium can signal quality, but it also raises a question: how much execution risk are you really willing to pay for?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fair Isaac Narrative

If this angle does not quite match your view, or you would rather stress test the inputs yourself, you can build a fresh narrative in minutes: Do it your way.

A great starting point for your Fair Isaac research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before the market narrows your options, use the Simply Wall Street Screener to uncover focused stock ideas that match your strategy and keep your edge sharp.

- Capture potential multibaggers early by scanning these 3577 penny stocks with strong financials with resilient balance sheets and room to grow.

- Position your portfolio at the heart of the AI revolution by targeting these 30 healthcare AI stocks transforming clinical workflows and patient outcomes.

- Lock in more reliable income streams by filtering for these 15 dividend stocks with yields > 3% that could strengthen total returns through market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FICO

Fair Isaac

Provides analytics software in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Solid track record with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026